Waka Waka is a trading solution that was introduced to the MQL5 community. Now, we have a sale that provides us with an opportunity to buy the system with a discount.

Detailed Waka Waka EA review

The presentation is featured with some details about how the robot works on a client’s account.

- We can expect automatic trading from the system.

- There’s a live track record of trading activities.

- It works on the MT4 or MT5 terminal.

- The price will be increased to $599 or even higher.

- The dev claimed that “Waka Waka is the advanced grid system which already works on real accounts for years. Instead of fitting the system to reflect historical data (like most people do), it was designed to exploit existing market inefficiencies.”

- There market mechanics behind the system.

- Trading is allowed on AUDCAD, AUDNZD, and NZDCAD.

- We are allowed to trade on the M15 time frame.

- There’s “One Chart Setup”.

- The system customize GMT offset automatically.

- The system doesn’t need us to know how the market works.

- The offer can be affordable.

- The system isn’t sensitive to spreads and slippage.

- The trading can be on an ECN account.

- A VPS is another good option.

- The leverage can start from 1:40.

- If we want to work with low risks the account has to have $6000.

- The medium-risk accounts need $1000 and 1:100 leverage.

Waka Waka EA strategy tests

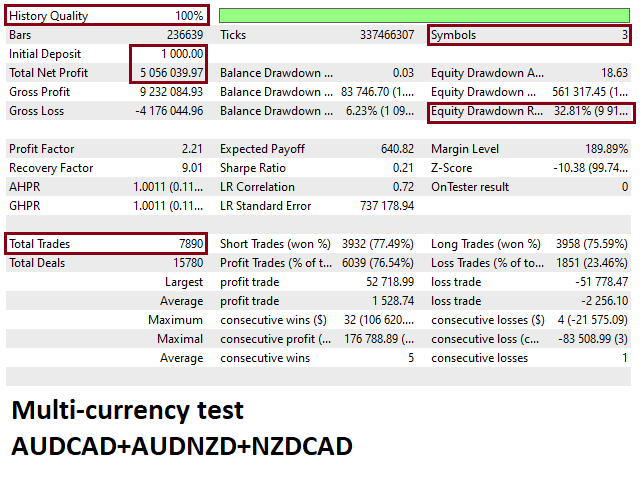

The system was backtested on AUDCAD+AUDNZD+NZDCAD. The historical quality was 100%. The devs set an initial deposit at $1,000 and it has become $5,055,039 of the final profit. Its profit factor was 2.21. The maximum drawdown was 9.91%. The system has executed 7890 orders with 77.49% of the win rate for short and 75.59% for long trading positions.

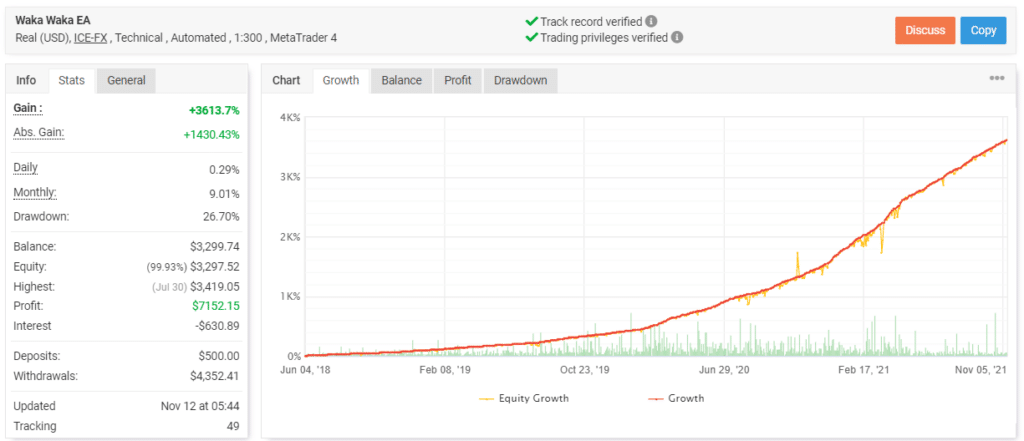

We have a real account where the robot works automatically on the low-known broker ‒ ICE-FX with 1:300 leverage on MT4. We have a track record verified. It means that the data should be relevant. The account was created on June 04, 2018, deposited at $500, and withdrawn at $4,532.41. Usually, high risk trading requires consistent withdrawing. Since then, the absolute gain has become 3613.7%. The maximum drawdown is 26.70%.

