A dedicated account management service is a big boon to traders who do not prefer or have the time for the hands-on approach. The Wall Street Traders Club is one such service that provides Forex managed accounts.

With this service, you will be able to hand over all the difficult work in Forex trading, including market research, risk management, entries and exits, and more. The New York-based service assures traders minimal risk, transparent, and profitable account management. This review delves deeper into this service, its performance, and other essential features.

Detailed Forex Robot Review

The vendor information reveals that the company is dedicated to developing market volatility-based trading approaches and models. From the website data, we could find that the contact address and phone number for the company are provided, along with an email address. At present, the service provides fully automated scalping trading and semi-automated systems. Price volatility trading approaches are also used.

Once you open an account with a reputed broker and deposit funds, the managed account is added to the service’s master account. Thus, the firm manages the funds via its portfolio manager. However, you retain control over the account all the time and the manager is given access to the trading decisions alone.

Wall Street Traders Club Strategy Tests

From the vendor data on the trading model, discrete algorithms are used with different trading logic and on a wide range of currency pairs. As a result, diversification and better risk management are ensured. Every trading model used by the firm is monitored for performance and capital protection.

No strategy tests are provided on the official site. Although strategy tests are about historical data that does not relate to the current performance, we prefer them. The backtests give a better outlook of the trading approach used and its efficacy.

Live Account Trading Results

On the performance of the system, the vendor claims that the consistent and disciplined trading approach used over the medium term has given superior returns to the clients. To prove this, the vendor provides live and verified trading accounts on Forex Factory and Myfxbook sites. However, when we used the link to the Myfxbook site, we could see only a blank page as shown in the screenshot below.

Although there is information about the company and that it has registered at the site in 2017, no trading results are posted. The lack of data makes us suspicious of the system and its performance.

Pricing

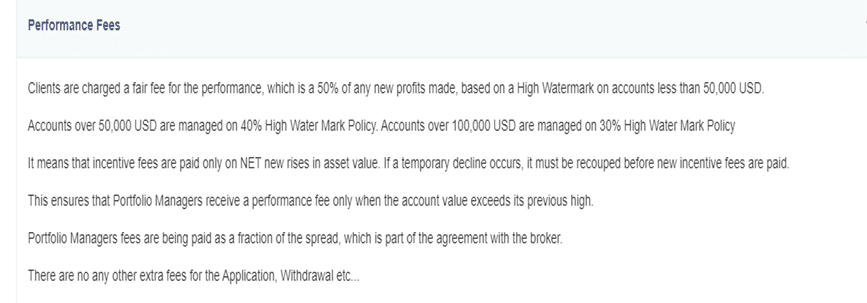

You have to invest a minimum of $5,000 or an equivalent amount of base currency that your broker supports to use this service. On top of this amount, the firm charges a performance fee of 50% of the ‘new’ profits you make.

The minimum investment is very high and so is the performance fee. Given the fact that the main strategy used is scalping, the risks involved are high. The average trader would not be comfortable with the risks involved and the high price package.

Customer Reviews

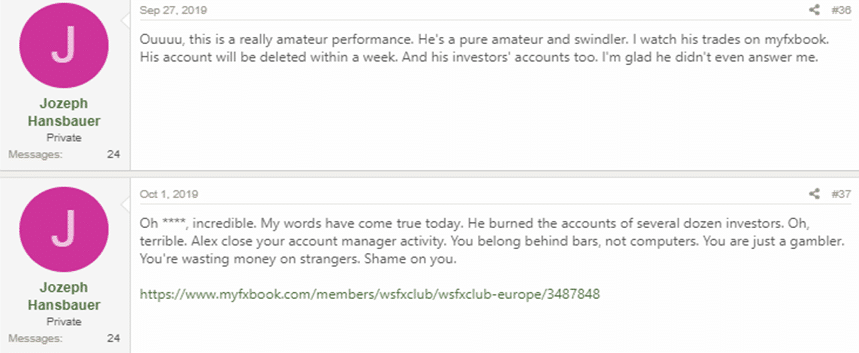

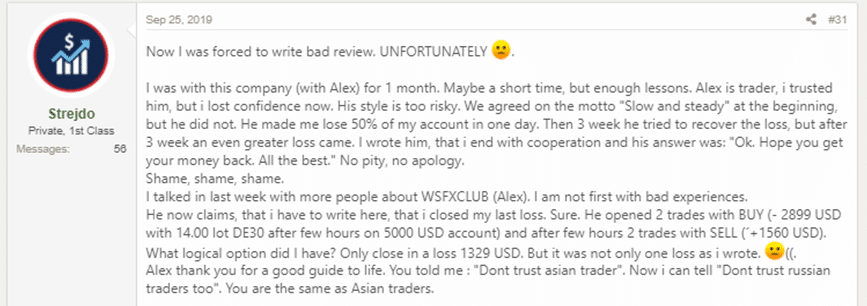

We found user reviews for this service on the Forex Peace Army site. Although the reviews are from 2018 and 2019, they provide an insight into the performance and support provided. Here are a few screenshots of the reviews posted.

While a few of the reviews are positive, many are negative. It is clear from the reviews that the trading strategy used is very risky, causing the client to lose 50% of his account in a single day.

And, one of the reviews indicates the reason why there is a blank page now on the Myfxbook site as the service has burned the accounts of several traders. The reviews prove that the trading approach and account management by the firm is not as effective as claimed by them.

Summing up our review of the Wall Street Traders Club, this account management service has some major hitches that it has to rectify before it can be deemed to be reliable. To start with, the strategy used involves scalping and volatility in prices, which indicate a high-risk approach.

Furthermore, the vendor does not provide proof of the performance through backtests or live trading results. Although the official website claims to provide live and verified trading accounts, there are no such accounts present. The other obvious downside is the high minimum investment required and the performance fee.

And, to cap it all, the user feedback is poor. For a system that claims to have trading experience of over a decade, there is very little proof offered. As you can see from the downsides, this system is not one that we would recommend.

Leave a Reply