The USDJPY pair was little changed on Thursday morning after the latest Bank of Japan (BOJ) interest rate decision. Investors are also eyeing the upcoming election in the country. It is trading at 113.65, which is about 0.95% below the highest level this month.

BOJ decision

The USDJPY has been in a bullish momentum in October as investors bet on the divergence between the Federal Reserve and the Bank of Japan. The pair has risen by more than 4% from its lowest level this month, which is a significant gain by a currency pair.

On Thursday, the BOJ concluded its monthly monetary policy meeting and did what most analysts were expecting. The bank decided to leave its short-term interest rates unchanged at -0.10% where they have been for years.

At the same time, the committee members voted unanimously to continue with its yield curve control and quantitative easing program. The yield curve control’s program is to ensure that the benchmark 10-year government bond yields around zero per cent, which lowers the cost of government’s borrowing.

As part of its QE program, the BOJ is purchasing assets worth billions of dollars per month. It is buying ETFs and REITs with an upper limit of 12 trillion yen and 180 billion yen respectively. The bank is also buying CPs worth about 20 trillion yen.

In the statement, the bank downgraded the company’s growth outlook. For example, it expects that the economy will rise by 3.4% in 2021. This prediction was lower than the previous estimate of 3.8%. It sees the economy expanding by 2.9% and 1.3% in 2022 and 2021, respectively. The country is expected to have the slowest recovery among G-7 members this year.

BOJ and Fed divergence

The USDJPY pair has rallied recently because of the potential divergence between the Fed and the BOJ. Analysts believe that the Fed will move earlier than the BOJ. Indeed, the market is pricing in a situation where the Fed will start tapering in the November meeting and then start hiking rates in 2022.

In a recent report, the Wall Street Journal (WSJ) reported that the Fed will start reducing asset purchases by about $15 billion per month until June next year. This is primarily because inflation has remained sticky for a longer time than expected.

At the same time, recent data shows that the unemployment rate has declined while the number of people seeking assistance has fallen.

The BOJ, on the other hand, is facing a major challenge. While the unemployment rate remains at a record low of about 2.9%, inflation has remained stubbornly low. Therefore, there is a likelihood that it will be among the last banks to move.

The USDJPY is also wavering as investors wait for the upcoming election that will happen on Sunday. The current prime minister, Fumio Kishida is expected to win the election. However, many analysts expect that his party, the Liberal Democratic Party will lose seats in parliament.

USDJPY forecast

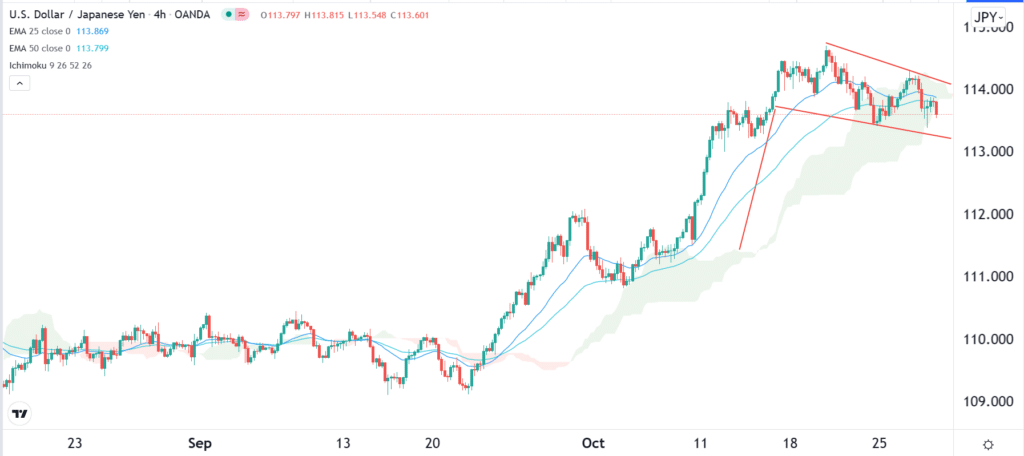

The four-hour chart shows that the USDJPY pair has been in a bullish trend this month. However, in the past few days, the pair’s bullish momentum has faded. As a result, it has declined below the 25-day and 50-day moving averages. It has also formed what looks like a bullish flag pattern. The pair has also declined below the Ichimoku cloud.

Therefore, the pair will likely have a bullish breakout in the near term as investors price in more tightening by the Federal Reserve.

Leave a Reply