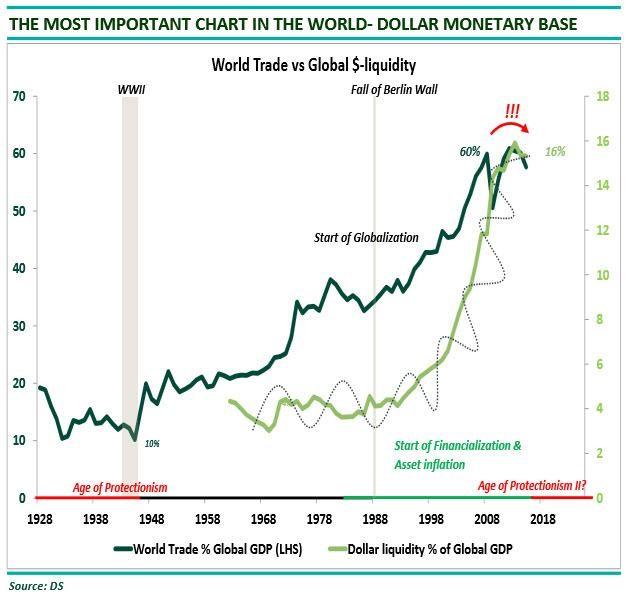

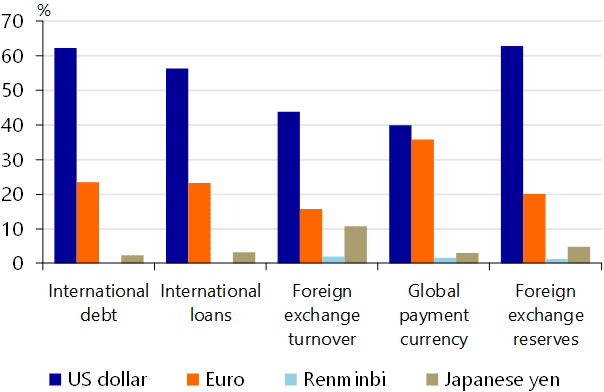

The US dollar is in a class of its own, given its role in the global financial system and global economy. It is the most traded currency in the $6 trillion currency market and doubles up as the preferred means of finalizing global markets transactions. It thus does not come as a surprise that it is often referred to as the de-facto global currency or reserve currency.

Central banks worldwide turn to the greenback for foreign reserve storage, banking on its stability as well as acceptance. As it stands, as much as 60% of global foreign exchange reserves are pegged in the greenback.

US dollar competitive edge

As it is commonly referred to, the buck accrues its edge as a global currency backed by one of the world’s biggest and most stable economies. Likewise, it is the most stable currency, thus a preferred means of storing wealth and completing transactions on the international scene.

In most cases, you will find countries transacting with each other and using the currency even though the US is not involved. Foreign governments and central banks hold the dollar, given its strength and stability relative to other currencies.

Likewise, it has become a preferred currency for former Soviet Union countries and Latin American nations. Most of the US dollars ever printed are in circulation overseas and used in day-to-day transactions.

People always want to put their money in something stable and solid. This explains why as much as 80% of all $100 bills in circulation are outside the US. Similarly, as much as 90% of trades that take place in the $6 trillion currency market involve the greenback despite it being one of the 185 global currencies.

Besides, as much as 40% of the world’s debt is pegged on the US currency. That said, foreign banks rely on the Federal Reserve to print more dollars to conduct business. In 2008, the central bank was forced to print more money in a bid to bolster the swap line.

Why the dollar is the de-facto global currency

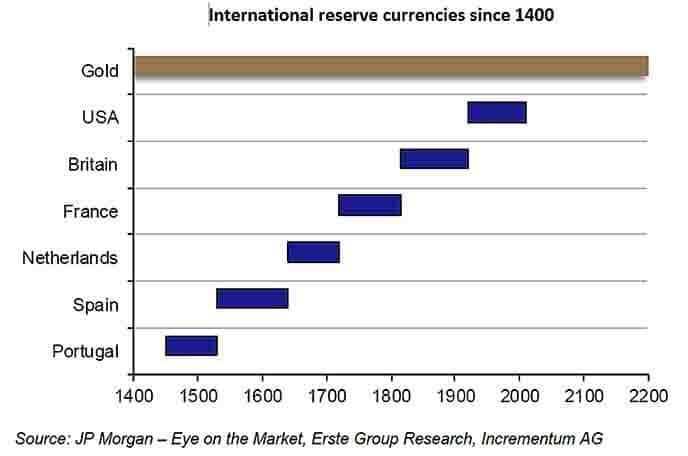

The US currency rise to dominance started in 1944 as the gold standard was dropped. The fact that the US held the most gold reserves at the time saw most countries opt to back their currencies to the dollar rather than gold.

As gold reserve status came to an end, the dollar rose to the occasion and became a preferred currency thanks to its stability and the fact that it was backed by one of the most stable economies. Countries shunned the precious metal and opted to have their reserves in the dollar. China holds trillions of dollars in reserves that it uses to fuel its export-dependent economy.

