- The sale of existing homes in the US declined 2.7% in April 2021.

- Switzerland is experiencing a surge in EV sales into 2021.

- Switzerland’s vaccination rate is at 23% of the population as it prepares for phase 4 reopening.

The USD/CHF traded at -0.59% in the week leading to May 21, 2021, after April 2021 data that showed a decline in the existing US home sales.

The sales decreased to 5.85 million (-2.7%) from March 2021 figures at 6.01 million. While jobless claims lowered to 444,000 in the week leading to May 15, 2021, the continuing jobless claims surged to 3.751 million. There was an increase in the API weekly crude oil stock at 0.620 million from -2.533 million as crude oil inventories soared to 1.321 million from -0.427 million.

Higher ratings

The Swiss franc edged higher against the dollar on May 21, 2021, after a stable outlook rating by Fitch that affirmed the country’s long-term currency Issuer Default Rating (IDR) at ‘AAA.’ Assets in the banking sector reached 525% of the GDP, with economic recovery in the second half of 2021 expected to grow to 3.1% after a 3.0% decline in 2020.

The Swiss National Bank (SNB) bought into Chinese electric car manufacturers Li-Auto and increased its holdings in XPeng (XPEV). The bank also added shares in Zoom Video Communications (ZM) as well as the Canadian marijuana grower Tilray (Tilray) in what is viewed as a strategic investment.

Surging EV market

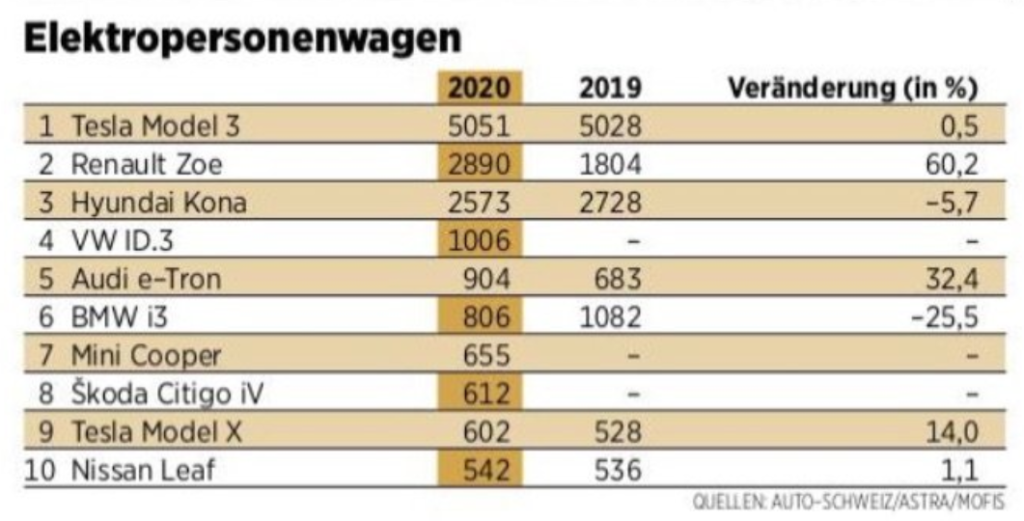

Q2 2021 data showed that the Swiss EV market was dominated by Tesla’s Model 3 that sold 5051 units in 2020 against 5028 in 2019 (+0.46%).

Swiss EV market

Renault Zoe followed Tesla at +60.2% selling 2890 EV units in 2020 against 1,804 in 2019. The surge in Switzerland’s market was also occasioned by the expansion of Fastned, a Dutch charging installation company. The company has built charging stations across Europe, including Switzerland, Belgium, and Spain among others.

The company announced its expansion into the UK and France in partnership with Tesla. It plans to add 10 MW of electrical power to help the firm’s future expansion goals.

Switzerland kept its interest rates at -0.75% by the end of Q1 2021 as the SNB is expected to review the policy decision on June 17, 2021. The bank expects GDP growth as the country pushes to increase its vaccination rates and emerge from the pandemic.

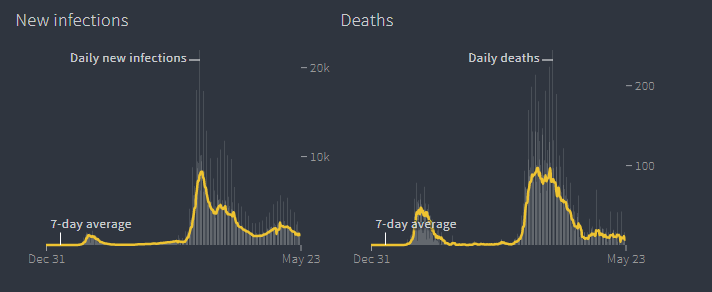

Switzerland’s Covid-19 infection rate decreased to 14% of the peak, with approximately 23.1% of the population vaccinated.

Covid-19 infection trends

As of May 23, 2021, Switzerland had administered up to 3.966 million doses averaging a daily uptake of 64,669. The country also plans to remove the quarantine mandate for travelers that have recovered from Covid-19 as it enters the 3rd phase or reopening from the nationwide lockdown.

Switzerland is preparing for phase 4 of reopening that will allow restaurants to offer in-door services and increase gatherings by the end of May 2021.

Trade ties

The US got a reprieve after the EU announced a pause in retaliatory tariffs (for now) on US products due to a dispute concerning steel. President Biden is under pressure to maintain tariffs on steel imports set by his predecessor, former President Trump, to protect American jobs.

The US imposed 25% tariffs on steel imports from the EU and 10% on aluminum products. Among the countries affected by the duties are Switzerland, Russia, Norway, Japan, and Turkey.

Technical analysis

USD/CHF trading analysis

The USD/CHF trading pair hit resistance at 0.9427 and has since been declining. The pair is staying below the 9-day Exponential Moving Average (EMA), indicating a strong downtrend. The 14-day RSI is at 29.10, also showing heightened selling among traders. In case there is a trend reversal, the USD/CHF may settle at 0.9200 that may also provide resistance.

Leave a Reply