- New home sales for June 2021 in the US fell 6.6% to 676,000 failings to beat consensus estimates at 3.5%.

- The surge in the Delta variant saw the US prepare to purchase an additional 200 million Pfizer & BioNTech doses meant for children below 12 years.

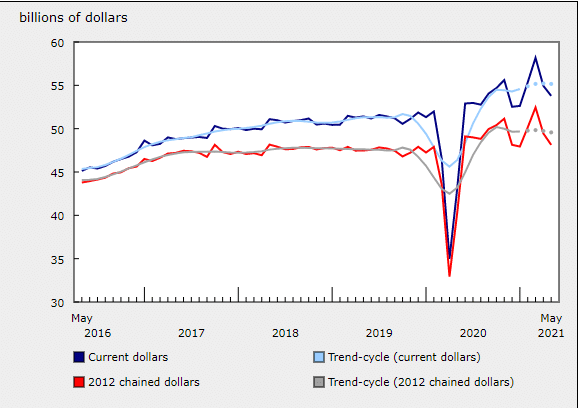

- May 2021 saw Canada’s retail sales dip 2.1% (MoM) at 53.8 billion as the third Covid-19 wave continued to force business closures into Q2 2021.

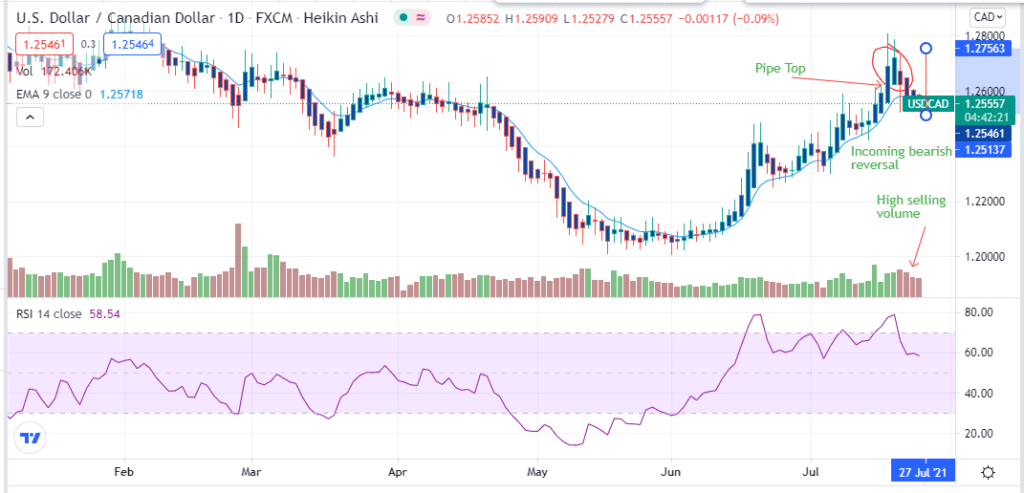

The USDCAD pair lost 1.50% in the week leading to July 26, 2021, with the pair pointing to a downside of 1.2510. It traded in the range of 1.2545 to a high of 1.2591 after losing 0.02% as of 6:55 am GMT. The US was expected to post new home sales data on July 26, 2021, for June 2021 (MoM).

The Canadian dollar gained an edge over the US dollar after new home sales for June 2021 fell 6.6% to 676,000. Monthly consensus estimates had suggested a 3.5% increase to 800,000 from a previous decline of 5.9%, where it stood at 724,000.

Wrong direction

In fighting the spread of the new Covid-19 variant, “Delta,” the US has been described as moving in the wrong direction. Daily deaths have reached 4,000 as total deaths climbed to 626,769 as of July 26, 2021. The US is preparing to purchase an additional 200 million Pfizer & BioNTech doses meant for children below 12 years.

Less than 50% of the population has been fully vaccinated at 49.7% representing 163 million from a total dosage of 342 million. Data from Israel gave the rate of Pfizer’s protection from Covid-19 to be 39%. The CDC has been asked to revise the masked requirement after it lifted the mandate. This condition may prolong the complete easing of restrictions after the UK posted a record rise in infections after lifting lockdown rules.

EDA investment

The US Commerce Secretary, Gina Raimondo, announced the launch of a $3 billion economic development (EDA) fund to support investments and boost jobs in the US. The fund is expected to help create up to 300,000 American jobs, where $500 million will support industries driven by a strong workforce. Up to $1 billion was left to drive innovation in more than 30 cities, and $300 million will be invested in coal communities.

With the American Rescue Plan (ARP) already on course, the Fed is grappling with the decision to taper asset purchases. Since July 2020 (Q2 2020), the Fed has been buying Treasury securities worth $80 billion and mortgage-backed securities (MBS) at $40 billion. The consideration to scale down the asset purchases may work to lower inflation. This is a precursor to a potential increase in interest rates, with the next FOMC meeting scheduled for July 27-28, 2021.

The 10-year Treasury yield fell to 1.1280% in July 2021 from a high of 1.776% recorded at the end of March 2021, throwing concerns if the Fed may still consider tapering.

Retail sales

May 2021 saw retail sales dip 2.1% (MoM) at 53.8 billion, as the third Covid-19 wave continued to force business closures into Q2 2021. Despite the decrease, the retail sales had exceeded expectations set at -3.0% from a previous record of -5.7%.

Canada’s retail sales

The US dollar dropped 1.13% against the British pound in the week leading to July 26, 2021, and 0.91% against the New Zealand dollar. It showed the continued weakness of the US dollar ahead of the FOMC meeting.

Technical analysis

The USDCAD pair formed a pipe top, signaling an upcoming short-term bearish reversal. We may see a decrease to 1.2514.

Sellers are stepping in, keeping the price below the 9-day EMA at 1.2572. The 14-day RSI is at 58.54, showing a decrease in buying momentum. We may still see an uptrend if the price fails to move above 1.2600.

Leave a Reply