The US dollar has had a rough ride in 2020. The currency soared to a multi-year high in the first quarter and then collapsed to the lowest level since 2012 in December. It has dropped against all major currencies like the euro, yen, and franc and emerging market currencies like the South African rand and the Mexican peso. In this article, we will provide an outlook for the US dollar in 2021 and identify the key events that will move it.

The US dollar index has been on a freefall in 2020.

Why the dollar rose in the first quarter of 2020

To make a convincing prediction of how the dollar will trade in 2021, we need to first explain the currency’s price action in 2020.

Looking at the chart above, we see that the US dollar rose by more than 6% between January and March 19. At this time, the world was in the early stages of the coronavirus pandemic. Primarily, in the past few months of the year, the disease was not spreading rapidly in countries outside China.

In March, the US dollar spiked when the World Health Organisation (WHO) declared the virus a global pandemic.

The reason for this is simple. See, the US dollar is viewed as the safest currency in the world because of the strength of the American economy. It is also a relatively safe currency because of the strict separation between the political class and the Federal Reserve.

As a result, in times of crisis, investors, individuals, and businesses usually move their holdings into dollars. In turn, this leads to a higher demand for the currency and pushes it higher. That’s what happened in the first few months of the year.

Why the US dollar tumbled in 2020

There are several reasons why the US dollar started to tumble in March 2020. First, as the virus spread around the world, and countries started imposing lockdowns, the Federal Reserve started to intervene.

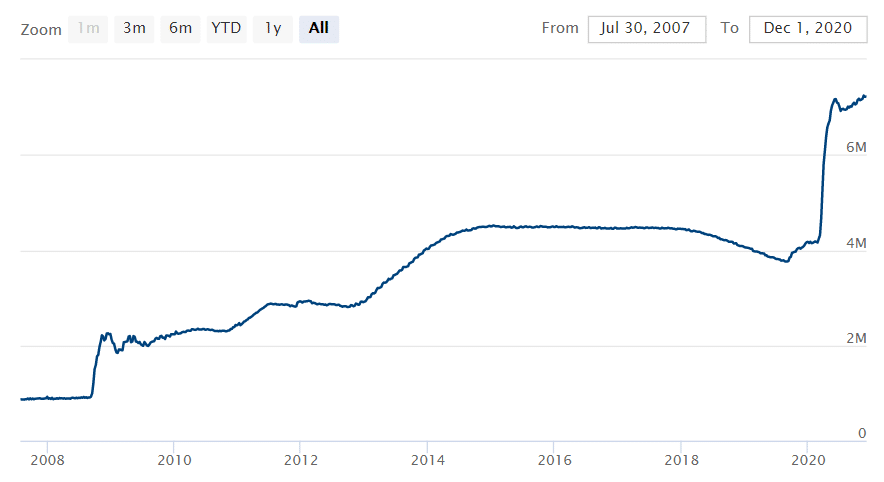

Within weeks, the Fed slashed interest rates to almost zero and initiated large asset purchases through quantitative easing (QE) programs. Notably, unlike during the Global Financial Crisis, the Fed made the QE open-ended, meaning that it did not have a limit on the number of assets it would buy. This led to a sharp increase in the bank’s balance sheet and money in circulation. The chart below shows the rapid expansion of the Fed’s balance sheet in recent years.

Fed balance sheet

In addition to Fed policies, the dollar crashed because of how other countries handled the virus. For example, while Europe was a major hotspot in the early days, the bloc managed to flatten the curve faster. The same was true for countries like New Zealand and Australia. As a result, the demand for the dollar started to wane as the risk-on sentiment started to come back.

Biden victory and the dollar

Further, the dollar weakness extended as poll after poll indicated that Joe Biden would become the next president. This came to pass in November when he carried most states, including the historically red states like Michigan and Arizona.

Joe Biden is considered a bad thing for the dollar because of two main reasons. First, Democrats, in the past, tend to be vast spenders, which leads to the debasement of the currency. Indeed, he has pledged to spend trillions of dollars on expanding welfare, investing in clean energy, and building infrastructure.