The US dollar edge as a reserve currency has been affirmed by countries buying US Treasury securities. The nations often use the Treasuries as a safe storage of their money and reserves.

Despite being home to some of the world’s biggest economies, Japan and China own more than $1 trillion in US Treasury securities, a move that strengthens the dollar status on the global scene. The UK owns close to $320 billion worth of US Treasury securities.

When economic powerhouses hold trillions of dollars’ worth of US securities, it is always a good sign that the greenback is still a force to reckon with compared to other currencies.

The US dollar reserve status will continue to exist partly because of the US economy’s size and strength. Robust and stable financial markets also continue to affirm the dollar edge compared to other currencies, such as the Euro.

Trust and confidence over the US’s ability to meet its financial obligation, such as paying debts from treasuries and bonds, continue to affirm the dollar status in the global market. As it stands, it remains the most redeemable currency for financing global commerce.

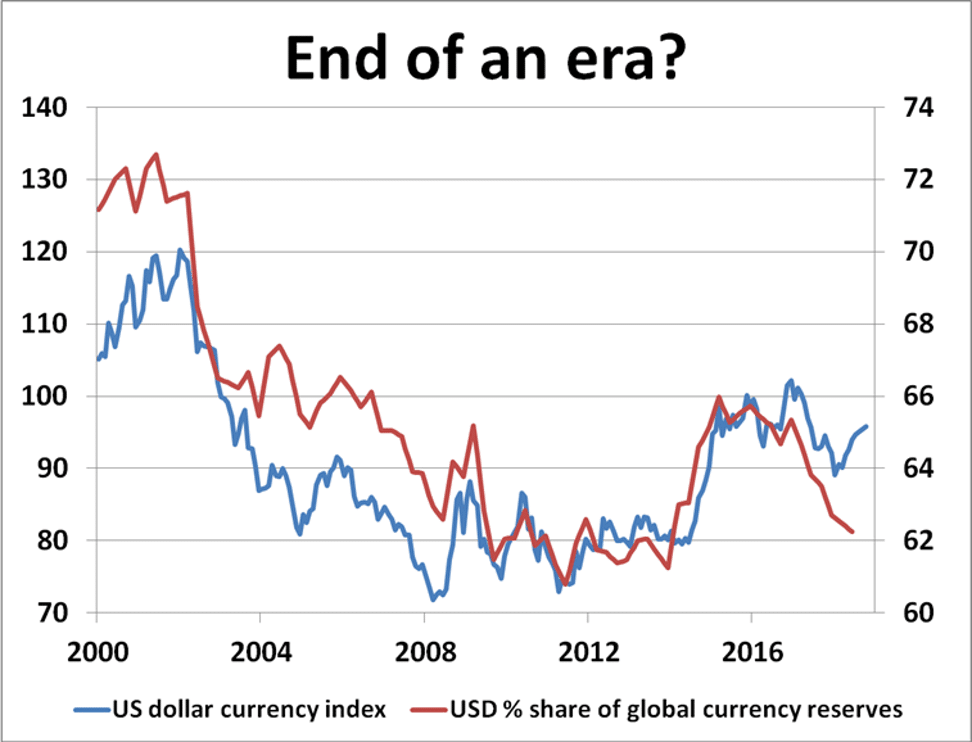

US dollar reserve currency status at risk

In recent years, there have been calls by world powers for a global currency. Russia and China, which are always fighting the US for dominance, have been pushing to dethrone the US currency as the de-facto global currency.

In their arguments, the countries insist the global currency should be disconnected from individual nations if it remains stable in the long run. China faces the biggest risk of the US dollar depreciating. It would make most of its reserves running into trillions of dollars worthless, thus pushing for an independent global currency.

Having hit a dead end on its calls for an independent global currency, China has already started to act. The country has already started reforming its economy as it seeks to strengthen and stabilize the yuan. It is also pushing for the yuan’s trading on the global foreign exchange as part of an effort to rival the greenback’s reserve status.

While foreign exchange reserves held in the Chinese currency have risen to about $220 billion, they are still a tiny fraction of the more than $6 billion in foreign reserves pegged on the dollar.

Bottom line

The US dollar status as the de facto global currency is more than assured despite the enormous deficit spending. The US economy’s strength and stability are one of the main reasons the greenback holds the title of the most vital world currency and preferred means of holding foreign exchange reserves and transacting on the global scene.

The reserve currency status affirms the world’s confidence in the United States to meet its financial obligations, especially in paying off debts. Similarly, this explains why some of the biggest economies backed by powerful currencies still hold reserves in dollars and have invested hundreds of billions of dollars in US Treasuries.

However, the greenback’s de-facto global currency status is under threat more than ever. Economic powerhouses are increasingly pushing for an independent global currency that is not tied to any economy. Likewise, Bitcoin’s emergence and growing popularity could significantly toll the dollar status going forward.

Leave a Reply