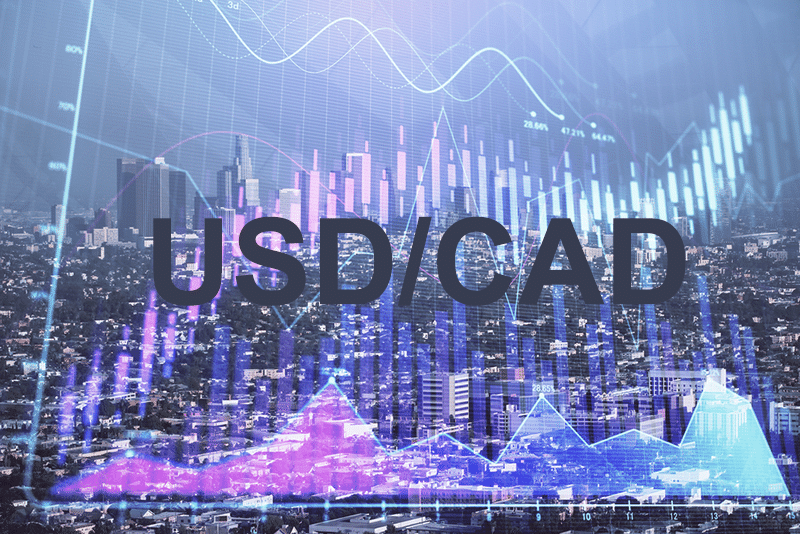

- The Canadian dollar is strengthening against the US dollar, sending USDCAD lower.

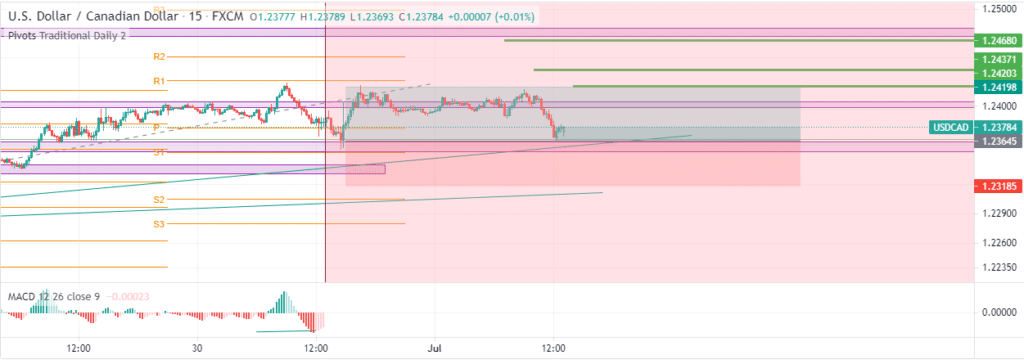

- EURGBP pair is trying to break out of a tight trading range amid British pound weakness

- US indices ended the first half of the year at record highs registering double-digit gains.

- Ethereum bounces back from six-month lows has stalled with ETHUSD remaining under pressure.

The US dollar is losing steam against the Canadian dollar, sending the USDCAD lower after a recent spike to seven-day highs. A mixture of diverging forces has failed to provide any meaningful impetus needed for bulls to continue supporting the pair above the 1.2400 level.

The pair has since dropped back to the 1.2370 level. It remains well supported for a bounce-back above the 1.2356 level seen as a key support level.

A breach of the 1.2356 support level would leave the pair susceptible to a decline, probably to the 1.2320 seen as the next substantial support level.

The bearish momentum on the USDCAD has been fuelled by the Canadian dollar strengthening on oil prices rallying to multi-year highs. However, modest US dollar strength ahead of the Non-Farm payroll report on Friday has helped limit the downside on the pair. Additionally, the US dollar is facing strong resistance depicted by the dollar index struggling to rise past three-month peaks of 92.50.

EURGBP trying to breakout

EURGBP is trying to power through a tight trading range of between 0.8567 and 0.8600 levels after a long period of consolidation. The greenback pilling pressure on the British pound is one of the catalysts fuelling a spike of the EURGBP pair.

A spike above 0.8600 is experiencing resistance as the pound remains on the defensive against the euro in the aftermath of the hawkish tone by the Bank of England. The BOE has brought forward the prospects of a rate hike, all but fuelling some bullish tone on the pound.

However, the spread of the Delta variant across the UK threatens to derail the UK economic recovery, which continues to affect the pound sentiments among traders.

US indices at record highs

Major US indices held on to gains at record highs in the equity markets at the end of the first half of the year. The Dow Jones Industrial Average was up 210 points on Wednesday, boosted by strong gains on Walmart and Boeing. The Dow was up by 12% in the first half of the year.

The S&P 500 held on to gains above record highs, registering fifth straight record close after a 0.1% spike to 4,297.50. On the other hand, the NASDAQ was on the receiving end, tanking 0.2% to end the first half at record highs of 14,503.95. The S&P 500 closed the first half 14.4% up, have, and the NASDAQ remained 12% up from levels at the start of the year.

Investors shrugging off inflation reading in the hopes of continued economic recovery is one of the reasons major indices are at record highs.

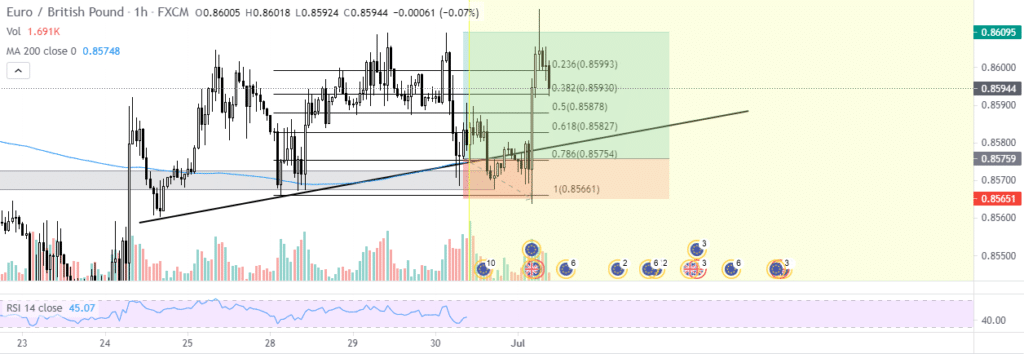

Silver bounces back

Silver is trying to bounce back in the commodity markets after coming under immense selling pressure in recent days. XAGUSD has struggled to rise past the $27 an ounce level even on fundamentals remaining strong in recent days.

In recent weeks the XAGUSD pair has resorted to trading between 26.29 and 25.66 levels as part of a long consolidation wave.

The consolidation has come into play even on record low rates and inflationary pressure, offering possible price swings to the upside. The relentless selling pressure has come on the US dollar strengthening across the board in the aftermath of a hawkish Federal Reserve report in June.

Ethereum bounce back stalls

In the cryptocurrency market, Ethereum’s bounce back from six-month lows has experienced some resistance. ETHUSD is struggling to hold on to gains above the $2,000 level, with the $2300 level emerging as a crucial resistance level.

With the upward momentum losing steam, a $2040 support level breach could trigger an increased sell-off down to the $1900 level.

Ethereum has come under immense pressure amid sell-off in the broader cryptocurrency sector. Increased crypto crackdown in China and valuation concerns are some of the factors that have fuelled sell-offs from record highs.

Leave a Reply