- The market ignores Japan’s CPI and household spending data.

- NFP data misses the target, easing pressure on the yen.

- Rising US Treasury yields and Covid-19 restrictions in Japan add pressure to the yen.

The US dollar lost steam in its upward rally against the yen on Friday, as the market reacted to weak US jobs data. The USD shed 0.20%of its value to trade at 115.612 at 1726 GMT. The new development dimmed hopes of a possible new five-year high by the dollar. The dollar’s gains earlier in the day signaled that it was still on course to retest Tuesday’s five-year high price. However, the NFP data fell below forecast, easing pressure on the yen.

The number of employed nonfarm payroll workers increased by 199,000 in December. The employment data, released by the US Bureau of Labor Statistics on Friday, was well below the projected 400,000. This created a bearish view of the dollar.

With the markets having largely ignored Japan’s latest CPI data and household spending, the dollar had a good chance of retesting Tuesday’s highs. However, that is unlikely to happen this week, following disappointing jobs data.

Market unmoved by Japan CPI release

In November, Japan’s household spending fell 1.3% year-on-year and 1.2% month-on-month. On the other hand, the CPI rose 0.5% year-on-year in December. These figures came out over the last 24 hours but hardly moved the market. Nonetheless, the market seemed unperturbed by the news, as the USD looked set for another day of gains against JPY.

It is the Japanese yen that has lost ground among major currencies because investors believe the Bank of Japan (BOJ) will be the slowest to raise interest rates. The yen’s losses have been exacerbated by the market’s reaction to the FOMC minutes for December.

The Fed is expected to hike rates at least three times in 2022. When interest rates rise, the Federal Reserve may also begin shrinking its balance sheet, according to St. Louis Fed President James Bullard.

Meanwhile, the BOJ inflation prediction for the fiscal year beginning in April is expected to be significantly revised upwards due to rising energy costs. While this is an improvement over the previous forecast, it will still fall short of the central bank’s 2% target.

Because inflation is expected to remain considerably below its objective of 2% for some time, the BOJ has no plans to stop its “powerful and continuous” monetary easing. During the upcoming policy meeting on January 17th-18th, the BOJ will provide its next set of quarterly forecasts.

Covid-19 restrictions could spell more trouble for JPY

The yen could yet again come under pressure as Japan prepares for another possible round of lockdowns. Japan’s Prime Minister, Fumio Kishida, warned that some virus-related restrictions might be reinstated following a persistent rise in Covid-19 infections at home and abroad.

Premier Kishida is expected to declare a quasi-state of emergency in three Japanese prefectures on Friday, according to reports. During the protracted shutdowns in 2021, Japan’s economy was adversely affected. Another round of restrictions at a time when the yen is at a 5-year low against the dollar could prove costly. In addition, the yen faces another onslaught in the form of high global fuel prices.

Technical analysis

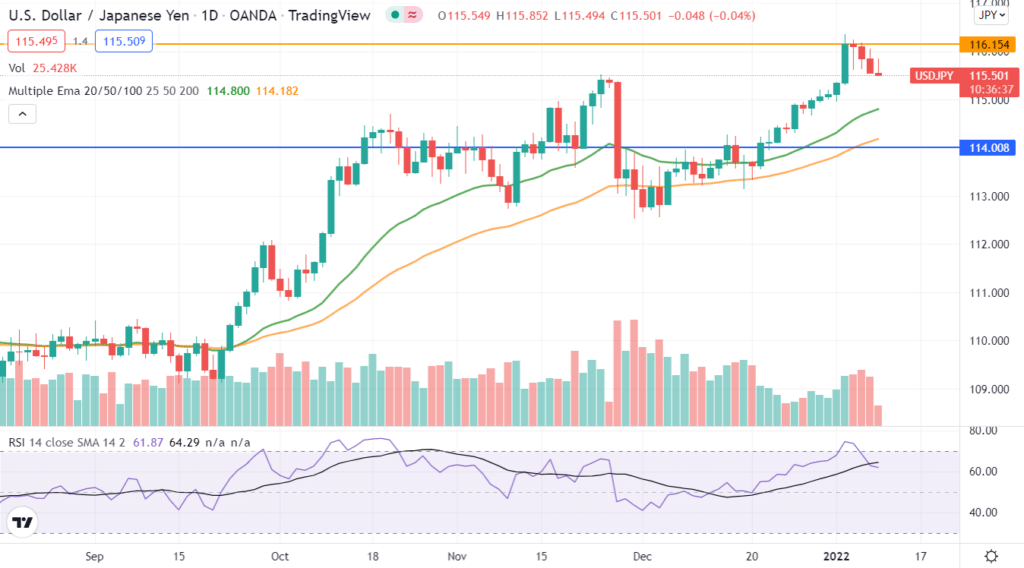

USDJPY is on strong momentum, with the RSI at 68. Therefore, the pair is likely to remain in the uptrend after the minor correction. The bullish target remains the five-year high of 116, set three days ago. The median price is likely to remain within small margins of 116.00.

Based on the current momentum, the first resistance is likely to be at 116.154, beyond which the bulls will set their next target, just above Tuesday’s high. Price action to the downside is likely to be minimal, with the near-term support likely to be at 115.439. A breach of this support level will invalidate attempts to hit the 116.356 target. If the present correction turns into a downtrend, the first level of psychological support will be met at around 114.

Leave a Reply