Source: Bloomberg

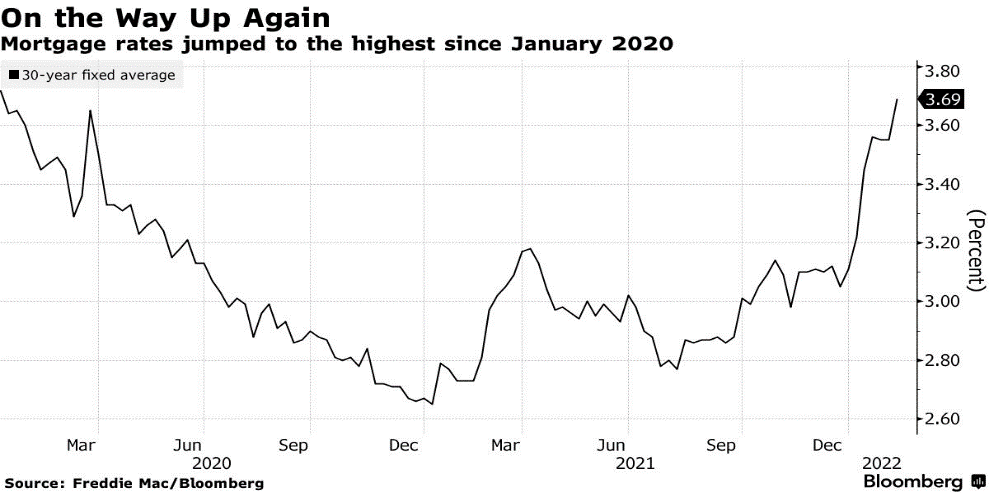

Mortgage rates for a 30-year loan in the US is 3.69%, a gain from last week’s 3.55% and the highest since January 2020. SPY is down -0.28%, DXY is down -0.22%.

- The rise in mortgage rates tracks a rise in US 10-year Treasury yields, which are close to hitting 2%.

- Freddie Mac’s chief economist Sam Khater says the normalization of the economy after the pandemic is behind the recent surge in the mortgage rates.

- Khater expects mortgage rates to continue rising as Fed tightens policy after a strong labor market and to tame the high inflation.

- The Freddie Mac economist says the rising mortgage rates will adversely impact housing demand. He still speculates that buyers may jump into the market early before the costs go higher.

- At the current rate, mortgage payment on a $300,000 30-year loan is estimated at a monthly $1,379, up from $1,209 a year ago.

Leave a Reply