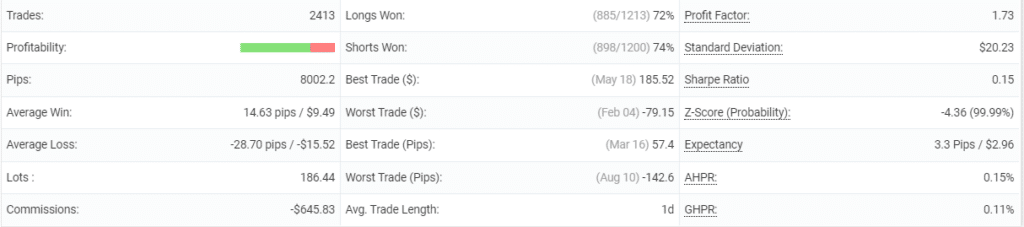

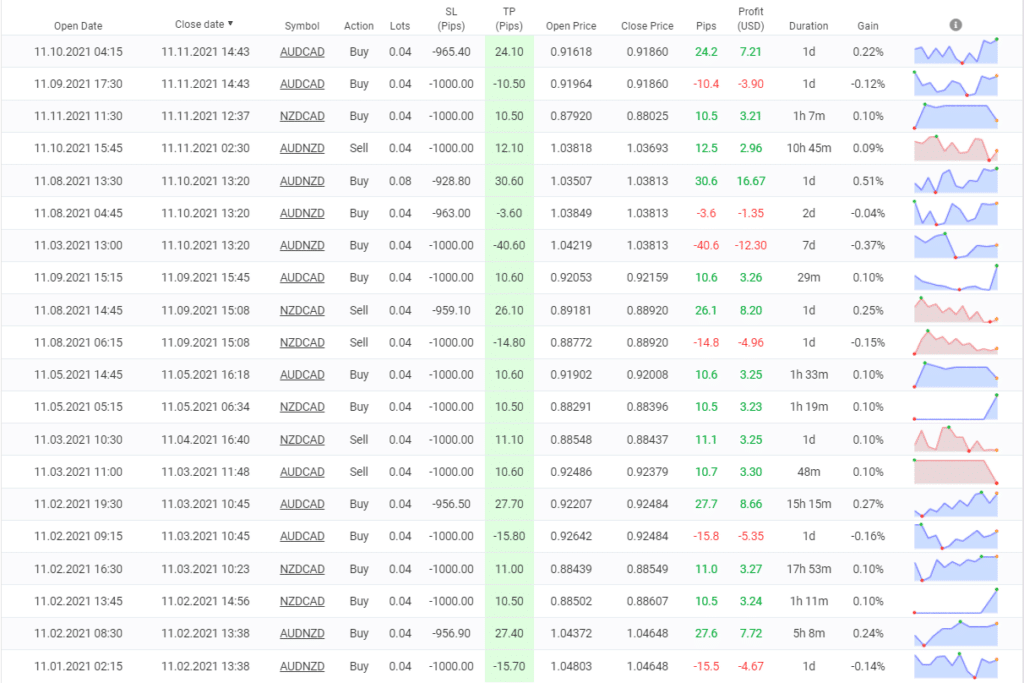

The system has executed 2413 deals with 8002.2 pips. There were 186.44 lots traded. An average win is 14.63 pips when an average loss is two times higher -28.70 pips. The win rate is 72% for long and 84% for short trading positions. An average trade length is a day. The profit factor is 1.73.

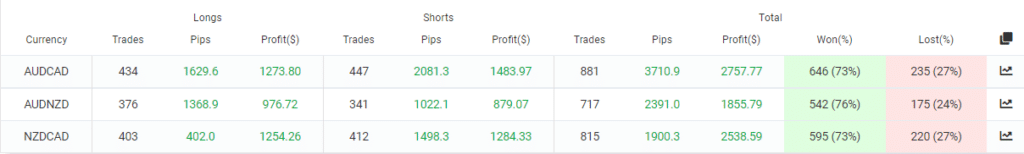

AUDCAD is the most preferable symbol to trade with 881 deals closed and $2757.77 profits gained.

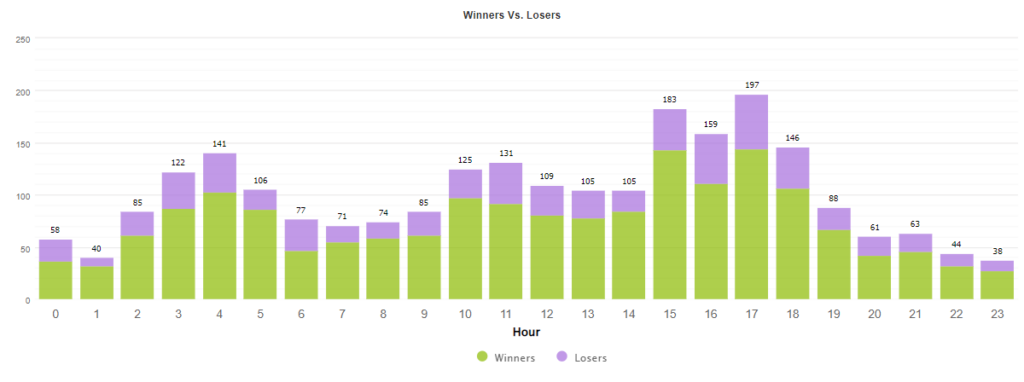

It opens orders during all sessions.

