- US unemployment rises, exerting more pressure on the dollar.

- December PPI falls below expectations as 2021 records the highest ever PPI.

- BoJ is reportedly considering an interest rate hike.

The USDJPY pair was in the red on Friday, shedding 0.40% to trade at 113.719 at 06:47 GMT. The US dollar is facing headwinds, coming under pressure from an underperforming US economy.

The bearish sentiment around the dollar is driven by news of historic inflation and high unemployment. In addition, many investors have turned their focus to emerging markets with the hopes of reaping better returns.

Dollar continues to bleed as investors seek alternatives

The safe haven yen continues to reap the benefits of the risk-off sentiment in the leading market indices. The Fed’s hawkish stance continues to exert downward pressure on equity markets.

The dollar continues to struggle against major currencies following a turbulent week influenced by the Fed Chairman’s comments and a weak show by the US economy. At 05:00 GMT, the dollar index, which weighs the US dollar versus six of the leading currencies, was at 9469. That was a further 0.10% lower, having shed 0.13% on Thursday.

With the Fed non-committal about the timeline for the next interest rate rise, markets seem to be looking elsewhere or cues. The latest statement from Ms. Lael Brainard, the Fed Vice Chair nominee, couldn’t move a numb market, following Jerome Powell’s earlier statement.

Pressure from US unemployment and inflation figures

US initial jobless claims applications unexpectedly climbed again this week, reaching their highest level in two months, pointing to a possible link between the recent spike in Covid-19 cases and layoffs.

The number of people claiming unemployment benefits rose to 230,000 in the week ending January 8, according to figures released Thursday by the Labor Department. That was well above the forecast of 200k and above the previous month’s figure by 23,000. Consensus estimates had projected that the figure would come in at 200,000.

Another noteworthy development was the announcement by the US Labor Department the Producer Price Index (PPI) climbed by 0.2% in December. This was significantly below economists’ projection of a 0.4% rise.

In addition, the headline producer prices hit 9.7% in 2021, printing a record high. This was the largest increase over a 12-month period since the introduction of this metric in 2010. Nonetheless, based on the Fed’s known stance currently, the figures are unlikely to influence the market.

Japan could raise interest rates

As the United States struggles to contain runaway inflation rates, Japan seems to be on course to hit its target. Reuters reported on Friday that the Bank of Japan could be considering introducing a long-awaited interest rate hike.

While the report didn’t specify a timeline for the potential raise, it hinted that Japan’s 2% inflation target appeared within reach. Going by BoJ Governor Haruhiko Kuroda’s latest statement on Japan’s economy, there is a realistic chance of an interest rate hike in 2022. If that happens, it could strengthen the yen further.

For the first time since October 2013, the Bank of Japan raised its economic estimate for each of the country’s nine prefectures, according to its latest quarterly report.

Investors will be focusing on the US retail sales data set for release on Friday, to take cues on the possible USDJPY trajectory.

Technical analysis

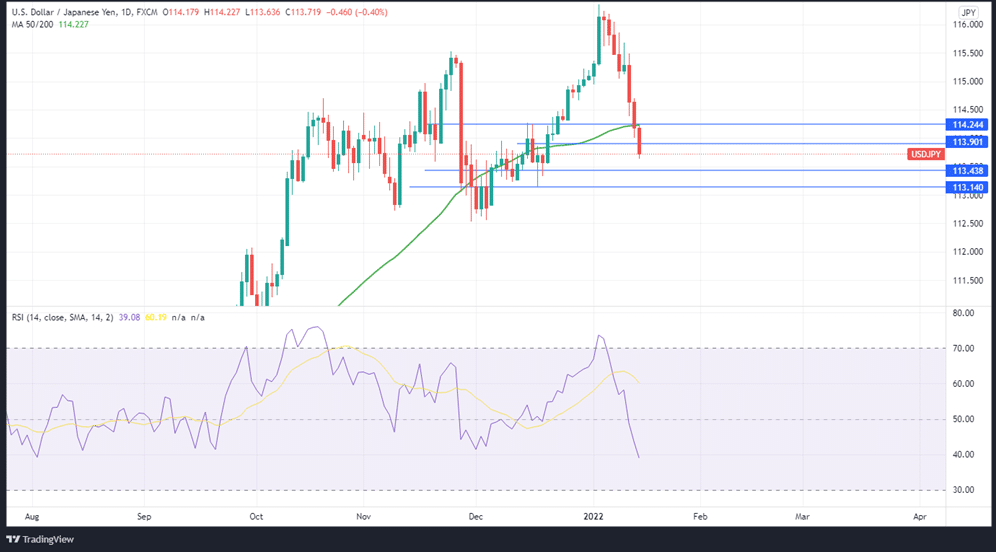

USDJPY is on a weak momentum, with the RSI at 39 and below the 14-SMA. Based on the current momentum, we are likely to see limited upward action. The near-term resistance is likely to come at 114.244 on the daily chart, which corresponds to the 50-MA on the daily chart.

If the momentum weakens, we are likely to witness the pair slide to the first support at 113.901 on the daily chart. If USDJPY breaches that support, it could head down to the one-month support at 113.438, shown on the daily chart. A breach of this level could invalidate attempts at 114.0. Instead, it could lead to a slide further down to 113.140. Beyond that point, USDJPY could touch 112.00

Leave a Reply