- Credit panic seems to be favoring the greenback.

- The looming US debt crisis could weaken the USD.

- Japan has a PM-designate, but Covid-19 remains a big challenge.

The US dollar was marginally down against the Japanese yen in early trading on Wednesday, and the greenback was trading at 111.291 at 0749 GMT, which was 0.17% lower than its price 24 hours earlier. For the last few days, the dollar has been performing well against the yen, and this trend is expected to continue due to what traders term as credit crunch risk.

CLO market jitters and Fed policy

As was sometimes witnessed back in March, the demand for havens like the US Dollar and anti-risk assets like the Japanese yen has surged. Back in March, this was due to the widespread panic of credits and the actual risk of default on corporate debts.

A repeat of the same is likely to happen if the Collateralized Loan Obligation (CLO) market undergoes a bout of panic, forcing traders to focus their money towards currencies that are known to perform better under stress like the USD.

The Fed policy may be another reason for the upward trend. In the last FOMC meeting, the chairman Jerome Powell mentioned that the officials intended to maintain the zero interest rates but will continue with the current pace of asset purchase.

Jerome also mentioned that a gradual tapering process that concludes around the mid-next year could be appropriate. Traders view this as a risky move as experts see a rise in the USDJPY if the policies destabilize the CLO markets.

Japan’s political crisis was resolved, but BoJ concerned about a slow economy

With Japan’s political uncertainty now resolved following Fumio Kishida’s election by the Labor Party as the country’s next Prime Minister, the focus now shifts to the Covid-19 pandemic.

The pandemic is still taking its toll on Japan’s economy, as more state of emergency curbs to contain the virus is affecting economic productivity in some parts of the country. This has been a major contributor to the weakening yen.

According to the Bank of Japan minutes of their last meeting, the yen is declining against most currencies, and the officials are starting to sound their concerns over a slower-than-expected pace of economic recovery.

US debt crisis

With all the indicators showing the already weak Japanese yen losing more ground, the yen may nonetheless have a short redemption period, taking advantage of the US debt crisis. The US is currently staring at a possible debt default unless it raises the debt ceiling.

Debt crises seem to be piling up, and this could favor the yen. According to Treasury Secretary Janet Yellen, the country will run out of cash to pay its bills by October 18th as it is already in a rush to defend its creditworthiness. With the Evergrande situation still unresolved, the US may have a shorter period to pay their debts, likely throwing the safe-haven dollar off-balance.

Technical analysis

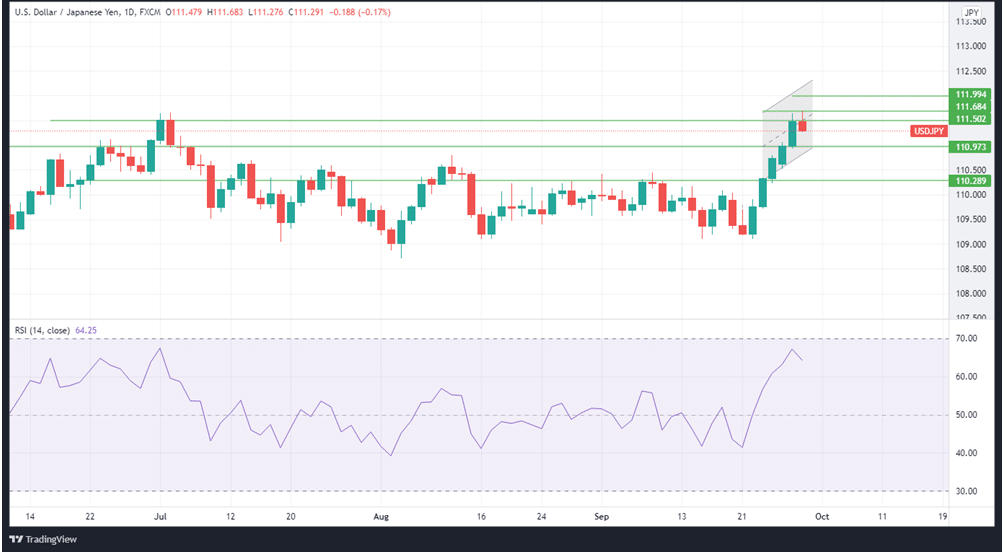

USDJPY has been on a strong uptrend over the past five trading sessions, and this could continue in the short term. The RSI is currently at 64, indicating strong bullish momentum. If the bulls keep control of the market, the USDJPY pair could rise to the first resistance at 111.684, beyond which it will encounter the second resistance at 111.994.

On the flip side, the RSI indicator is pointing downwards, indicating that the bears could make some gains. In that case, the pair could find the first support at 110.973 and the second one at 110.289.

Leave a Reply