- US dollar strength persists.

- USDJPY is near five-year highs.

- USDCHF steadies amid dollar strength.

Dollar strength remains the central theme in the Forex market, with market participants turning to the greenback amid the ongoing geopolitical tensions in Europe. The dollar has already strengthened to 22-month highs against the majors.

While the Japanese yen and Swiss franc have always attracted bids in times of uncertainty, that has not been the case in recent weeks. The two majors have struggled against the dollar, which remains the market preferred option for hedging against the ongoing tensions on the political and economic front.

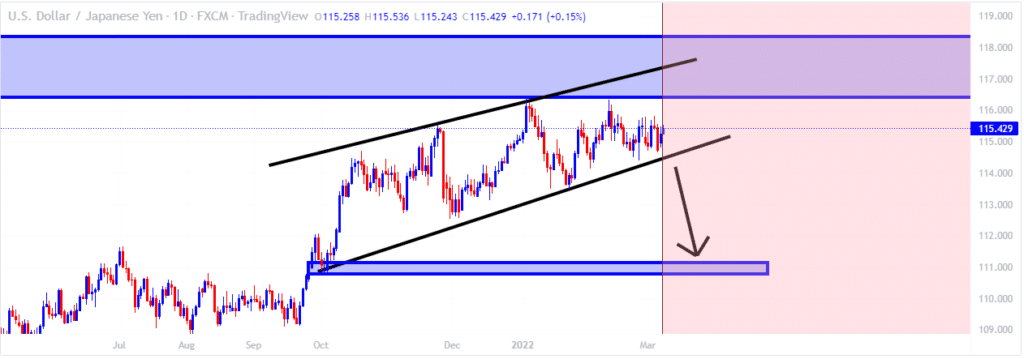

USDJPY technical analysis

Consequently, USDJPY has rallied to five-year highs of 115.43 as investors continue to bet on the dollar at the expense of the yen. After touching highs of 116.39 in recent days, the pair has pulled back slightly in what could be attributed to traders taking profits after the recent surge higher.

Source: Tradingview.com

The 116.30 area has emerged as the immediate short-term resistance level standing in the way of the USDJPY edging higher in continuation of the uptrend that began early last year. The 114.72 has since emerged as a crucial support level above which the pair remains bullish and likely to continue edging higher. A sell-off followed by a close below the 114.70 area could trigger renewed sell-off that could see the pair edging lower.

Why USDJPY is bullish

A number of factors continue to underpin USDJPY bullishness. Disappointing economic data out of Japan is the latest factor fuelling yen weakness. The island nation recording a current account deficit of 1.1887 trillion yen in January is seen as the latest factor weighing heavily on the yen against the dollar.

Escalation of the Russia-Ukraine war is another development that continues to offer support to the dollar, all but fuelling the upside action on the USDJPY pair. The ongoing war has already triggered a surge in oil prices to levels not seen in eight years. The net effect has been a surge in inflationary pressure, with Japan one of the hardest hit given that the country is a net importer of black gold.

The US announced it was considering banning Russian oil and natural gas should continue to fuel inflationary pressures, something that could weigh heavily on the yen, all but supporting the upside action on USDJPY.

USDCHF steadies

Unlike the Japanese yen, the Swiss franc has held steady. The USDCHF pair has resorted to trading in a tight trading range of between 0.9330 and 0.9160. The pair has struggled to power through the 0.9330 resistance level despite the dollar strength across the board. Likewise, the bears have struggled to fuel a drop below 0.9160 despite the Swiss franc being supported by a number of solid economic data.

Source: Tradingview.com

The Swiss State Secretariat for Economic Affairs is fresh from posting a monthly unemployment rate of 2.2% lower than the market consensus of 2.3%, all but affirming the labor market is doing well. However, the Swiss franc has struggled to capitalize on the solid employment data.

The USDCHF has continued to scale higher amid a rally in US treasury yields. Yields have been rising in recent days amid expectations that the US Federal Reserve will move to hike interest rates next week by 50 basis points. FED chairman Jerome Powell has already hinted of a 25bps hike, but odds of a 50 basis point remain high.

Looking ahead, the focus is on the release of the US Consumer Price Index numbers for February. The report’s outcome could have a significant impact on whether the FED pursues an aggressive monetary policy tightening spree, something that could fuel further dollar strength. The initial indication is that the CPI number will come out at 7.9%.

Leave a Reply