- Switzerland’s trade balance grew 31.14% (MoM), increasing imports over exports in May 2021.

- The SNB maintained its interest decision at -0.75, retaining the world’s lowest funds rate into Q3 2021.

- Weekly US continuous jobless claims are expected to beat consensus estimates at 3.43 million.

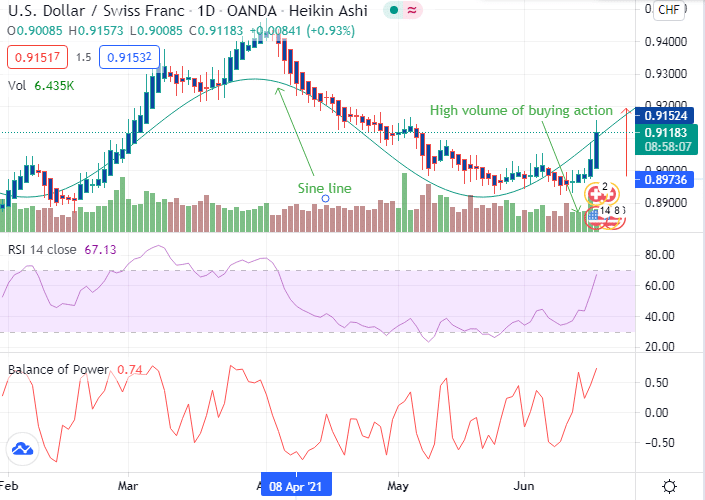

The USD/CHF pair grew 0.75% on June 17, 2021, from the previous day’s close. It hit a high of 0.9157 after opening at 0.9086.

Switzerland saw a 31.14% increase in its trade balance from a previous reading of 3.773 billion Swiss francs to 4.948 billion Swiss francs (MoM).

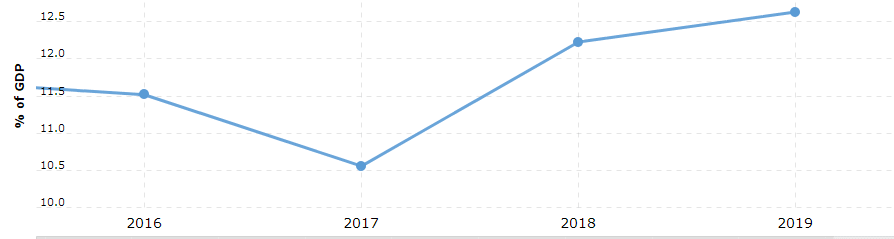

Trade Balance against GDP

The trade balance has risen steadily since 2017, hitting a high of 12.5% of GDP at 81.23 billion francs ($88.79 billion).

Rate decision

The Swiss National Bank (SNB) maintained its interest rate at -0.75, retaining the world’s lowest funds rate into Q3 2021. The lower rate acted negatively on the CHF even as the SNB preferred to maintain liquidity and credit supply.

Inflation forecast for 2021 stood at 0.4% with 0.6% predicted for 2022-2023. It is expected that the forecast (0.4%-0.6%) will be maintained as long as the rate remains -0.75% during this period.

GDP growth for 2021 is likely to be 3.5%, buoyed by mortgage lending, prices of residential properties, and management of Covid-19. Pandemic recovery is central to SNB’s growth forecast, with analysis showing a long-term inflation projection of 1% in 2023.

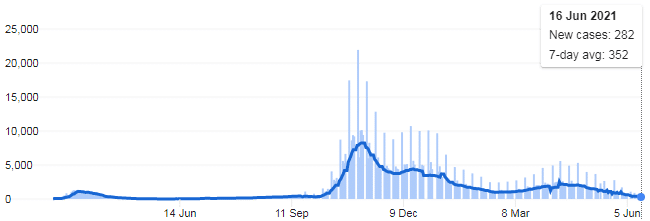

As of June 16, 2021, new coronavirus cases in Switzerland dropped 94.94% to 282 from a high 5,583 on April 12, 2021.

Approximately 6.09 million doses have been issued in Switzerland, with 27.4% of the population being vaccinated (or 2.34 million people). Up to 43.9% of the Swiss citizens had received at least one Covid-19 dose as of June 13, 2021.

US jobless claims

The US dollar climbed against the Swiss franc ahead of the jobless (weekly) claims, with consensus estimates at 3.43 million from a previous reading of 3.499 million.

Weekly (initial) jobless claims are also expected to beat consensus estimates at 359,000 from a previous reading of 376,000 realized on June 10, 2021.

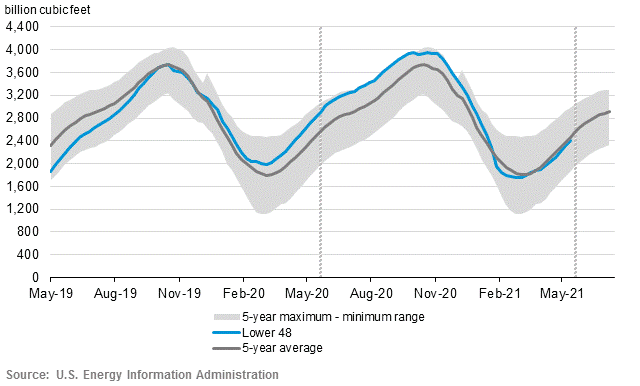

Energy estimates

Ahead of the weekly Energy Information Administration (EIA) natural gas report on June 17, 2021, the net increase of the commodity stood at 98 Bcf on June 4, 2021, at 2,411 Bcf.

There was a strong demand for working gas in 2021 as stocks decreased by 383 Bcf YoY. Compared to the 5-year average, natural gas estimates declined by 55 Bcf as working (natural) gas storage stood at 2,466 Bcf.

Natural gas underground storage

Gasoline inventories had also declined to 1.954 million barrels on June 16, 2021, from a previous reading of 7.046 million barrels. However, the decrease failed to beat estimates at -0.614 million barrels, indicating slow consumption.

Yellen is optimistic about the economy

In her testimony before Congress, US Treasury Secretary Janet Yellen expressed optimism about the growth of the American economy. The successful enactment of Biden’s $1.9 trillion rescue plan by Congress was cited as a building block to alleviate the country’s economic challenges.

However, the Secretary mentioned wage disparities among races and low labor participation as the main obstacles to this realization.

Technical analysis

The sine line of the USD/CHF chart shows the price is moving towards 0.9200 on the high volume.

There is a decisive buying action with the balance of power at 0.74 (close to 1), indicating higher net increases between the closing and opening price of the pair. The 14-day RSI is at 67.13, close to the overbought zone of 70.00.

Leave a Reply