Any person who has studied some form of power-law distribution owes some gratitude to Vilfredo Pareto, one of the influential economists from the early 1900s. Of the many contributions the Italian made to society, the Pareto principle is perhaps one of his most well-known.

Of all the names the law is known by, the 80-20 rule is probably the most popular and straightforward to remember. Ever since Pareto discovered disproportionate power dynamics, the 80-20 rule has been used in virtually all fields from health and safety, economics, finance, computing to education, business, manufacturing, human resources, and sports.

Fortunately, the law is very much applicable to trading forex. It is a crucial philosophy worth noting as investors combine various inputs and resources and need to understand where there could be relationships to exploit.

What is the 80-20 rule?

The Pareto principle is a power-law distribution aphorism stating 80% of the results come from 20% of the causes. It was named after Vilfredo Pareto, an economist who first discovered 20% of the Italian population in the late 1800s owned roughly 80% of the land.

Soon, he began making other revelations showing similar disparities. Over the decades, the theory has taken a life of its own, helping people change their mindsets when observing how resources correlate to success.

For instance, a widespread adage in business is 80% of the profit comes from 20% of the clients; or 80% of the world’s wealth is owned by 20% of the people.

Many proponents of the rule believe the 80/20 theory is not random. Although it is based on 80 and 20, other ratios like 70/30, 75/25, 85/15, or even 99/1 are pertinent as they all show a drastic imbalance; essentially, any quotient well above 50-50.

For most, trading forex seems like a labyrinth. While it’s no easy endeavor, the goal of any successful trader is only prioritizing the most productive activities. When we understand what needs a priority, trading the markets does become a lot simpler.

How can forex traders use the 80-20 rule?

The application of the Pareto principle is quite diverse, hence why it’s a popular philosophy. It is a reminder of quality over quantity that the correlation between what traders put in and get out is typically never balanced.

Pareto’s principle can influence a myriad of things, such as how much knowledge is necessary, the supposed high failure rate in forex, how much time traders should spend, the irrelevance of high win percentages, and much more.

Below, we’ll observe some common scenarios traders encounter and how they can use the law to their benefit:

- 95% of forex traders lose money in the long run: This is one of the generally accepted statements in the markets, despite being disheartening and having no comprehensive study. Nonetheless, it does exhibit the level of difficulty to achieve success.

Only until we break down some of the fundamental reasons why many do lose does it become evident how traders can change this statistic. Of course, there are many reasons why the failure rate seems so large, but perhaps the main one is over-leveraging or risking too much per position.

Other causes will be lack of experience, having no defined strategy, lack of patience, etc. though all of these are connected to the primary problem. In other words, a trader can perfect everything, but having no respect for money management will ultimately cause them to struggle.

- 80% of the profits can come from 20% of the trades: On the surface, there is an abundance of profiting opportunities in forex. However, this doesn’t mean every moment is tradeable.

Traders fail to grasp this concept end up over-trading in the belief of frequent execution correlating to greater profits. Theoretically, there is some truth with this concept, though successful trading is more about selecting opportunities with favorable risk to reward and less about the number of trades.

Another aspect of using the 80-20 rule here relates to high winning percentages, a commonly held misconception. Statistically, someone can achieve consistent profitability, winning less than 50% of their positions provided their average return or reward is a few times larger than their losses over time.

Here are other simple demonstrations of the 80/20 rule in forex:

- 80% of trading success comes from psychology and money management; 20% from technical skills

- 80% of trading forex is simple; 20% is challenging

- 20% of the time should be spent executing; 80% shouldn’t

- 80% of the moves in forex are noise; 20% are not

Looking at the input and outputs of a forex trader

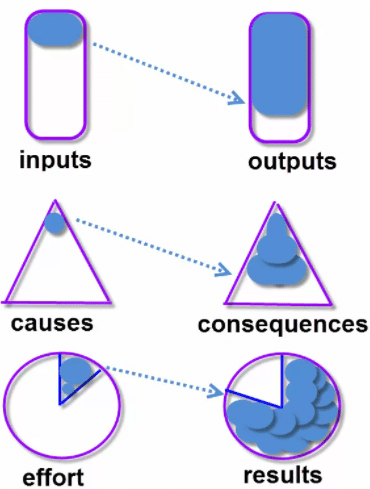

Part of the core for the Pareto principle is observing the inputs and outputs in a particular system. For a trader, their inputs would include time, resources (computer, internet, websites, indicators, etc.), effort, and skill.

Most traders would agree their primary outcome or output is profit. While this is true, a successful trader isn’t just someone who can trade. More often than not, a seasoned trader knows when to get involved in the market and when not to.

Achieving this should be considered as a favorable outcome because when someone has not yet executed a trade, they have not lost any money, which is a superior position.

For instance, by practicing stronger patience and discipline (input), while the (output) will not always be profitable, it is still a better standing. As they say, ‘not being in a position is a position itself.’

Final word

The 80-20 principle may seem irrelevant but is a practical performance-measuring concept in trading currencies. It also shows how not every unit of effort or input has an equal correlation for the desired outcome of profits.

In truth, the figures are quite skewed. Therefore, what matters more is prioritizing only the most relevant inputs instead of focusing on too many variables. More often than not, it’s the small things that produce the most significant impacts.

Leave a Reply