- The Indian rupee is under pressure against the dollar as a surge in new coronavirus infections raises prospects of lockdown restrictions.

- The euro and British pound remain under pressure against the dollar at the start of the new week as the EUR/GBP bounce back gathers steam.

- Gold and silver were sliding lower on renewed dollar strength after an impressive performance last week.

A data-heavy week is what awaits traders in the forex market, going by the plethora of economic releases lined up. The US dollar is again in the spotlight, having bounced back on Monday ahead of crucial Inflation and retail sales.

The euro and British pound are once again under pressure amid a resurgent dollar. The deteriorating COVID-19 situation in Europe continues to arouse concerns on the two fiats. The Indian Rupee is another currency under pressure, having tanked to multi-month lows amid worries of expanding lockdown restriction to counter rising cases of infections.

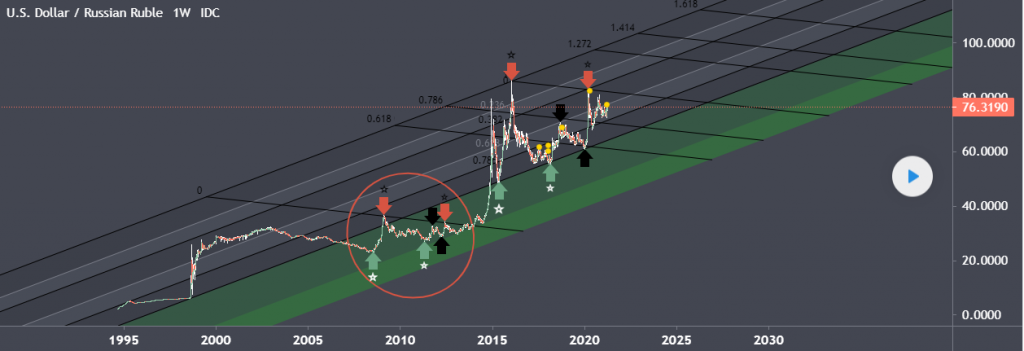

Rupee weakness

The Indian Rupee fell to two months lows against the dollar, dropping past the 76 to a dollar level for the first time since August 2020. Indian Stocks also remain under pressure, with the Benchmark S&P BSE Sensex dropping by as much as 3% as the country struggles with an escalating health crisis.

The second wave of infections has hit record highs, all but arousing concerns about India’s economy. Hospitals running out of beds and immunization centers turning people away threaten to bring the health sector to its knees and take a toll on the economy.

Similarly, some of the biggest cities led by Mumbai and New Delhi are already contemplating bringing back more restrictions to curb a surge in cases. Charter about new restriction measures is the latest tailwind weighing heavily on the Rupee against the dollar.

EUR/GBP bounce back

The British pound weakened against the dollar, and the euro persisted on Monday. Since September, the EU/GBP saw its biggest weekly gain as the impressive pound run came to an end. While the UK has been a success story on the COVID-19 vaccination drive that helped offer support to the pound, uncertainty over AstraZeneca’s vaccine’s viability continues to weigh heavily.

The EUR/GBP pair has since bounced off one-month lows amid pound weakness. The formation of a bullish engulfing pattern on the weekly chart might as well suggest further price gains. The pair has bounced back to three-week highs.

However, there are also suggestions that the pound weakness might have been influenced by traders taking profits after recent price gains. Conversely, there is a higher probability that the pound could regain its footing against the euro. Therefore it is highly likely that the EUR/GBP pair could decline back to the 0.85 level.

