- US trade balance (deficit) for June 2021 rose 6.62% (MoM) to -$75.70 billion from a previous record of -$71.00 billion.

- Canada’s exports jumped 8.74% to C$53.76 in June 2021, causing the trade balance to rise to C$3.23 billion.

- As of August 4, 2021, new Covid-19 cases in the US had risen to 112,270, the sharpest rise since April 15, 2021.

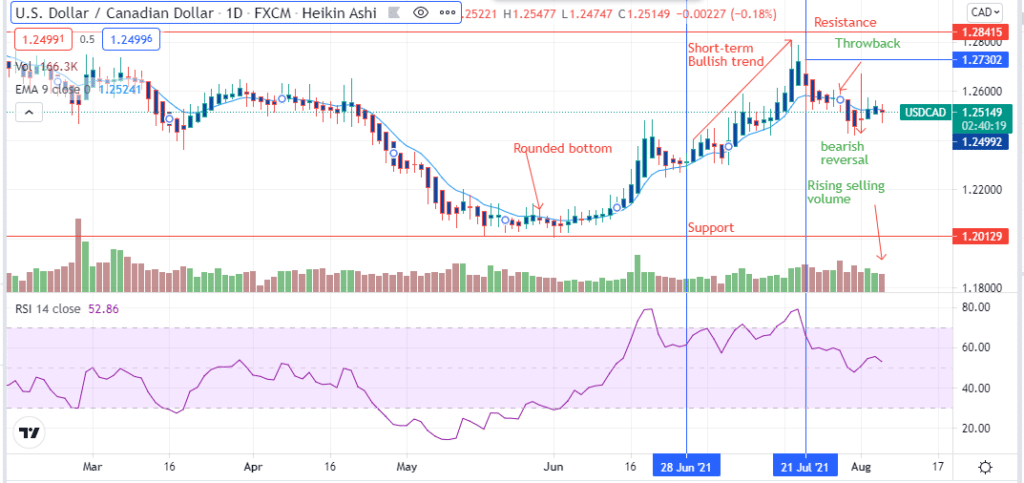

The USDCAD pair lost 0.42% as of 11:30 am GMT on August 5, 2021, from the previous day’s close. It reached a low of 12473 after opening at 1.2541. US trade balance for June 2021 rose 6.62% (MoM) to -$75.70 billion from a previous record of -$71.00 billion. It indicated an increase in imports as compared to exports, failing to beat estimates at -$74.10 billion.

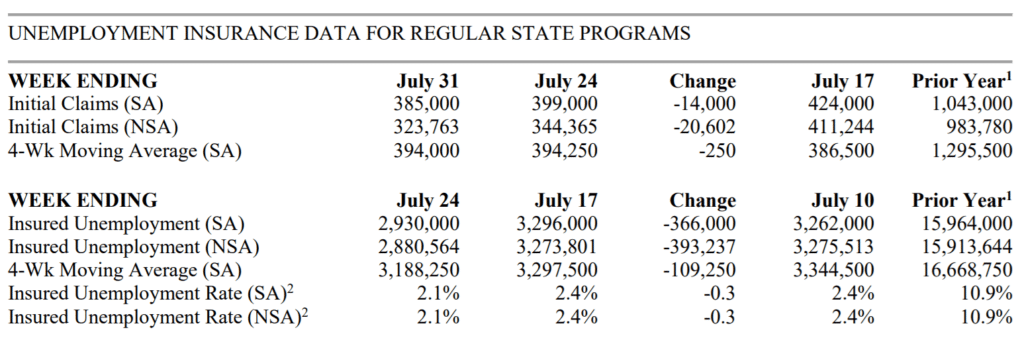

US unemployment claims

On a positive note, continuous jobless claims (for the week ending July 24, 2021) beat estimates at 3,260K and fell to 2,930K. Previous claims stood at 3,296K, showing an 11.10% decline in continuous US unemployment.

Figure 1 Continuous and Initial jobless claims in the US

Initial jobless claims in the week ending July 24, 2021, also declined 3.5% from 399,000 to 385,000. However, this decrease failed to beat estimates at 384,000, slowing down the US dollar against the Canadian dollar (loonie).

