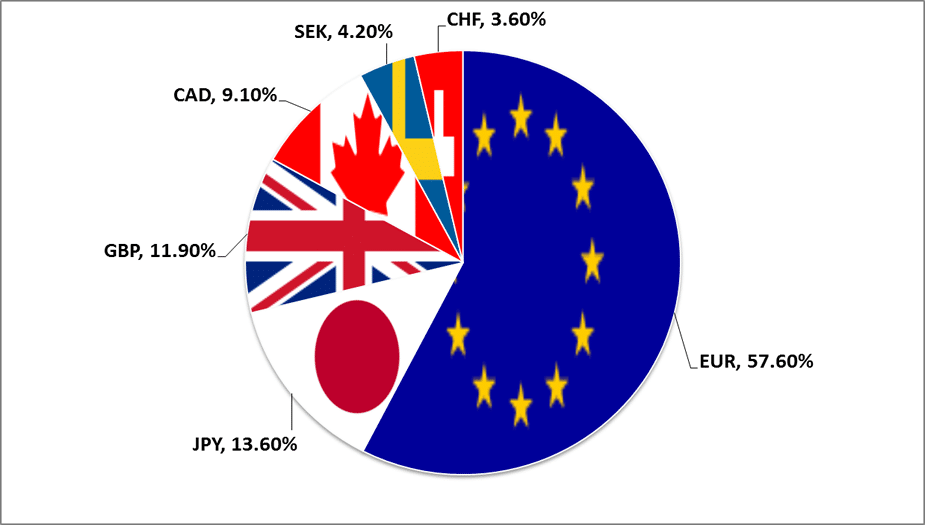

DXY, also known as the US Dollar Index, measures the US dollar’s strength against a basket of six major currencies. It is a trade-weighted index calculated using the exchange rates of the British Pound, Euro, Canadian Dollar, Japanese Yen, Swedish Krona, and The Swiss Franc.

The Euro exchange rate accounts for the most significant share of the US Dollar index value at about 57.6%, followed by Japanese Yen at 13.6%, GBP 11.9% Canadian dollar 9.1% SEK 4.2% and CHF 3.6%. The DXY index measures the percentage change of the dollar’s value in response to changes in exchange rates of the other six major currencies.

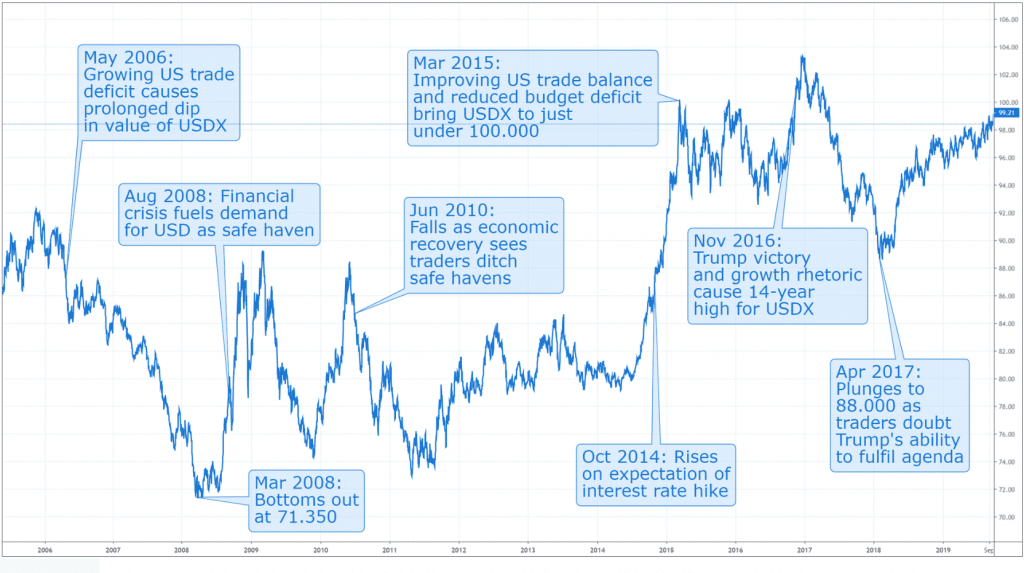

The index first came into being in 1973 as the US Central Bank, the Federal Reserve, sought to track the dollar’s value or strength in the forex market. The index was launched as President Nixon ditched the gold standard conversely, allowing the US dollar to float easily as the world’s reserve currency. Initially, the US dollar value was fixed at $35 per ounce of gold.

Interpreting and Trading the US Dollar Index

Given that the US dollar initially started at 100, an appreciation to the 115 level indicates that the dollar has appreciated by 15% against a basket of the other currencies. Similarly, a decline to the 80 level signals a 20% depreciation against the other major currencies. While the index started at 100, it hit an all-time high of 163.83 in 1985. It also hit an all-time low of 70.69 in 2008 as the financial crisis came calling.

When the US dollar is going up, it indicates the US dollar is strengthening against the other major currencies. When it goes down, it suggests the dollar is weakening and attributed to some underlying developments.

In addition to exchange rates of the other six major currencies, supply for and demand of the US dollar also influences the DXY index value. Supply and demand, in this case, is influenced heavily by the monetary policies as passed by the US Federal Reserve.

