The US dollar index (DXY) declined sharply on Friday after the US published the January nonfarm payroll (NFP) data. On Monday morning, the index was trading at $91.0, the lowest level since Wednesday last week.

US weak NFP

The US dollar index was in a strong upward trend last week before the NFP data. At the time, analysts were expecting that the US created more than 50,000 jobs in January after shedding more than 140,000 a month before.

Before Friday, there was optimism that the number would have been substantially better because, on Wednesday, Automatic Data Processor (ADP) reported that private payrolls increased by more than 140,000.

In reality, the US added just 40,000 jobs in January while the overall unemployment rate dropped to 6.3%. Also, wages rose by 5.4% in January.

These numbers mean that the labor market in the world’s biggest economy is struggling mostly because of the lockdowns imposed by many states. In total, the economy has more than 10 million people out of work, when you factor in the 20 million job losses that happened in April last year.

The weak job numbers mean that the new US administration will do its best to pass a new stimulus bill in the next few weeks. Already, Joe Biden has committed to passing a $1.9 trillion package. That package will probably have another $1,400 stimulus check for individuals.

Inflation data ahead

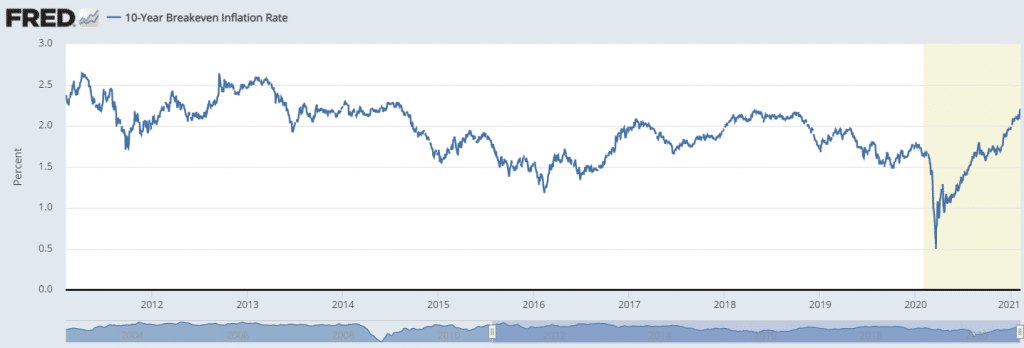

In general, analysts expect that such a package will lead to higher inflation in the United States. Indeed, as shown below, the 10-year breakeven inflation rate has risen to the highest levels since 2018. This number is usually a difference between the yield of inflation-linked government bonds and those not pegged on inflation.

10-year breakeven inflation rate

On Wednesday this week, we will receive the important inflation numbers from the United States. In general, economists expect that the headline and core consumer price index rose by 1.5% in January.

If the trend continues, it means that the overall inflation will rise to about 2% by the end of the year. In the past, the Fed has committed to letting inflation rise beyond the 2% target. However, there is a possibility that the Federal Reserve will start sounding more hawkish in the next few months. If this happens, it will be bullish for the dollar index.

This week, the dollar index will react to the JOLTs job numbers that will come out on Tuesday. Economists expect the numbers to show that the economy had about 6.4 million job vacancies in December compared to 6.52 million in the previous month.

The index will also react to the US budget that will come out on Wednesday. This budget will come out on Wednesday and will show Joe Biden’s priorities. On Thursday, it will react to the initial jobless claims numbers, followed by consumer sentiment data on Friday.

US dollar index technical outlook

On the four-hour chart, we see that the US dollar index has been in an uptrend for the past few weeks. It has remained above the ascending blue trendline that connects the lowest swings since January. Also, the index is along with the 38.2% Fibonacci retracement level and slightly below the 25-day exponential moving averages.

Therefore, even with the recent decline, the index will likely remain in an uptrend so long as it is above the ascending trendline. If this happens, the next key resistance level to watch is $92.0.

Leave a Reply