Second, unlike Donald Trump, Biden has promised to take a measured tone on international relations. He will reinstate the Iran nuclear treaty, re-join the Paris climate accord, and boost relations with American allies like Canada, Mexica, and Germany. Also, he said, he will engage with China, which will be the opposite of Trump’s tariffs.

As such, the overall thinking is that with Biden, global risks will ease.

Outlook for the US dollar in 2021

In recent outlooks, analysts from banks like Goldman Sachs, Morgan Stanley, and JP Morgan have sounded extremely bearish about the dollar. Indeed, they expect the currency to drop by between 6% and 10% in 2021. In other words, they expect the current trend will continue. However, two factors below top up dollar bulls’ confidence in 2021.

Return to risk-off sentiment

In 2021, there is a high possibility that the Covid pandemic will be eliminated because of the recent progress on a vaccine. In fact, the vaccines by Moderna and Pfizer have been more than 90% effective, and some countries have already started preparing the logistics of delivering the shots.

Therefore, with the pandemic done, investors will start thinking about potential risks in the market. The most notable one will be global debt. See, to deal with the pandemic, most countries, and companies loaded-up on debt.

In total, in the first three quarters of the year, global debt soared by more than $19 trillion to more than $272 trillion. Therefore, as central banks start ending their pandemic response measures, there is a possibility that investors will start worrying about the ability of companies and governments to fund their obligations.

Further, there are potential international relations risks. For example, Joe Biden campaigned on being tough on China. Indeed, he has said that he will not remove Trump’s tariffs immediately. Therefore, there is a possibility that tensions between the two countries will remain.

Most importantly, the United States will possibly be in a deadlock, which will be a major challenge for Joe Biden. For example, to ramp-up investments, he will need support from Senate Republicans, which will not come easily.

US dollar is oversold

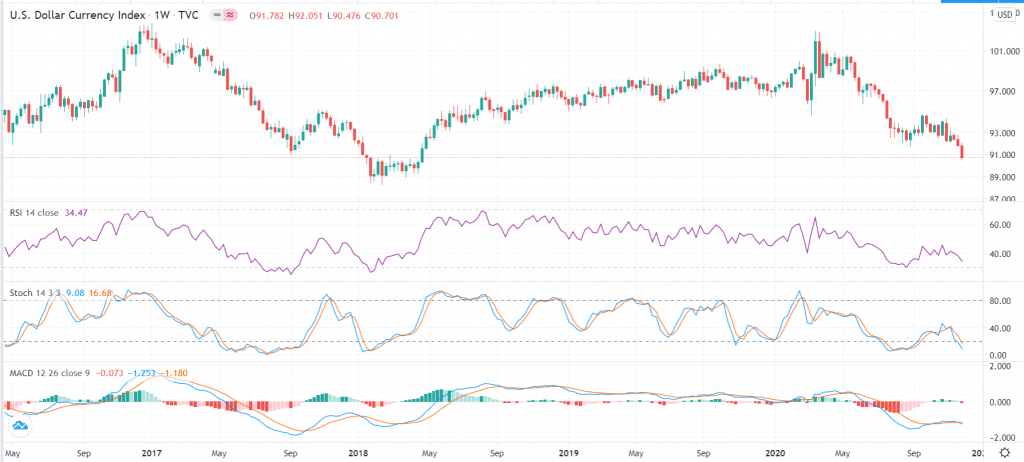

According to most indicators, the US dollar could bounce back in 2021 because the currency is oversold. As shown below, on the weekly chart, the Relative Strength Index (RSI) is on a downward trend and is at 34. While it is not yet oversold, it is relatively close.

However, a look at the MACD and the Stochastic oscillator shows that they are both in the oversold zone. Therefore, there is a possibility that some investors will try to scoop the currency on the cheap.

US dollar is getting oversold.

Summary

The US dollar has had a rollercoaster ride in 2020. It rose as risks posed by the Covid pandemic became real and then tumbled because of a combination of factors. Will this trend continue in 2021? Some analysts believe so. However, as shown above, there is further evidence that 2021 could be the year when the dollar bounced back.

Leave a Reply