- The US dollar has risen against the Japanese yen, with investors optimistic about Biden’s stimulus.

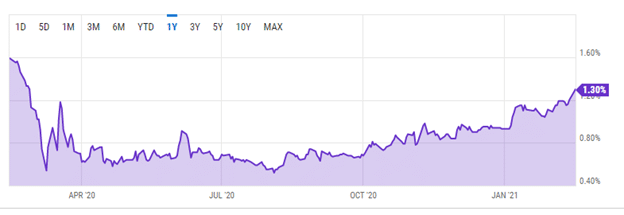

- The US 10-year treasury rate has grown by 1.30%, while Japan’s government bond interest rate is at 0.08%

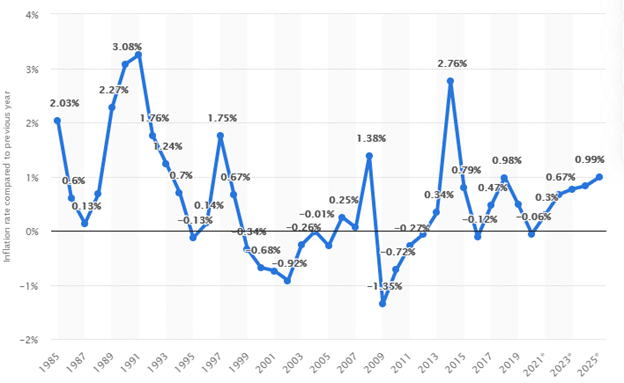

- Japan may see positive inflation growth of 0.3% in 2021.

The USD/JPY rose 3.18% to 105.867 on February 17, 2021, and YTD due to the increase in the US-10-year treasury yield. The trading pair edged closer to levels last seen in October 2020. Japan’s 10-year interest rate of the government bond maintained a low position of 0.08% on February 16, 2021, as investors watched to see how the economy will rebound from the new Covid-19 restrictions.

10-year benchmark

The US 10-Year Treasury rate gained 8.33% to 1.30% on February 17, 2021, after the previous day trading hit a high of 1.20%. The one-year high of the US yields provides impetus to the dollar against significant stocks in the Asian market. Japan’s Nikkei declined 0.5% on the same trading day despite hitting a 5-year high of $30,323.

Investors are upbeat about global recovery prospects given a rise in commodity prices such as oil and agricultural products. Ahead of the FOMC meeting on February 17, 2021, investors will desire to know the monetary policy that will guide the US economy after the passage of Biden’s stimulus, with prospects indicating a rise in inflation numbers.

The 10-year rate primarily affects fixed mortgages and conventional loans that run up to 15 years. A rise in the treasury rate will signal an increase in these rates. The Fed conducted auctions on February 16, 2021, ahead of the FOMC meeting selling the following:

| Auction Amount | Period |

| $54 billion | 13-week bills |

| $51 billion | 26-week bills |

| $30 billion | 119-week bills |

| $30 billion | 42-week bills |

Japan’s economic growth

The Japanese yen rose 0.08% against the dollar on February 17, 2021, to keep the currency steady at the $105 level after robust economic data showed recovery into 2021. From October-December 2020, the annual growth rate of the Japanese economy was at 12.7%. The fourth quarter also saw increased consumption, government expenditures, and trade exports from the country. The third quarter of 2020 (July-September) had seen a 22.9% annualized growth rate of the seasonally-adjusted GDP. However, the economy had declined 4.8% over the 2020 calendar year.

Slow delivery of Covid19 vaccinations across Japan has delayed recovery into 2021 ahead of the much-anticipated Tokyo Olympics later in the year. Japan is set to administer the US Pfizer and Germany’s BioNTech vaccine first to 20,000 health workers before the rest is rolled out to the public by Q2 2021.

On February 13, 2021, Japan was hit by a 7.1 magnitude earthquake (near the Fukushima area), with Tokyo shaking. Japan is planning to revamp its nuclear power stations located in Fukushima to aid in renewable energy generation. The country’s energy plan targets that by 2030 it will generate up to 24% of its energy from renewables, 22% from nuclear power, and 56% from fossil fuels.

However, Japan is set to see positive growth in inflation numbers that will steer economic growth by 2022.

Inflation may grow to 0.3% from a downside of -0.6%. By 2025 it is expected to hover above 1%.

Technical analysis

The USD/JPY currency pair chart shows a double bottom above the $102.533 point, with the confirmation line at 104.338 offering new support. The currency pair has a price target of $108, showing an upside of the US dollar against the yen. The 14-day RSI is bullish for the dollar with a buy at 57.864 amid low volatility.

Leave a Reply