The US dollar index (DXY) was little changed on Monday as investors waited for important inflation, retail sales, and production data from the United States. The index is trading at $92.20, which is a few points below last week’s high of $92.80.

US inflation ahead

The US dollar index has bounced back by more than 3% after dropping to $89.50 in June. This rebound was attributed to the Federal Reserve, signaling that it would start hiking interest rates in 2023. In the previous meetings, the bank signaled that tightening would come in 2024.

The hawkish sentiment continued last week when the Fed published minutes of its previous meeting. The minutes showed that some members of the Federal Open Market Committee (FOMC) began talking about tapering of asset purchases. The bank is currently buying $120 billion worth of bonds and mortgage-backed securities every month.

This will be an interesting week for the DXY because of the important inflation and retail sales numbers that will come out. The Bureau of Labor Statistics (BLS) will publish the latest US inflation data on Tuesday. Economists polled by Reuters expect the data to show that the country’s inflation rose by 0.5% on a month-on-month basis. This will be a small decline from the previous 0.6%. On a year-on-year basis, analysts expect the CPI to increase by 4.9%.

The core CPI, which excludes the volatile food and energy prices, is expected to have increased by 0.4% in June after rising by 0.7% in May. This will, in turn, lead to a 4.0% year-on-year increase.

Inflation data is a critical number because it forms part of the Fed’s dual mandate. In the previous meetings, the Fed has made the case that the rising inflation is only transitory. Therefore, higher-than-expected inflation data will be good for the DXY because it will signal that higher inflation is here to stay. On the other hand, a drop or estimates miss will signal that the Fed was right that the rise in inflation was transitory.

The CPI data will be followed by the latest producer price index (PPI) data that will come out on Wednesday. The data is expected to show that the PPI rose from 6.6% in May to 6.7% in June.

US retail sales data

The US dollar index will next react to the latest US retail sales numbers that will come out on Friday. We should watch these numbers because they are crucial indicators of consumer spending, which is the most significant component of the GDP.

Economists expect that the US retail sales declined by 0.4% in June after falling by 1.3% in the previous month. This decline will lead to a year-on-year gain of 24%.

Other significant numbers from the US will be the initial and continuing jobless claims data that will come out on Thursday. The New York and Philadelphia Fed will also publish the latest manufacturing index data on Thursday.

US dollar index analysis

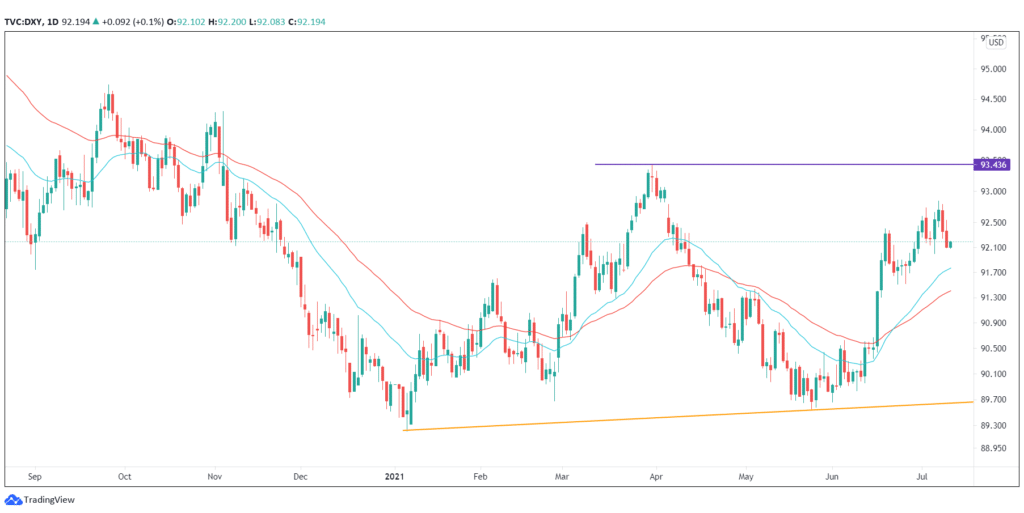

The daily chart shows that the DXY index has made some recovery after dropping in June. It is also on its first day in the green after falling for the past two straight days.

The index remains above the 25-day and 50-day Exponential Moving Averages (EMA) and slightly below the important resistance at $93.40. It has also formed a W pattern. Therefore, the index will likely keep rising as bulls target the critical resistance level at $93.43. The scenario will be invalidated if a drop below $90.50 occurs.

Leave a Reply