Other factors that come into play include inflation, economic performance, and credit ratings that sway trader’s sentiments on the dollar. Appreciation and depreciation of the US Dollar index are usually a factor of time.

How the US Dollar Index Affects the Forex Market

The US dollar is the world’s reserve currency, and the US dollar index goes a long way in influencing trader’s sentiments on an array of financial instruments. For starters, it affects commodity prices as well as other currencies.

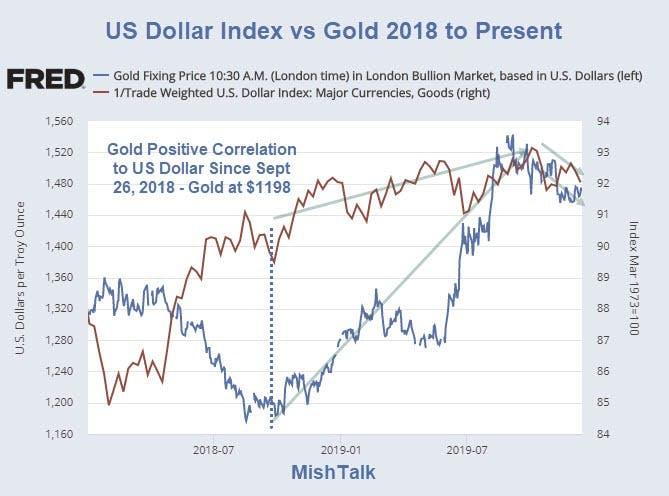

The US Dollar index also finds excellent use in technical analysis as traders use it to confirm trends while trading commodities, currency pairs, stocks, and indexes. Commodities such as oil, gas, and gold tend to fall in price as the DXY value increases.

Currency pairs increase in value as the DXY value increases if the US dollar is the base currency in the pair, i.e., USD/CAD. Likewise, a currency pair where the dollar is the quote currency, i.e., EUR/USD, would decrease as the dollar index appreciates.

Most of the time, the US dollar index has a direct correlation with stocks. As the US dollar index appreciates, so do stocks, and significant indexes tend to move up. Likewise, the value of American stocks tends to increase as the demand for the US dollar increases.

Applying US Dollar Index in Trading

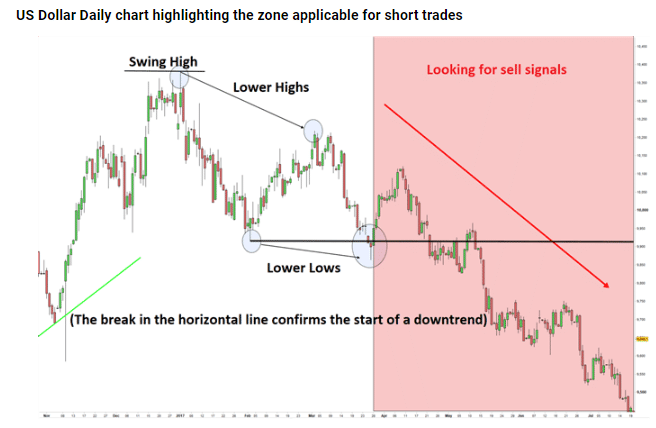

Technical analysis of the DXY index helps traders identify trading opportunities in the forex market. The index is especially important when trading the EUR/USD pair, given that the Euro currency is weighted at over 50%.

Therefore, an analysis of the DXY index is often used to confirm the direction the EUR/USD pair is likely to move. Likewise, the index movements provide a sense of how other major currencies are likely to behave.

When the DXY index is appreciating, it means the dollar is strengthening across the board. In this case, traders can enter short positions on the EUR/USD and GBP/USD pair or long positions of USD/CAD and USD/JPY pairs.

Besides, financial media outlets report on US Dollar index performance to provide a sense of how the US dollar performed against the other major currencies. The index performance also shows how individual currencies performed against the dollar.

When to Ignore the US Dollar Index

Unlike other currencies in the forex market, the US dollar boasts of unique characteristics. It tends to rise in times of global market uncertainty, and when the US economy is thriving. Likewise, the US dollar index forms trends that traders leverage to predict price movements in other pairs.

At times, the US Dollar Index appreciates even as weak economic data evoke concerns about the US economy’s health. In such scenarios, it is widely expected that the index would depreciate, especially if the Eurozone economic block is printing impressive economic data.

If the US Dollar behaves differently, it would be wise to ignore it for some time until the developments in the US are correctly priced. Similarly, whenever the index edges lower even as economic data points to a solid and stable US economy, it would be wise to ignore the index.

Similarly, whenever commodity prices pegged to the US dollar, such as gold (XAUUSD) increase in value, it is highly expected that the DXY index would be edging lower. If that is not the case, and the index is also edging high, it would be wise to ignore it when making trading decisions.

Bottom Line

The US Dollar Index is an index that indicates the strength of the US dollar relative to six other major currencies. It is a gauge of the US dollar strength in the currency market. Traders analyze the index in a bid to predict price patterns in currency pairs where the greenback is a base or quote currency.

The DXY is one of the most-watched indexes given that the US dollar accounts for more than 80% of the trades that take place in the currency market. Likewise, a clear understanding of the US Dollar index is crucial if one is to make informed trading decisions.

Leave a Reply