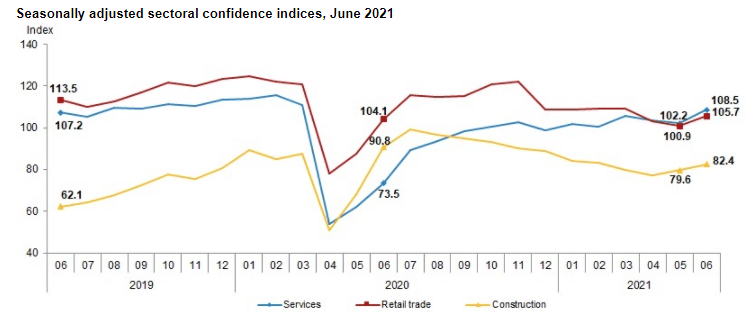

- Turkey’s construction index rose to 82.4 from a low of 79.6 but still denoted lower confidence among investors as it fell below 100.

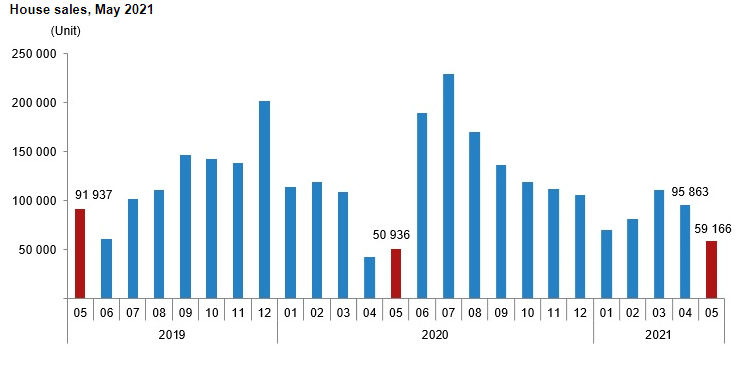

- The sale of houses in Turkey fell 38.28%, from 95,863 in April 2021 to 59,166 in May 2021.

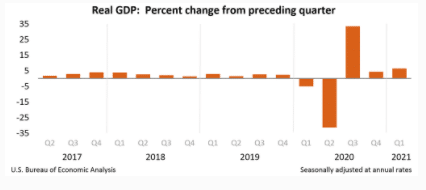

- US GDP may rise above 6.5% (QoQ) due to higher inflation numbers.

The USD/TRY gained 0.42% on June 24, 2021, from the previous day’s trading after hitting a low of 8.6330.

It hit a high of 8.6728 after Turkey’s manufacturing confidence data. The manufacturing index rose to 113.0 for June 2021 (MoM) after adding 0.3% points in May 2021 to close at 110.3. Capacity utilization also increased to 76.6% (MoM) from 75.3%.

However, these indices were inadequate to lift the Turkish lira against the US dollar, with the pair gaining 26.24% annually.

Confidence indices

June 2021 saw Turkey’s service confidence index (seasonally-adjusted) surge 6.2%, retail trade increased by 4.8%, and construction posted +3.6% (MoM).

Turkey’s sectoral confidence Index

Service confidence in Turkey rose to 108.5 while retail trade hit 105.7 from 100.9 in May 2021. These two indices (above 100) indicated optimism. However, the construction index rose to 82.4 from a low of 79.6but still denoted lower confidence among investors as it fell below 100.

House sale statistics

The sale of houses in Turkey fell 38.28%, from 95,863 in April 2021 to 59,166 in May 2021. The decline was highest among mortgaged houses as home sales declined 54.3% (YoY). First-hand mortgage home sales declined 62.6%, while second-hand home sales declined 50.1% (YoY).

Trajectory of employment

Consensus estimates view a downward trajectory to continuous US jobless claims ahead of the data release on June 24, 2021. The claims stood at 3.518 million and are projected to decline 1.36% to 3.470 million.

Failure of the numbers to beat analysts’ estimates will work negatively against the US dollar. Initial jobless claims (released by the Labor Department) in the week leading to June 12, 2021, showed an increase to 412,000 (+37,000) from the previous record of 375,000. An increase in the numbers can hurt the strength of the dollar.

