- The US dollar remains firm as traders keep focus on Biden’s stimulus despite the Fed’s economic warning.

- Euro remains under pressure as the bloc grapples with surging coronavirus cases.

- Yen edges up as Japan’s exports likely increased for the first time in two years.

Dollar holds ground despite Fed’s dovish tone

The US dollar index rose 0.12% to $90.35 in Asian trading hours. The index measures the strength of the greenback against a basket of currencies consisting of euro, yen, pound, Swiss franc, Canadian dollar, and Swedish krona. Euro has the biggest weight in the basket at nearly 60%.

The index slipped 7% in 2020 as the coronavirus outbreak ravaged the US economy, with millions of people losing jobs and businesses shutting down or scaling down their operations. But it has had a fairly strong start to the new year, rising 0.45% as the coming change of guard in the White House has bolstered hopes of a quick economic recovery, which has, in turn, supported the dollar’s rebound.

The dollar’s Friday gain came after President-elect Joe Biden unveiled an initial $1.9 trillion pandemic stimulus plan. The plan includes a $1,400 direct cash handout to households and money for managing the pandemic.

Biden is working on a bigger economic recovery plan to be unveiled in February. That will include funds for infrastructure development and climate programs. Big government spending will be crucial to getting the economy back on track quickly, and for now, traders see that as a positive for the dollar.

Euro struggles as COVID-19 threat grows in the bloc

Euro fell against major currencies Friday as surging COVID-19 causes parts of the Eurozone to shut down. Many parts of France are already under a 12-hour curfew, which is expected to extend to more regions. Germany, the EU’s largest economy, is also moving toward a lockdown. Social restrictions are also tightening in Spain and other EU countries.

Amid the rush to contain a more dangerous strain of coronavirus from getting out of control, the common currency euro is coming under pressure. First, traders fear it may take longer for the Eurozone economy to recover, which is tempering demand for the euro.

Moreover, the deepening recession would force the EU central bank to pump more euros into the bloc’s economy, and traders’ fear would impact the common currency’s value.

Euro eased 0.16% against both the dollar and the Japanese yen. The common currency retreated 0.02% against the pound and eased 0.03 against the Swiss franc.

Yen rises ground as poll shows exports rose

Japanese yen edged up against several major peers. It rose more than 0.06% against the US dollar to 0.0096. It made a similar gain against the euro to 0.0079. The yen edged up 0.03% against the pound and 0.04 against the Swiss franc. It rose 0.08% against the Canadian dollar.

Yen’s gains came as a Reuters poll showed that Japan’s exports likely increased in December, marking the first such rise in two years. Additionally, the safe haven seemed to benefit from traders hoping that locking down Tokyo and neighboring areas will help Japan bring coronavirus under control quickly, which would be positive for the economy.

Although the yen generally advanced against major peers, it notably faltered 0.03% against the Australian dollar and 0.16% against the New Zealand dollar.

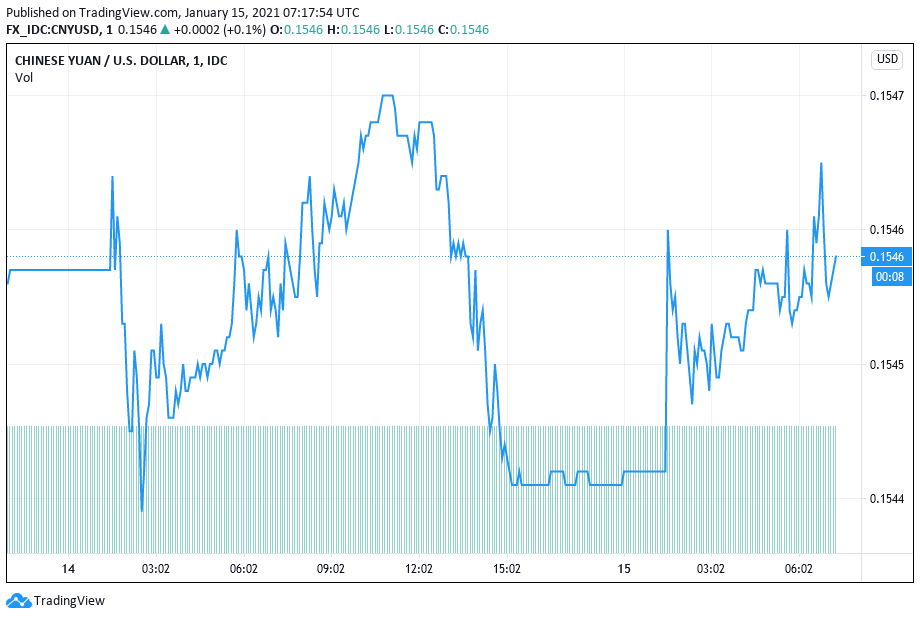

Yuan edges up as China moves swiftly to contain fresh COVID-19 outbreaks

China’s yuan rose against all its major peers as China stepped up efforts to bring fresh COVID-19 outbreaks under control. Pockets of the country have been locked down to avoid a rapid spread of the virus, which could undo the economic gains the country has made since the initial outbreak.

Yuan rose 0.14% against the US dollar and advanced 0.32% against the euro. It edged up 0.09% against the yen and rose 0.29% against the pound. It advanced 0.16% against the Swiss franc and moved up more than 0.52% against the Australian dollar.

Leave a Reply