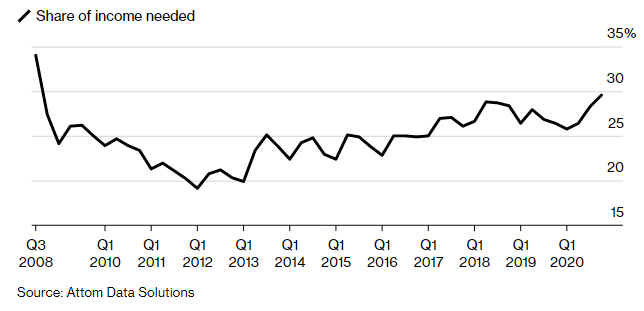

U.S. home buyers needed to spend almost 30% of their average wage to afford a typical house in the fourth quarter, according to Bloomberg. The rate is the biggest share since 2008 despite borrowing costs hitting a record low of below 3% for a 30-year loan.

- Analysts link low mortgage rates to the fall in affordability as it spurred a buying frenzy, driving prices up as buyers competed for a shrinking supply of house listings.

- During the pandemic, housing prices rose faster than earnings, hitting double digits in 79% of 499 countries.

- Todd Teta, chief product officer at Attom, feels “the future remains wholly uncertain and affordability could swing back into positive territory.”

SPDR S&P Homebuilders ETF is currently declining. XHB is down 0.88%

Leave a Reply