Interpreting and exploiting the statistical figures are two very important things you have to excel at to succeed in forex while using technical analysis. The key tool that helps in this endeavor is the chart form.

By knowing the various forms and their meaning, you can easily foresee market performance. One such form is the Golden Cross. This guide will take you through the various nuances of this form and how to capitalize on it while trading.

What Is A Golden Cross?

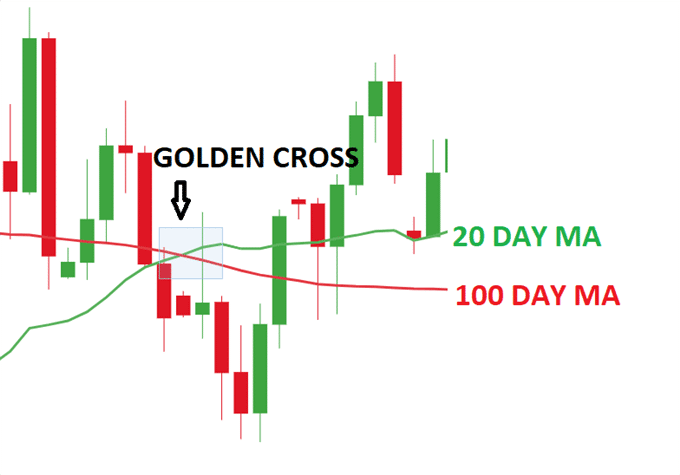

This form is a candlestick design shaped due to an edge taking place when a short term (say about 15 days) moving average value breaks with a longer-term (like 50 days).

The duration may vary from 15 to 50 days or more on the lower side and 50 to 200 days or more on the higher side.

Here are some features of this pattern you must keep in mind:

- It denotes a bullish sign that tips you about a vast rally possibility.

- It is further pronounced when volumes are large in trading.

Three Stages of a Golden Cross

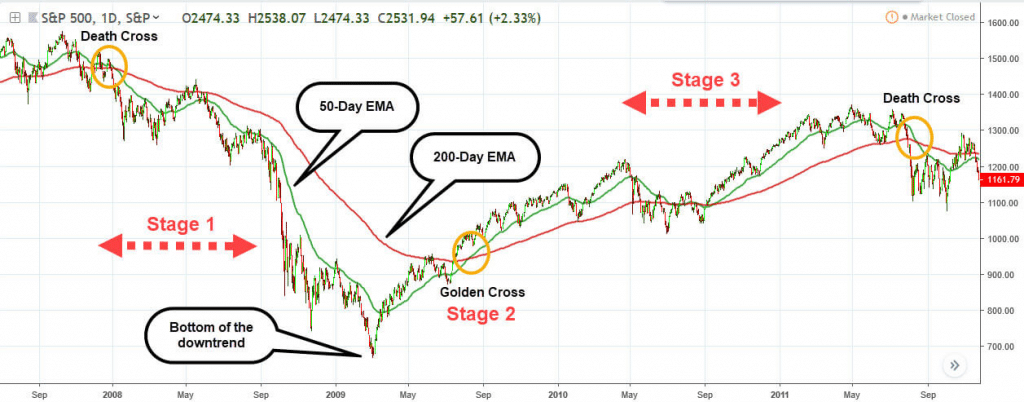

Because this form is symbolic of an encouraging upward movement, knowing the form in its entirety is important. You can find three different stages here, which include:

- Stage 1: A downward slope that stops when an interchange bout is exhausted.

- Stage 2: The limit of the moving average occurs in the short span space.

- Stage 3: The upward movement continues motioning an upsurge in the price.

In the image below, you can see the different stages of the form from a short to a longer moving average form.

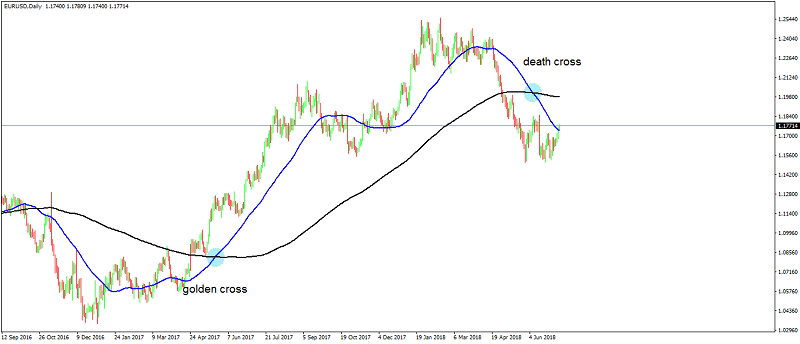

Golden Cross vs. Death Cross

A form that is the exact reverse of the golden cross is named the death cross. Instead of an ascending movement, you get a downward movement as the crossover happens. The short-term mean moves downward and crosses the long-term mean value. This indicates a downturn or a bearish phase.

