- US dollar remains under pressure after a recent spike to five-month highs

- USDCAD has resumed its movement to the downside amid renewed CAD strength

- Turkish Lira is strengthening across the board on improved Turkey economic outlook

- US indices turned bullish on Biden Administration inking a bipartisan infrastructure deal

The US dollar is struggling for direction near multi-month highs as investors await further inflation data. After a hawkish FOMC report the past week, the greenback has struggled for direction on FED chairman Jerome Powell and other officials moving to calm the markets amid concerns about imminent rate hikes.

USDCAD retreats

The USDCAD has come under pressure amid the dollar weakness. The pair has since retreated from two-month highs of 1.2475 registered at the start of the week to lows of 1.2300.

The pullback has come on the dollar weakening at multi-month highs and the Canadian dollar strengthening across the board. A spike in oil prices to multi-year highs is one-factor offering support to the CAD and helping fuel slide in USDCAD.

Oil prices surging to three-year highs should continue to strengthen the CAD against the dollar. Improved market sentiments on the Canadian economy also offer support to the CAD, fuelling a move lower on the major.

The Export Development Canada’s Trade Confidence Index rising 19%, the highest in the last 20 years, continues to underscore ongoing Canadian economic recovery in the aftermath of the pandemic. Wholesales Sales also advanced In May by 1.1% as the manufacturing sector grew 1.0% from a 2.1% drop in April.

Turkish lira strengthening

The Turkish lira is also strengthening against the US dollar, with the USDTRY pair sharply dropping to 8.6690. The pair has been on a downtrend in recent days amid dollar weakness across the board.

Additionally, the Lira has received support from the Turkish Finance Minister Lufti Elvan, reiterating the expectation of economic growth more than the government forecast for 2021. The minister expects the Turkish economy to grow by about 20% in the second quarter.

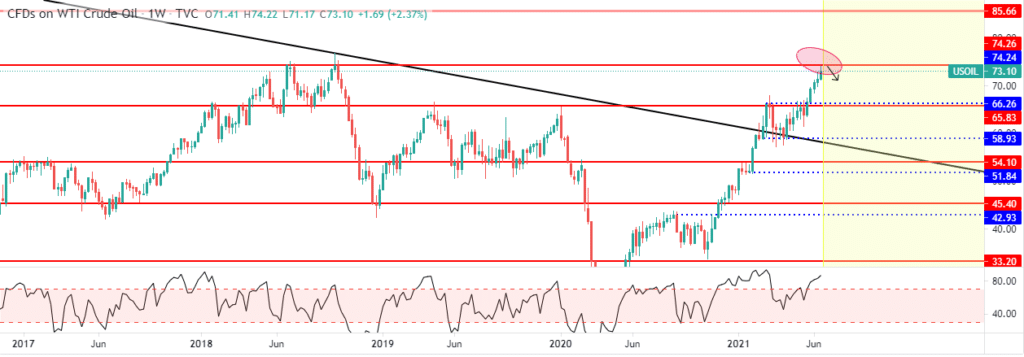

Oil rally

In the commodities market, oil and gold are also up heading into the weekend. Brent crude futures were up by 0.03% Friday morning to $75.58 a barrel as WTI futures inched 0.04% to $73.33 a barrel.

Oil prices are currently flirting with the overbought territory after a spike above the $70 barrel level.

Amid the spike to multi-year highs, the rally could experience some challenges on the OPEC hiking supply amid an uncertain oil demand environment. Oil prices are up by more than 50% for the year on a spike in demand amid low supply following last year’s OPEC production curbs.

Oil outlook remains bullish as economic activity in China and Europe improves, fuelling strong demand for black gold. A successful COVID-19 vaccination drive worldwide has also contributed to a bright fuel demand outlook given the ongoing economic opening.

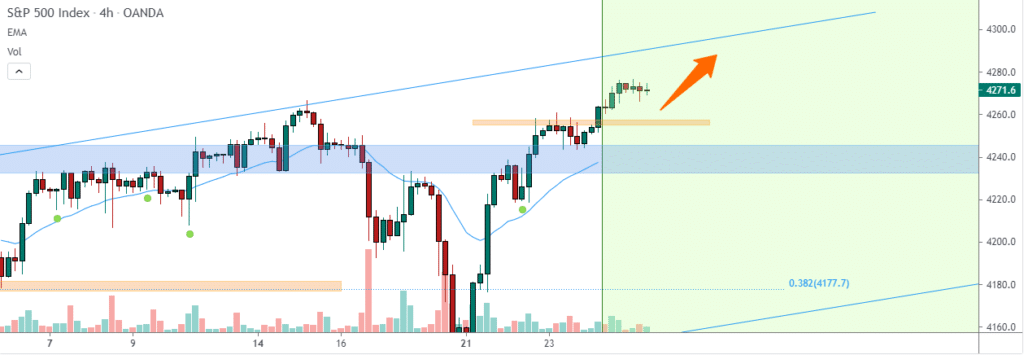

Indices rally on Biden infrastructure deal

Major indices in the US are poised to finish at record highs in the equity markets after Jumping on Thursday on President Joe Biden striking a bipartisan infrastructure deal. The S&P 500 rose 0.6% to record highs of $4,266.49, recouping all the losses following last week’s hawkish FED report.

The Dow Jones Industrial Average was also up a bit, jumping 1% to 34,196.82 as tech-heavy Nasdaq rose 0.7% to close the session at 14,369.71. The rally came on Biden sealing a deal that includes $579 billion in new spending. Additionally, FED Chair soothing the market by reiterating inflation pressures is transitory and fuels the bullish momentum.

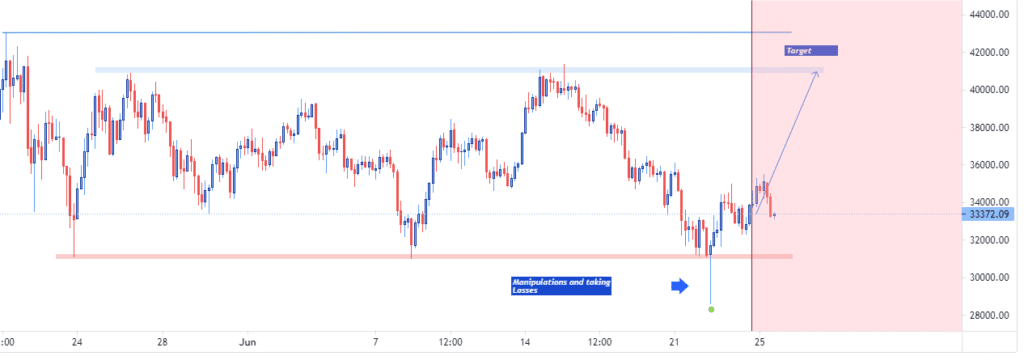

Bitcoin bounce back struggles

Bitcoin bounce back from five months lows has stalled with BTCUSD struggling to rise past the $36,000 level. The pair has resorted to trading in a tight trading range after bottoming out below the $30,000 level.

The $35,500 level has emerged as a critical resistance level curtailing any movement to the upside.

Support to the downside is seen at the $31,700 level below which BTCUSD remains susceptible to dropping below the $30,000 level. Weighing heavily on Bitcoin sentiments is the ongoing mining and trading crackdown in China.

Leave a Reply