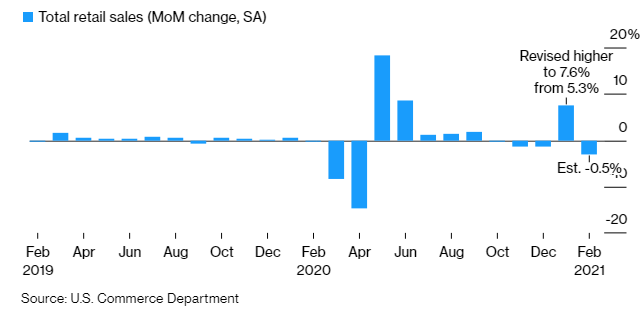

U.S. retail sales in February declined by 3%, more than expected 0.5% drop, according to the Census Bureau press release. The retail slump follows an upwardly revised 7.6% jump in January and is linked to severe winter weather that swept large parts of the country.

Eleven of the 13 retail categories registered declines in February, including a 4.2% decrease at motor vehicle dealers.

- A rise in gasoline prices, partly due to the energy crisis in Texas, supported sales from falling more.

- Retail sales, excluding autos, declined by 2.7% in February, the most since April.

- Control group sales, which exclude food services, car dealers, building materials stores, and gasoline stations, fell 3.5% after jumping 8.7% in January.

- Over the last 3 months, control group sales rose at an annualized 3.5%

- The fall in retail sales represents a temporary setback in demand that was projected to accelerate in the coming months.

- Retail spending may also have been subdued by the IRS’s delayed tax filing window, which opened two weeks later than usual, leading to a 32% year-over-year decline in refunds.

- Despite the fall, the total retail sales remain above pre-pandemic levels and are set to strengthen into the second quarter as Americans receive stimulus checks.

Retail spending is also likely to be supported by easing of Covid-19 restrictions and acceleration of vaccinations.

U.S stocks and the dollar are currently gaining. SPY is up 0.32%, QQQ is up 1.55%, EURUSD is down 0.16%

Leave a Reply