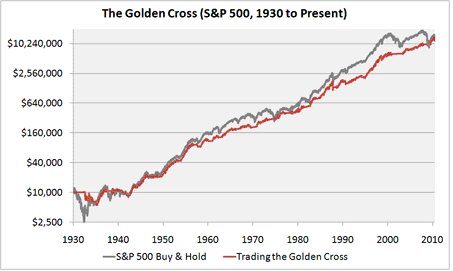

Some of the crossover forms seen in the past include the economic debacles of 1938, 2008, etc. The image below shows how the upward move helps in reducing the losses brought on by the downward movement during the1930s and 2008.

So, what do the two signals mean to a trader?

| Golden Cross | Death Cross |

| It signifies long-term bullish form moving upward. | It indicates a long-term bear market on the downslide. |

| After the crossover, the long-term moving average is measured as a key support line from the point of crossing. | The long-term manifestation is interpreted as a resistance line from the crossover point. |

Similarities

Both confirm the presence of a significant trend formed by the crossing over of a short-term mean with a big long-term moving average. Additionally, both forms are measured as significant only in the event of the trading volume being phenomenally high. They can forecast a trend shift. The two signal an important trend to look out for.

3 Tips to Use the Golden Cross

At the outset, you have to keep in mind that earning from the form rests on various factors, such as the currency category and how to enter the trade. So, some influencing factors include:

Resistance

By identifying resistance beforehand, you can know about the selling prospects of the longs, which are holding on for a longer span.

Use the Death Cross

By using the inverse cross over (short over long) as the selling opportunity, you can see some returns. But, this way has a drawback. It can force you to part with a considerable share of your profits as the moving averages are nothing but indicators that are lagging.

Trendline

The form is a definitive indicator of a profitable purchasing chance. All you have to do is exploit the initial reactionary lows to form an upward line and hold your position until you find a break in the trendline.

Now that you are familiar with the influencing factors, here are a few tips for using the pattern profitably:

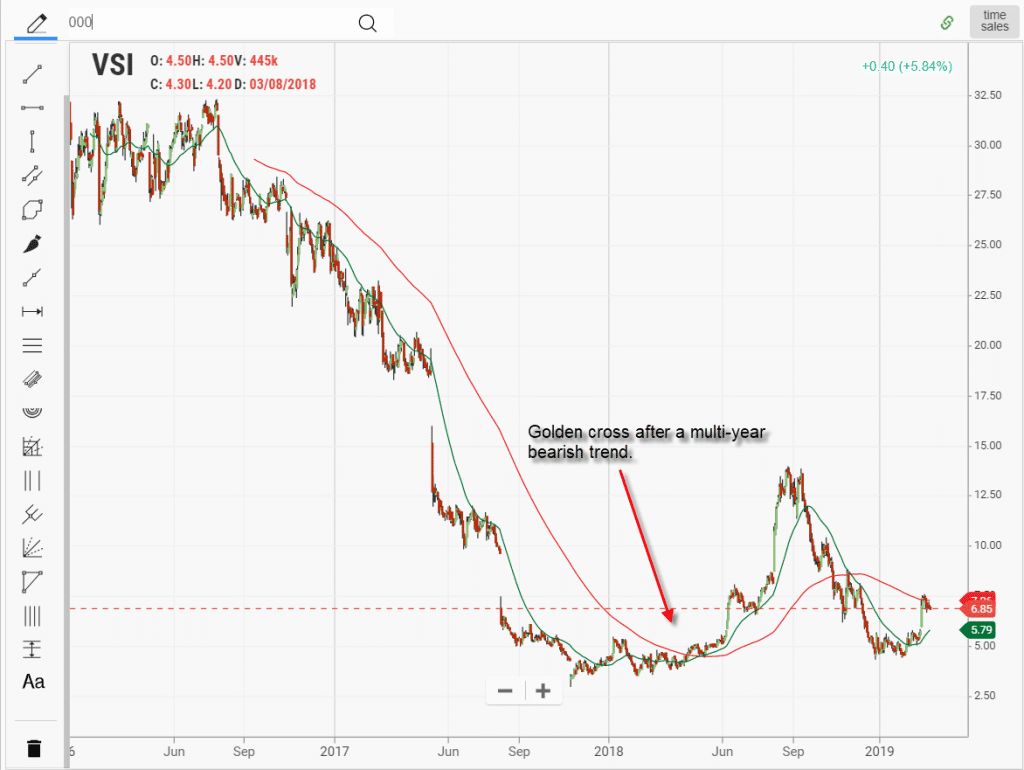

Tip #1: Spot Long Downward Trending Currency

All the setups in this form are different from one another. An effective tip is waiting for a currency with a long and sustained downward curve and currencies that are intended to inch upward. This tip is useful as the bearish nature of the asset makes the crossing or shift gain significance.