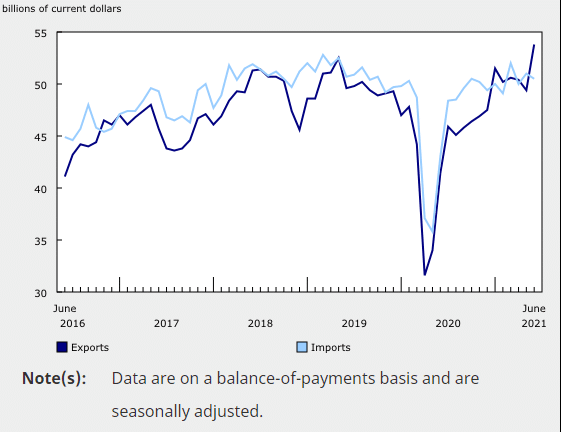

Canada’s trade balance

June 2021 saw Canada’s exports jump 8.74% from C$49.44 billion in May 2021 to C$53.76 billion. Imports reduced from C$51.02 billion in May 2021 to C$50.53 billion in June 2021. Consequently, the trade balance rose to C$3.23 billion, beating estimates at -C$0.68 billion. May 2021 had seen the trade balance fall to -C$1.58 billion.

The positive trade balance puts Canada in a surplus position.

Figure 2 Canada’s falling imports against rising exports

In terms of volume, exports were up 7.0%, with a 5.5% increase in 9 out of 11 commodities, including non-energy products. Energy products had their export rise at a record high since March 2021 at 22.9% to settle at C$11.3 billion.

Motor vehicles and related accessories had their exports surge 14.9% in June 2021. This increase was significant since monthly declines due to supply-chain disruptions had pushed motor vehicle imports/ exports to record lows.

June 2021 saw import volume declined 2.2%, prominent among 7 out of the 11 sampled products. There was a 24.4% decrease in the importation of passenger cars. However, the decrease was offset (partially) by an increase in aircraft importation that rose 28.0% (+C$458 million).

As of 12:42 pm GMT on August 5, 2021, the loonie had gained 0.16% against the New Zealand dollar, +0.33% against the Swiss franc, and +0.60% against the Japanese yen.

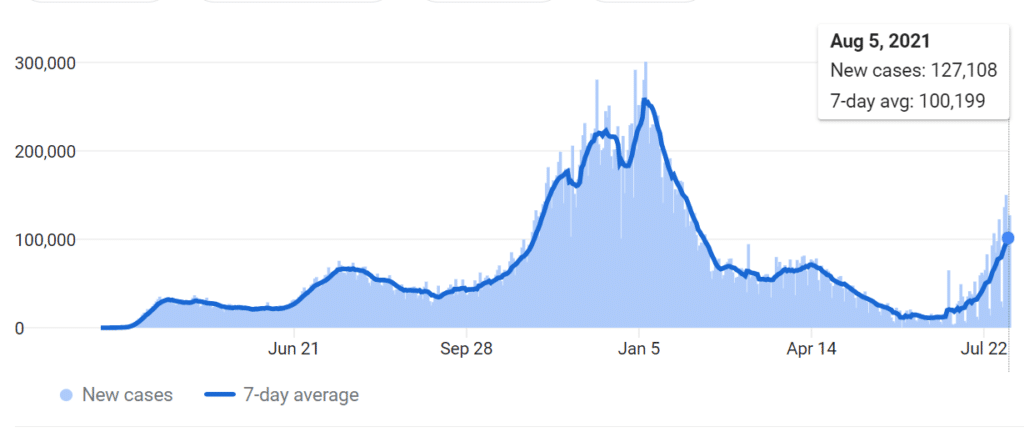

Coronavirus cases

The greenback was also pulled back by the rising Covid-19 cases across the US.

Figure 3- Rising Covid-19 cases in the US

As of August 4, 2021, new cases had risen to 112,270, the sharpest rise since April 15, 2021, when it rose to 73,294. The number of deaths now stands at 615,000, with states like California recording the highest daily rise at 64,626. The vaccination rate has just crossed 50.4%, with 165 million people fully vaccinated out of a total dosage administration of 348 million.

Canada has a higher vaccination rate at 60.7%. About 22.8 million people have been fully vaccinated out of a total dosage administration of 49.9 million.

Technical analysis

After forming the rounded bottom (at the 1.2013 support level), the USDCAD responded with a short-term uptrend. The move was looking to hit the resistance level at 1.2842. The bearish reversal was confirmed after the throwback began at 1.2730.

There is a rise in selling volume, with the 14-day RSI declining to 52.86. The pair is currently staying below the 9-day EMA at 1.2524, indicating bearish bias.

Leave a Reply