Orders for core durable goods (MoM) stood at 1.0% in May 2021 over a previous reading of 3.2%. Although the number represented a decline in the orders for manufactured goods in the month, it stood above the forecast at 0.8%. The resumption of air transportation is expected to increase the orders in June 2021.

A higher reading of the durable core orders may result in a bullish turn in favor of the dollar.

Q2 2021 is expected to record an increase in GDP sales with forecasts at 9.5% from a previous reading of 9.4%.

The GDP is expected to increase past 6.4% (QoQ) from a rating of 4.3%. At 6.4%, the GDP fell below estimates that stood at 6.5%. Additionally, the forecast for the price index is a high of 4.3% from 1.9% realized in Q1 2021.

US Real GDP

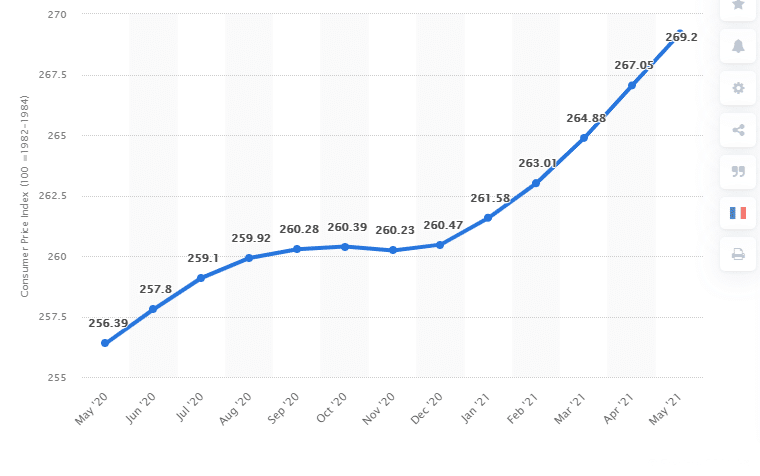

There may be an increase in the GDP due to the rise in the US consumer price index (CPI). Urban US consumers saw their monthly CPI as of May 2021 (YoY) rise to 269.2 from April 267.05. Since May 2020, the CPI (not seasonally adjusted) has risen from 256.3,9 to 269.20.

Monthly CPI (for US urban consumers)

Overall annual US inflation rose 5% in May 2021 from 4.2% (in April 2021), indicating a strengthening consumption economy. This rise may reflect on the GDP.

Technical analysis

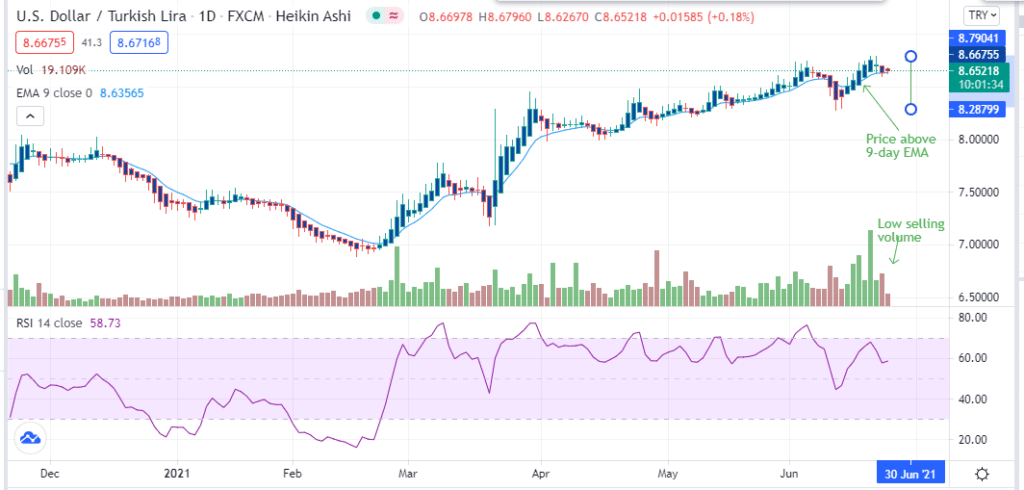

The USD/TRY is moving above the 9-day EMA at 8.6357. At the current price, 8.6676, the pair seems to be in an uptrend, likely headed towards 8.7904.

There is also a low selling volume. The increase in buyers is supported by the 14-day RSI that stands at 58.73.

Leave a Reply