Introduction

The global foreign exchange (forex) market is enormous. For context, figures from the Bank of International Settlements’ (BIS) latest triennial survey show that forex traders moved a daily average of $5.1 trillion in April 2019. The amount overshadows the total global value of bonds and stocks.

The BIS’s survey further stated that the US dollar (USD) participates in 88% of forex transactions. Effectively, this evidence places the USD on the throne of the world’s most valuable currency. Many international financial transactions depend on the USD to complete, and about 75% of global central banks use the greenback as a reserve currency.

Arguably, the USD’s prominence should translate into something big such as a massive trade surplus in favor of the US economy. However, US consumers import more than they export, and the resulting trade deficit has some negative effect on the value of the dollar. Read on to find out how the relationship between the USD and the trade deficit plays out.

Explaining the US Trade Deficit

Global trade has been a defining feature of globalization since the 20th century entered the last two decades. Each country has been working hard to bump up its total trade. Total trade is the sum of the goods and services it exports and imports. Most importantly, countries have been working hard to achieve a positive trade balance.

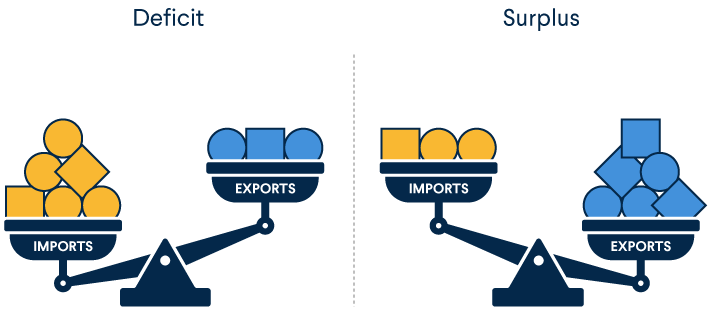

In light of this background, the trade deficit refers to cases where a country imports more than exports. When summed, these two categories yield a negative result in terms of net trade. Imports are the products and services that a country buys from others, while exports are the goods and services a country sells to others.

The table below shows the figures for the trading relations between the United States and her critical allies in 2018:

Table 1: US imports and exports with its major trading partners in 2018 (in billions)

| United States | China | Canada | Mexico | Japan | Germany |

| Total Trade | $739 | $721 | $678 | $300 | $251 |

| Imports | $559 | $360 | $378 | $179 | $159 |

| Exports | $180 | $361 | $300 | $121 |

According to Table 1, the United States experienced a trade deficit with four out of five top trading partners in 2018. In total, the goods trade deficit (not including services) of the US against significant trading partners in 2018 touched $891.3 billion, which is a record figure and a 10.4% increase from the previous year.

What Causes the Trade Deficit, Does It Matter?

A country fails to balance its trading activities due to spending more than it produces, which is more like personal finance, right? No piece of literature explains this phenomenon better than Harvard University’s Martin Feldstein in this article. According to Feldstein, a country that spends less and invests the extra output in business infrastructure has “extra output to sell to the rest of the world.” This principle agrees with a fundamental accounting identity for every country that says:

However, does the US trade deficit matter? It does. The US government has to find ways to plug the deficit, usually through borrowing. In an assessment, Joseph E. Gagnon of the Peterson Institute for International Economics (PIIE), the US has directed much of the money borrowed to plug the trade deficit into financing consumption rather than investment.

Moreover, the trade deficit matters because the increased use of foreign debt to finance consumption at home could generate financial bubbles. Since countries such as China and Germany are running substantial trade surpluses against the US, the money flows back into the US as a foreign direct investment (capital flows). On this issue, Jared Bernstein and Ben Bernanke argued in 2016 that the “large and persistent” trade deficit could weaken the US economy.

Does the Trade Deficit Weaken the Dollars?

Providing a satisfactory answer to this question requires that we recall the definition of a trade deficit. Since exports are lower than the US consumers’ imports, the US relies on foreigners to finance its spending. The foreigners will either invest in the US or buy government debt. If the foreigners are to get their money back in the future, the US government must turn the trade deficit into a surplus.

For there to be a surplus, exports must exceed imports. How can the government make this adjustment? Well, the most obvious trick in the government’s hat is to depreciate the greenback. A depreciated dollar makes US goods and services cheaper for foreigners, while imports suddenly become expensive for US consumers. Therefore, in the long-run, a weaker dollar is the inevitable consequence of an unsustainable trade deficit.

Hold On, Are Trade Deficits All That Bad?

No, they are not. Trade deficits have an interesting flip side, one that continues to support the strength of the US dollar in today’s global economy. Consider an example of China. In 2018, China earned a trade surplus of $524 billion against the US. Where does this money go? At least we know that the money does not sink into a vacuum.

The influx of dollars into China could hurt its exports by making the Chinese yuan expensive relative to the USD. For this reason, China encourages its businesspeople (even the government itself) to park the extra dollars in the US by buying government debt and real estate.

For these dollars reinvested in the US, US consumers enjoy valuable goods through high foreign investment. In the end, the trade deficit has a net positive effect on the US economy and the US dollar.

Conclusion

The US ranks high among the world’s most indebted countries because of an ever-expanding trade deficit. Economists worry that this trend could eventually weaken the dollar because of the need to finance the deficit via foreign capital. Nonetheless, the unique relationship between the US and major trading partners such as China makes it difficult for the trade deficit to hurt the greenback, at least in the foreseeable future.

Leave a Reply