Source: BOE

Mortgage approvals in the UK in October were 67,199, down from 71,900 in September and below expected 71,851. FTSE 100 is up +1.36%, GBPUSD is down -0.05%.

- The low rate of mortgage approvals reflects fading activity in the housing market, with record prices being posted amid a low number of units coming to the market.

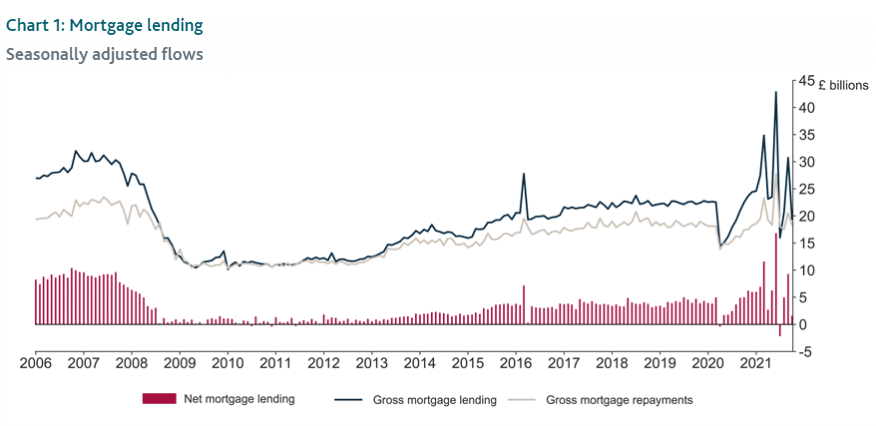

- Mortgage debt by individuals in October hit the lowest since July 2021, with net borrowing reaching 1.6 billion pounds.

- Pantheon Macroeconomics economist Samuel Tombs expects housing demand to pick up in the remaining part of the year before slowing next year as taxes are rolled in to the market and inflation rises.

- October’s mortgage approvals in the UK are now close to the 12-month average to February 2020, when it was 66,700.

Leave a Reply