- Nonrenewal of Cementa’s license risks up to 400,000 jobs in Sweden and monthly revenue of 20 billion kronor (11% GDP share).

- Sweden’s telecommunication giant Ericsson has its Chinese revenues plunged 63.41% in Q2 2021 (YoY) from SEK 4.1 billion ($470 m/ year- in 2020) to SEK 1.5 billion ($171.95 billion).

- US core PPI increased 5.6%, beating forecasts at 5.1%, with the previous reading of 4.8%.

The USDSEK pair added 1.37% in the week ending July 16, 2021. The Swedish krona fell against the US dollar after Sweden’s unemployment rate for June 2021 stagnated at 7.9% (MoM). It was followed by a 1.3% decline in the consumer price index (CPI) for June 2021 (YoY) from a previous reading of 1.8%. On monthly analysis, the CPI dropped 0.1% from 0.2%, meeting estimates in both instances.

Sweden’s environment and construction industry

The Supreme Land and Environmental Court (SLEC) of Sweden rejected the renewal of the trading license for the Cementa plant in Gotland (Sweden).

Cementa’s Gotland quarry for limestone

The plant is Sweden’s main cement producer and the second-largest source of greenhouse gas emissions. While responsible for up to 3% of all carbon dioxide emissions in Sweden, Cementa is also accused of intoxicating groundwater.

Nonrenewal of the license threatens to not only derail infrastructural progress but also puts at risk up to 400,000 jobs in Sweden. The construction industry stands to lose a monthly revenue of 20 billion kronor, with an 11% GDP share. Tax revenue of SEK 40 billion may not be remitted to cover healthcare and education-related costs if the limestone quarry is closed down.

5G network ban

Chinese sales of Sweden’s telecommunication giant Ericsson plunged 63.41% in Q2 2021 (YoY) from SEK 4.1 billion ($470 m/ year- in 2020) to SEK 1.5 billion ($171.95 billion). This decrease was retaliation from China after Sweden banned Huawei from installing its 5G network in the Scandinavian country. 2020 had seen Ericsson make SEK 10 billion in China before Sweden followed the US in banning Huawei 5G infrastructural progress.

However, Ericsson announced a 5G network deal with Verizon, a US telecommunication operator worth $8.3 billion. While its Chinese revenues dropped, Ericsson’s Q2 2021 net profit jumped 51% (from Q2 2020) to SEK 3.9 billion ($450 million). However, sales dipped to 54.9 billion kronor, following a 2.5 billion kronor fall from Chinese operations.

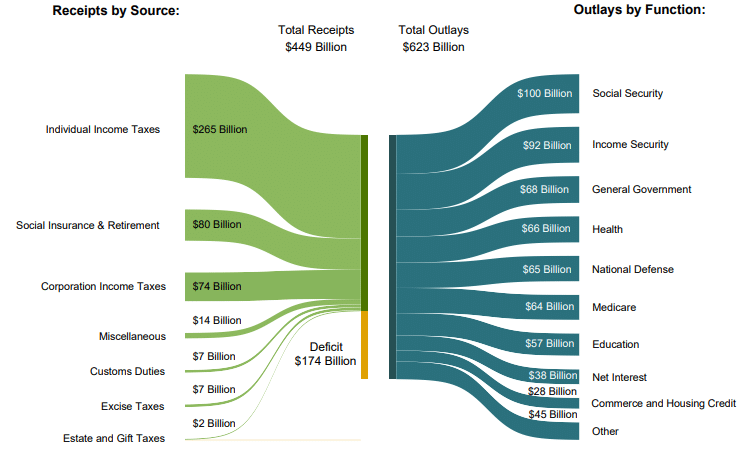

US budget balance

The US Treasury Department announced a decline in its budget deficit from a forecast of -$194.0 billion to -$174.0 billion. The deficit decline positively impacted the US dollar against the SEK, driving the pair +5.67% YTD.

Total receipts stood at $449 billion (with the highest gainers being individual income taxes at $265 billion). Outlays rose to $623 billion, driven by social security costs that stood at $100 billion.

June 2021 Receipts and Outlays

Cumulatively, the fiscal year 2021 has seen individual income taxes rise to $1.591 trillion against income security of $1.365 trillion. With total receipts at $3.056 trillion against outlays amounting to $$5.294 trillion, the budget deficit in the FY is $2.238 trillion.

The US saw the core Producer Price Index (PPI) for goods and services in final demand jump 1.0% in June 2021month-on-month (seasonally adjusted). The core PPI increased 5.6% annually, beating forecasts at 5.1% and from a previous record of 4.8%.

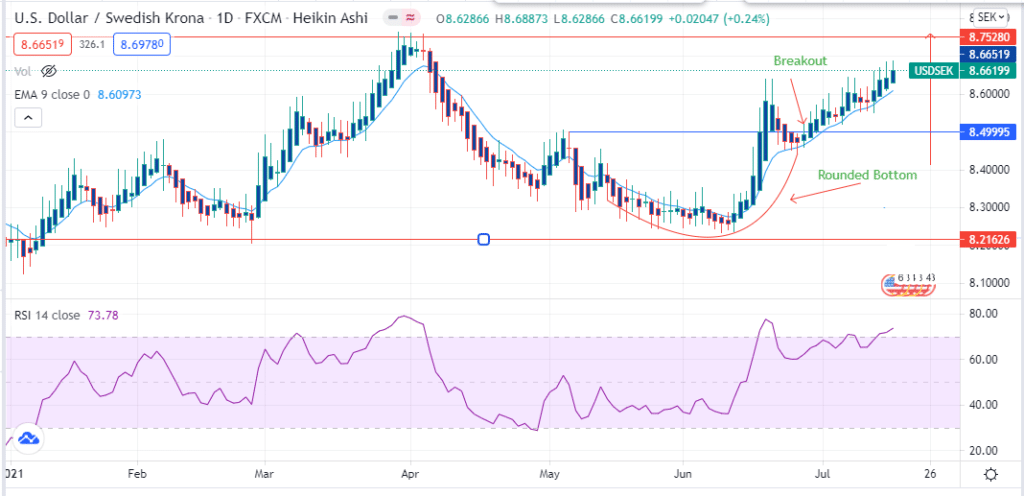

Technical analysis

The USDSEK pair formed a rounded bottom in the daily chart. The upward breakout was confirmed at 8.49995.

Following the pattern, the uptrend may proceed towards 8.6652 before crossing 8.7528. Failure of the price to advance may push the pair to 8.4000. The 14-day RSI is in the overbought zone at 73.78, indicating a strong uptrend.

Leave a Reply