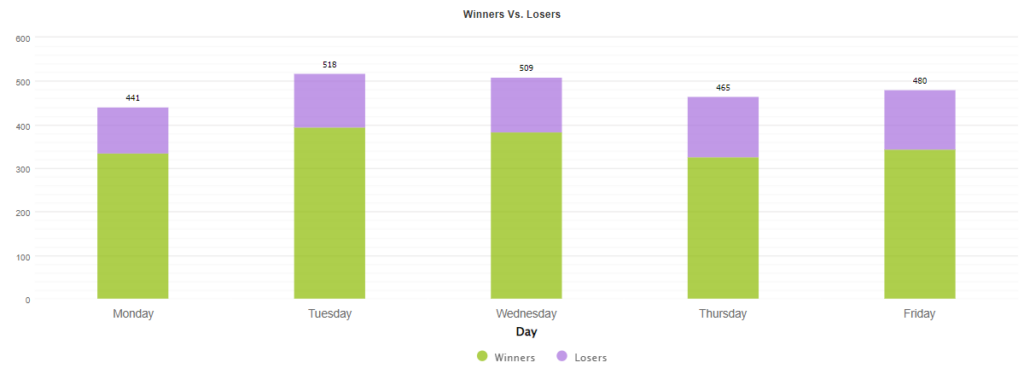

It opens orders equally during the day.

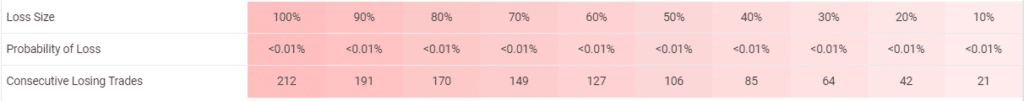

It runs the account with medium risks. It requires 21 orders to lose 10% of the account balance.

The system uses dynamic SL and TP levels that can be dangerous.

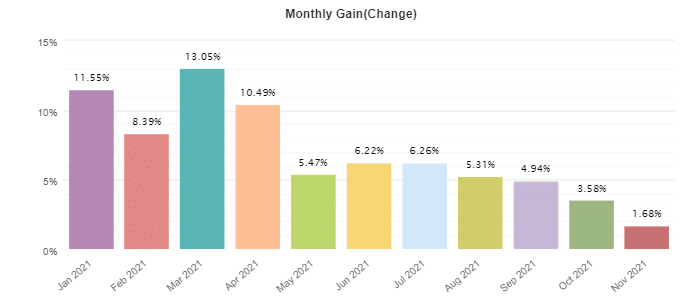

The system works with the profitability that has been going down since the beginning of the year.

Pricing

The system costs $50 less than several weeks ago. Now its price is $499. There’s no rental option. Anyway, we can try it for free on our demo account.

Customer reviews

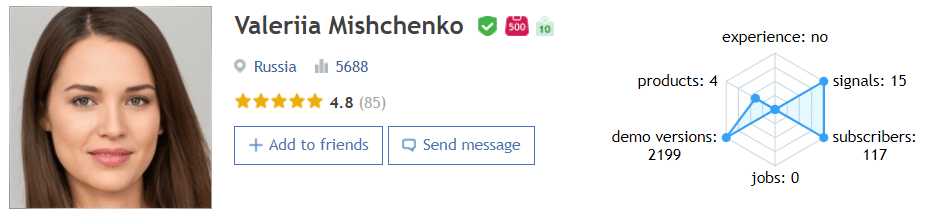

Valeriia Mishchenko is a developer from Russia with a 5688 rate. There are four products in her portfolio. Unfortunately, this info is everything we could find about the dev.

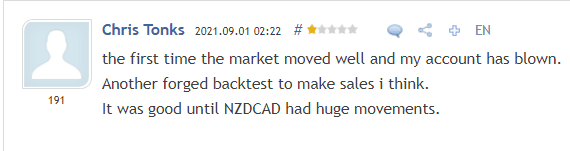

This person claimed that the rough move had blown his account.

Waka Waka EA is a trading advisor that makes profits on the real market but with every month they are lower and lower. It means that the advisor must be updated before treating it as the system to trade.

Leave a Reply