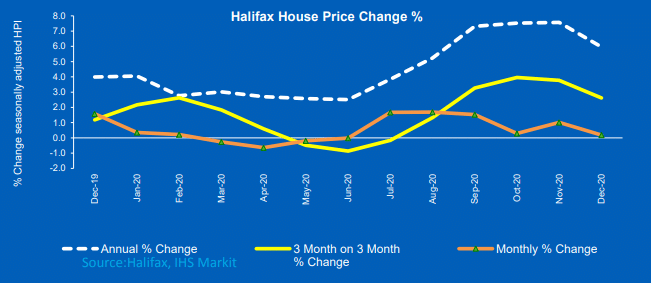

U.K average house prices were £253,374 in December, 6.0% higher than in the same month a year earlier, according to Halifax press release. The monthly house prices rose only 0.2% from November despite the October-December quarter having a 2.6% growth from the preceding three months.

- December’s rise in average house prices stretches the current run of continuous gains to six months.

- The 0.2% rise in house prices in December was the slowest seen in the last six months and significantly down on the 1.0% increase in November.

- During the first half of the year, house prices fell 0.5% due to the restrictions brought about by the COVID-19 pandemic.

- Housing prices rose during the second half of the year due to pent-up demand, a higher desire by buyers for greater space, and the time-limited incentive of the stamp duty holiday.

- Mortgage approvals remain at a 13-year high, which could add residual strength in the market to sustain prices up to the stamp duty holiday deadline at the end of March.

- Downward pressure on housing prices could, nonetheless, be brought by renewed national lockdowns and rising unemployment in the coming months.

U.K stocks and the pound are currently gaining. FTSE 100 is up 0.24%, GBPUSD is up 0.15%

Leave a Reply