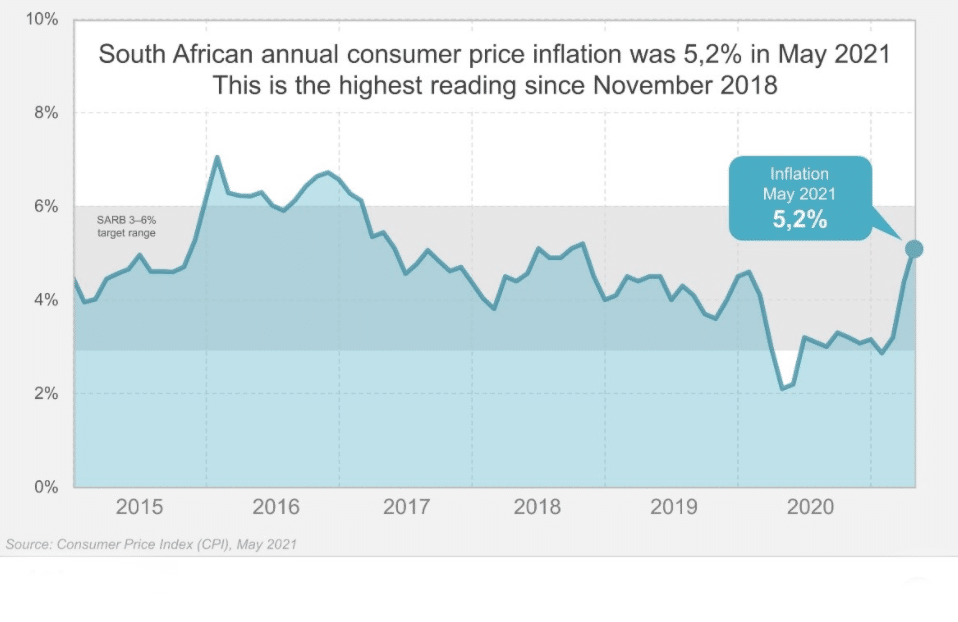

- SA’s CPI hit a 2.5 year high at 5.2% (YoY), moving above the 4.5% midpoint.

- New coronavirus cases in South Africa reached a 2-month high on June 21, 2021, at 9,160, with WHO planning to set up a vaccination hub in Africa.

- US mortgage applications increased 2.1% (Week-on-week) as well as refinancing.

The USD/ZAR pair traded at a -0.43% price change on June 23, 2021, from the previous day’s trading. It opened at 14.2642 and traded to a low of 14.1469 after South Africa released its CPI data. The rand gained over the US dollar after statistics indicated CPI had reached a 2.5 year high at 5.2% (YoY). April 2021 had seen inflation climb to 4.4%, with May’s figure moving above the 4.5% midpoint set by SA’s Reserve Bank.

South Africa’s CPI

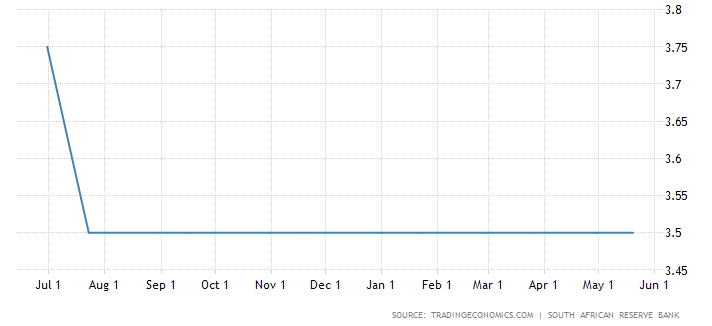

The core inflation (that excludes fuel/energy, food, and non-alcoholic drinks) inched up 3.1% (-0.1%), lower than expectation at 3.2% despite rising by the same margin from a previous reading of 3.2%. Fuel price edged up 37.4% (YoY) in May 2021 from a previous reading of 21.4%. Leading the pack was petrol (+41.8%) and diesel (+27.0%). Prices of vehicles also increased by 6.5%, with food/ non-alcoholic drinks at +6.7%. These numbers pull up hawkish concerns, with SA’s interest rate currently at 3.5%.

SA Interest rates

At the May 2021 meeting, the SA Reserve Bank warned that slow vaccination progress and a low supply of energy would quash the economic recovery of the African powerhouse. The central bank has maintained the repo rate at 3.5% since August 2020, with growth forecasts for 2021 at 4.2% from a previous record of 3.8%.

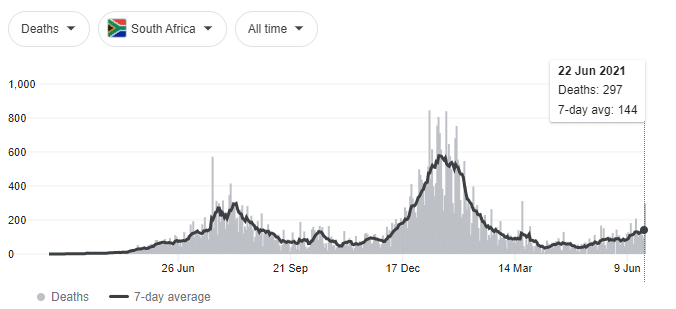

Coronavirus cases

New coronavirus cases in South Africa reached a 2-month high on June 21, 2021, at 9,160 (+483.11%) from 1,569 recorded on April 21, 2021.

SA Covid19 deaths

The number of deaths has increased by 440% in the same period. However, Covid-19 deaths have decreased by 51.71% since January 15, 2021, when it stood at 615 against 297 recorded on June 22, 2021.

Slow vaccination progress has hampered the quick recovery of the South African economy, with only 0.8% of the population fully vaccinated. Approximately 480,000 people have been fully vaccinated out of the 2.23 million doses issued in the country.

The World Health Organization (WHO) is looking to set up a vaccination hub in SA to help developing countries produce and license their Covid-19 vaccines. In 9-12 months (or by the end of 2022), the WHO will have transferred the advanced medical technology used in the mRNA vaccines to African companies. Companies such as Pfizer-BioNTech and Moderna use mRNA technology to make Covid-19 shots.

As the host to the Afrigen Biologics & Vaccines Co. (company linked to vaccine manufacturing), South African citizens will directly benefit from quicker vaccination procures ahead of other African states. The WHO acted to a call by the SA’s President Ramaphosa to waiver patent rights on manufacturing Covid-19 vaccines to allow Africa and other developing countries to increase vaccination rates.

US mortgage rate hikes

In the US, mortgage applications increased 2.1% (Week-on-week) from a previous reading of 4.2%. According to the Mortgage and Bankers Association (MBA), in the week ending June 18, 2021, there was a 3.18% hike in the 30-year fixed-rate, with the Market Composite Index (MCI) jumping 1% (WoW) on an adjusted basis. However, despite higher rates refinancing also increased, with conventional applications of refinancing surging 4% in the second week running.

The US dollar may be positively affected by the manufacturing PMI data set for release on June 23, 2021, with the previous index at 62.1.

Technical analysis

The USD/ZAR pair initiated a V-shaped recovery pattern with the downtrend from May 17, 2021, ending on June 8, 2021.

Prices are oscillating above the 9-day EMA at 14.18560. The weakening of the buying volume may lead to a downtrend towards 13.9139. However, there is a strong buying momentum with the 14-day RSI at 64.90. We may see an increase in price towards 14.4428.

Leave a Reply