The USDJPY pair was relatively unchanged on Tuesday morning as the market reflected on Japan’s economic data and the ban on foreign travelers. The pair is trading at 113.65, which is a few points above last Friday’s low at 113.00.

Japan economic situation

The Japanese economy has staged a relatively slow recovery from the Covid-19 pandemic. This slowdown is mostly because many of its industrial champions like Toyota and Nissan have faced logistics challenges because of the chip shortage. This means that the country will have the slowest recovery among G7 member states.

Data published by the country’s statistics office on Tuesday showed that Japan has one of the lowest unemployment rates. The rate declined to 2.7% in October from 2.8% in the previous month. This decline was better than the median estimate of 2.8%.

Additional data showed that the country’s industrial production rose by 1.1% in October after it crashed by 5.4% in the previous month. The agency expects that production will rise by 9.0% in November and then retreat to 2.1% in December.

The biggest challenge for the Japanese government is that the country seems vulnerable to the current wave of the virus. In a statement, the government raised omicron variant alerts to the highest level.

In a statement, the country’s National Institute of Infectious Diseases said that omicron was a variant of interest because of its ability to evade vaccines. As a result, the country has closed its borders to foreign travelers. This decision will likely hurt the country’s economy.

Another challenge is that Japan has struggled to stimulate inflation. Recent data showed that the country’s headline consumer price index (CPI) remained at about 1% in October. In Tokyo, inflation is even less than 1%.

The government and the central bank have announced plans to stimulate the economy, but they will likely not work. In October, the government proposed new stimulus checks. However, analysts expect that most Japanese people will use the checks to shore up their savings. For stimulus checks to stimulate inflation, receivers need to spend them.

US consumer confidence and jobs data

The next key mover for the USDJPY will be data from the United States. On Tuesday, the Conference Board will publish the latest consumer confidence data. Economists expect the data to show that the country’s consumer confidence retreated in November as worries about inflation remained.

Consumer confidence is an important number for the US since consumer spending is the biggest component of the economy.

The US will also publish the latest home price index (HPI) on Tuesday. With pending and new home sales rising, there are signs that the country’s home prices did well in October.

On Wednesday, Thursday, and Friday, the US will publish the latest jobs numbers from the US. ADP will publish its private payrolls estimates on Wednesday. These numbers are expected to show that the private sector continued to add jobs even as the great resignation continued. The official jobs numbers will come out on Friday.

USDJPY forecast

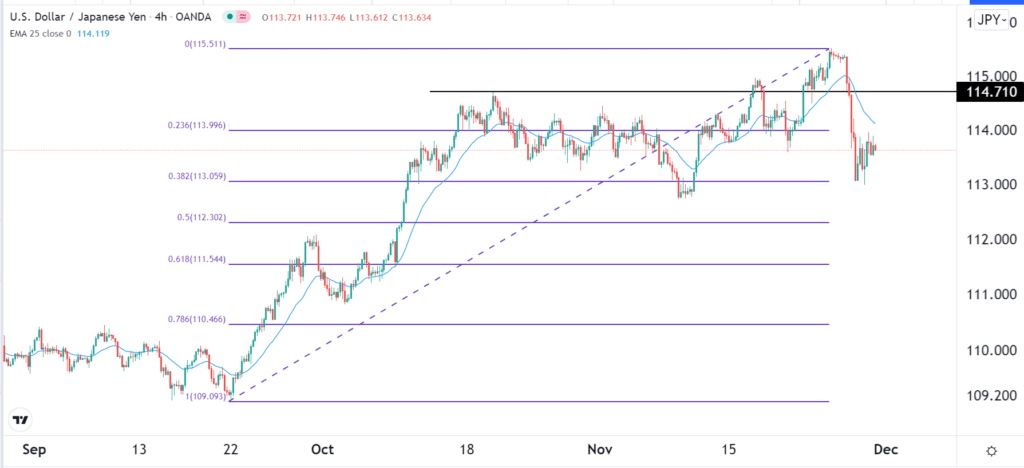

The four-hour chart shows that the USDJPY pair was in a strong bullish trend earlier this month. This trend was undone on Friday as the pair crashed by more than 2%. By doing so, it managed to move below the key support level at 114.71.

It also dropped below the 25-day and 50-day Moving Averages. At the same time, it has formed a bearish pennant pattern. This is a sign that the pair will break out low as bears target the 50% retracement level at 112.30.

Leave a Reply