The bearish trend is so long that it will need some sort of basing phase before reaching the bullish cross. The phase has the bears and bulls fighting for supremacy. Hence, when prices show a peak, it indicates strong price values. Buying on the initial breakout phase after the basal phase is a decent move. But, this stage can still be bearish, so the wise action would be to pause until the upward move happens to make your profits.

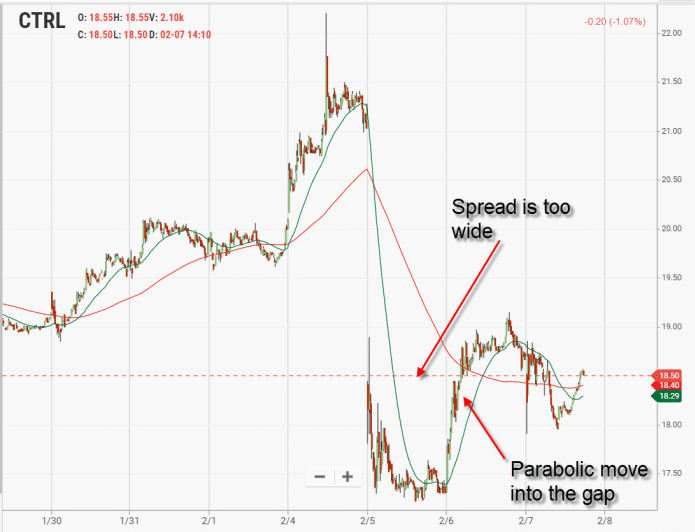

Tip #2: Beware of Wide Spreads

If you find a widespread between the long and short averages and the price is spiking up, it can result in a price reversal. Hence, it is prudent to avoid any action if you spot such a formation.

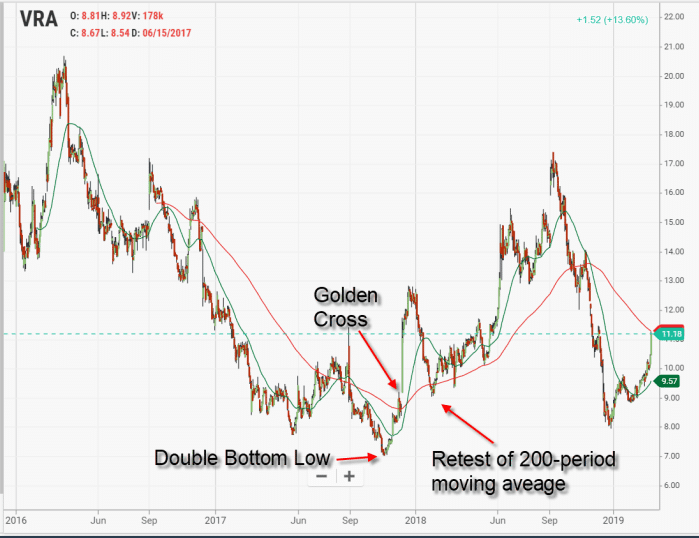

Tip #3: Double Bottom

If you spot a form with two dips, the second one lower when compared to the first, look for the golden cross reveal. Also, ensure the price retests the higher moving average level. Buying at this specific stage is a decent move as you get to use the two dips as a limit stop.

The Bottom Line

Of the various forms that remain useful in forex, the Golden cross is a popular one. You should handle it with care as there is the possibility of the market whipsawing you. However, it is smart to employ it as a filter for recent trends. It is possible to ride big trends using this form by exiting only when you spot the downward cross.

And, remember that any indicator you use has some degree of lag. So, you cannot precisely predict future movement. There are several instances when the form has induced a false motion. When you place a long in such a condition, you can get yourself in trouble.

The smart way to capitalize on the trend is to check it with other forms and indicators. Using supplementary pointers and filters appropriately by assessing the risk proportions and constraints is vital to profit from the Golden Cross in forex.

Leave a Reply