- US dollar stays under pressure amid profit-taking.

- USDCAD edges lower on CAD strength.

- AUDUSD bounce back stalls after RBA.

- Bitcoin and Ethereum trim losses.

The US dollar suffered its biggest daily fall since November as it dropped by about 0.70% against the majors on Monday. The sell-off came as investors consolidated gains following a recent spike to 1-1/2 year highs on expectations of a much faster rate hike by the Federal Reserve.

The FED has already signaled to raise interest rates as early as March, with the markets expecting five to six rate hikes before year-end. The accelerated rate hike push comes at the backdrop of the FED racing against time to try and control runaway inflation that has spiraled to 40-year highs.

Over the weekend, Atlanta Fed President Raphael Bostic reiterated that the FED could be a super-size rate hike if inflation remains at the elevated levels.

USDCAD pull back

The Canadian dollar is one of the currencies taking advantage of the dollar softness across the board. USDCAD has since pulled back from three-week highs near the 1.2800 level to lows of 1.2700. The pair is likely to trade with a negative bias, especially on a sell-off through the 1.2700 level.

A drop to 1.2651 could be seen as the next substantial support level in the cards. USDCAD finding support above the 1.2700 level could trigger a bounce back to the 1.2800 handle. Around 1.2700, the pair remains on the defensive.

USDCAD drivers

The bearish bias is being fuelled by a spike in oil prices, Canada’s main export, to seven-year highs. With US oil closing in on the elusive $90 a barrel level, the Canadian dollar could continue to shrug off dollar strength, consequently fueling a sell-off of the USDCAD pair.

Oil prices are expected to remain at multi-year highs owing to limited production increase by oil majors. A recovery in demand to the pre-pandemic level also continues to offer support above the $80 a barrel level, conversely fuelling CAD strength. In addition, the faltering of US treasury yields continues to keep USDCAD bulls on the defensive, all but contributing to the negative bias.

AUDUSD struggling for direction

Meanwhile, the AUDUSD bounce back from one-month lows appears to have stalled on the Reserve Bank of Australia taming rate hike concerns. The pair is struggling to power through the 0.7073 level, which has emerged as the short term resistance level.

A drop to 0.7030 could be on the cards as the AUD remains under pressure against the dollar. A breach of the 0.7030 support level could trigger further losses to the 0.7000 handle. On the flip side, the pair needs to rise and find support above the 0.7073 resistance level to affirm the upward momentum.

The negative bias comes from the RBA, keeping the benchmark interest rate unchanged at about 0.10%. However, the move by the central bank to cease purchases under the bond purchase program continues to limit the losses. Disappointing economic data characterized by Retail Sales for December marking the lowest point since mid-2020 of -4.4% versus 3.9% expected continue to weigh on the pair.

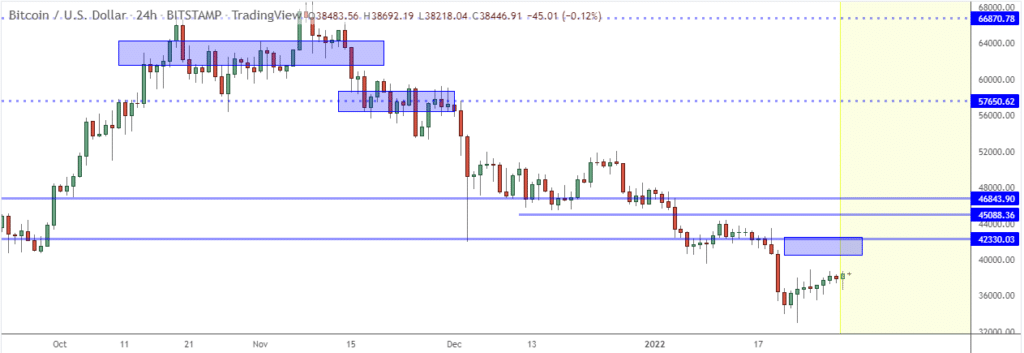

Bitcoin and Ethereum bounce back

Meanwhile, Bitcoin and Ethereum are on the front foot after being under pressure in recent days. BTCUSD has powered through the $38,000 handle to one-week highs of $38,340.

The bounce-back comes at the backdrop of immense sell-off fuelled by profit-taking and regulatory pressures. China and Russia moving to curb crypto trading and mining appear to have hurt the flagship crypto sentiments.

ETHUSD has also felt the pressure slumping below the $3,000 level. The pair is once again above the psychological level to highs of $3,032, waiting to see if it will find support.

However, Ethereum has come under pressure in recent days amid concerns that it is losing its market share in the decentralized finance space and non-fungible tokens.

Leave a Reply