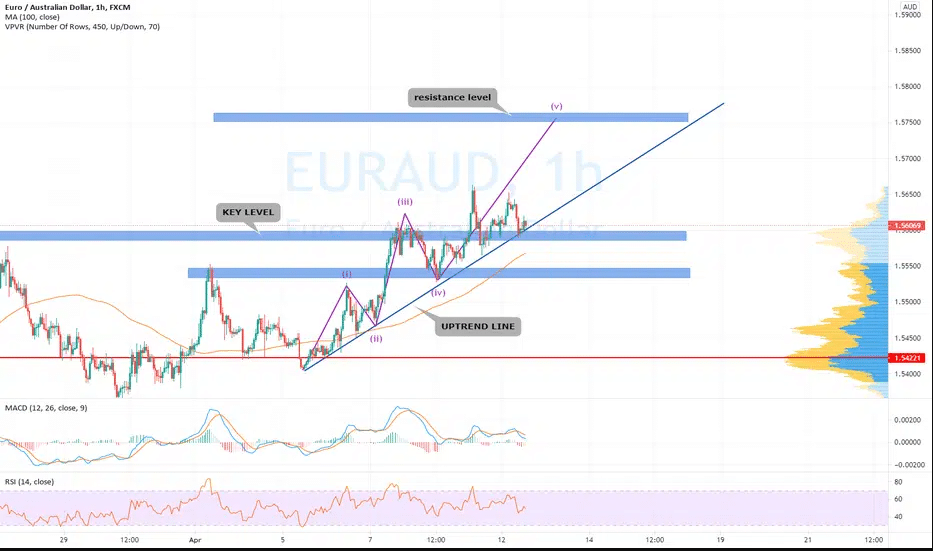

EUR/AUD rally

EUR/AUD is another pair edging higher as the upward momentum builds from where it left last week. The pair has received a boost on renewed euro strength amid dollar weakness. The shared currency continues to strengthen against the Australian dollar in the aftermath of the Austria central bank governor suggesting that the European Central Bank could reduce its bond purchasing program during the summer.

News of a new wave of coronavirus infections in the trading block is yet to significantly impact the euro, which continues to strengthen against the AUD at the start of the week. However, the EUR/AUD is closing in on a key resistance level near the 1.5690 level from where new catalysts will have to come into play if the pair is to continue racing higher.

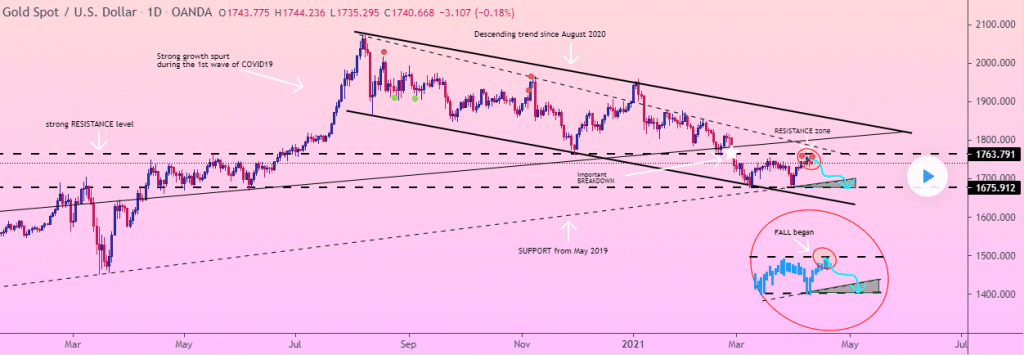

Gold-silver selloff

In the commodity markets, gold remains on the back foot amid a resurgent US dollar. The yellow metal shed more than 1% in Monday trading session, plunging back to lows of $1,728 an ounce level.

Last week’s lows of $1,721 are the descent support level that could shield against further sell-offs after the recent pullback.

The sell-off comes after the precious metal rallied to one and a half month highs last week, close to highs of $1,760 an ounce level.

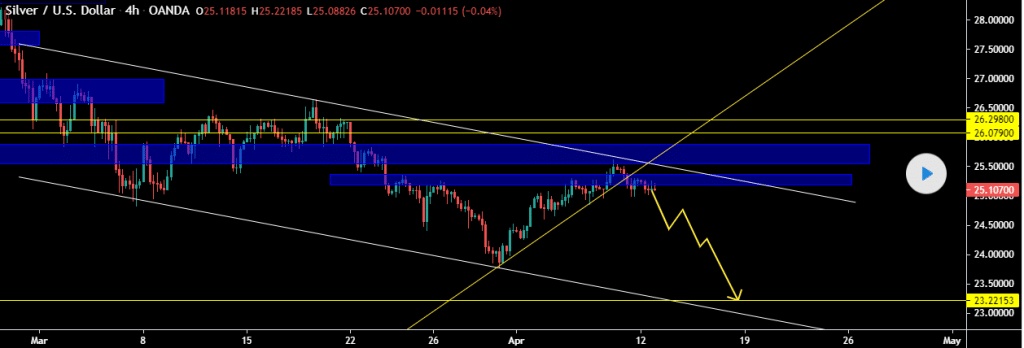

Silver also remains under pressure as it struggles to benefit from rising inflation expectations. With the greenback firming across the board, the white metal has found the going tough above the $25 level.

It has since dropped to lows of $25.27. However, a bounce-back could be in play as the precious metal is the subject of strong Chinese and Indian demand.

Leave a Reply