TradeStation is a US broker that is regulated by current US law and an independent SIPC body. The peculiarity of this forex broker is reliable protection of deposit capital in the amount of $0,5 million for each client. This is confirmed by the user agreement and established by the charter of the financial company. True, potential traders and investors from Europe, Asia or the CIS will have to go through a rather complicated verification procedure. Opening an account can take several days, since all the submitted information is manually checked by moderators.

General information about the financial company:

• Year of foundation – 1982;

• Headquarters – Florida, USA;

• Specialization – banking, investments, trading.

Account Opening Requirements

You can open an account with this broker of the following type:

• Cash Account (cash deposit) in the amount of $ 500;

• Standard marginal account in the amount of $ 2000;

• Account for futures contracts in the amount of more than $ 5000.

Please note that a cash account is opened through a direct transfer of funds to the company’s bank account. But at the same time the client is not giving leverage. That is, it will only be possible to trade a variety of financial assets for its own amount. This is a disadvantage and is designed only for fairly large amounts. Accordingly, for a full-fledged trading with a leverage of 1:50, it is worth opening an account of the “Standard” type in the amount of $2,000.

If you are a US citizen, the process of opening an account is simplified. This can be done immediately, online, without the anxious waiting of the moderators. But for citizens of other continents there is a mandatory procedure – sending a number of identity documents by mail. The necessary list of scanned copies of documents will be listed on the site upon registration. Sending is carried out in the standard form W8. Shipping costs are paid by the sender. It is important for a fx broker company to verify your identity, so they require you to send certified copies of your passport with your registration address, driver’s license and a number of other documents.

Deposit and withdrawal rules

Replenishing an account for non-US citizens can only direct bank transfer. In this case, the term of enrollment is up to 15 working days. Disappointing that popular services are not available on the example of Paypal and Skrill. Therefore, forget about the possibility of using electronic wallets and even VISA or Master Card to replenish the deposit. In this direction, the company has created a number of bureaucratic problems.

No fee for account replenishment is set. But the issuing bank may charge its own processing fee. When making a bank transfer, any currency will be converted into USD, since the US dollar is the only currency of the brokerage company.

Another disappointment is the withdrawal procedure. Make a request is quite convenient, through a special section of the Client Center. But for each withdrawal there is a very large commission of $ 35, regardless of the amount. Of course, there are American companies and higher rates of withdrawal. But for a simple trader, this is a very large amount. Money is transferred to a bank card or account.

What financial assets are available to TradeStation customers?

As it turned out, trading currency pairs is no longer available to broker clients. They sold this function to Oanda, while they themselves concentrated on other groups of financial instruments. Among them:

• Bonds and futures;

• Options;

• Shares of companies;

• Funds and ETFs.

The company TradeStation earns from fees for each transaction made. For example, in a share category, a $ 5 commission is charged per transaction. And for contact on bonds is charged almost $ 20. These are actually very large sums that can completely offset the potential profit of a trader. Especially when it comes to a small deposit or an unstable financial market.

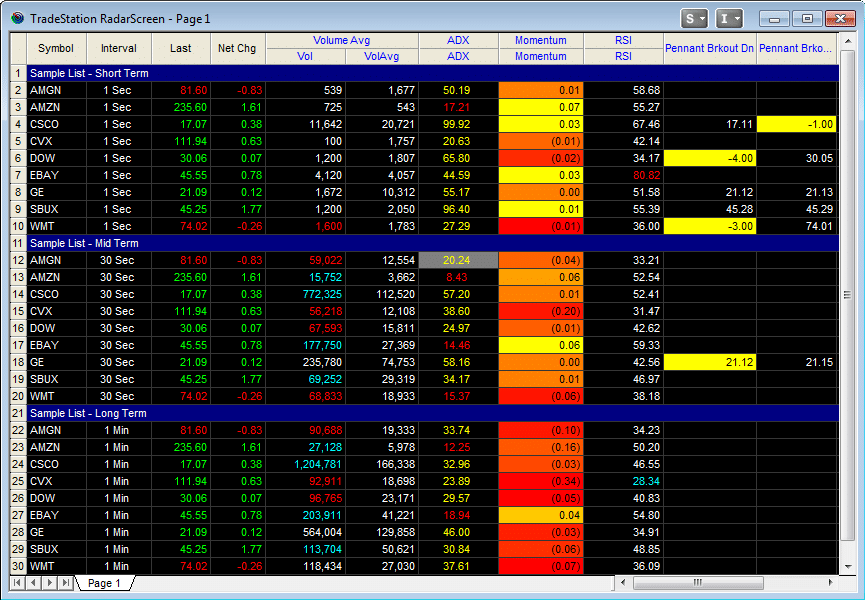

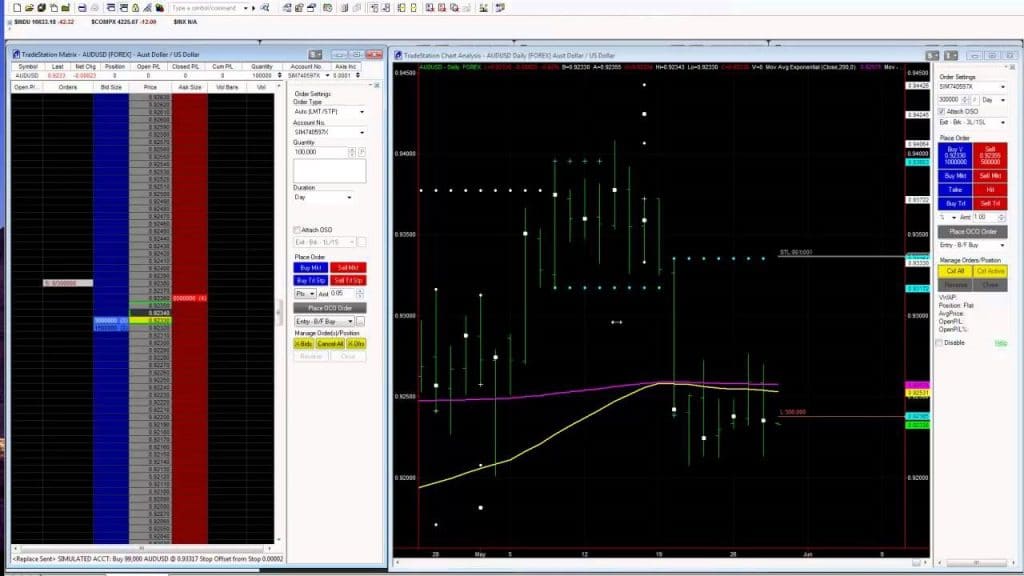

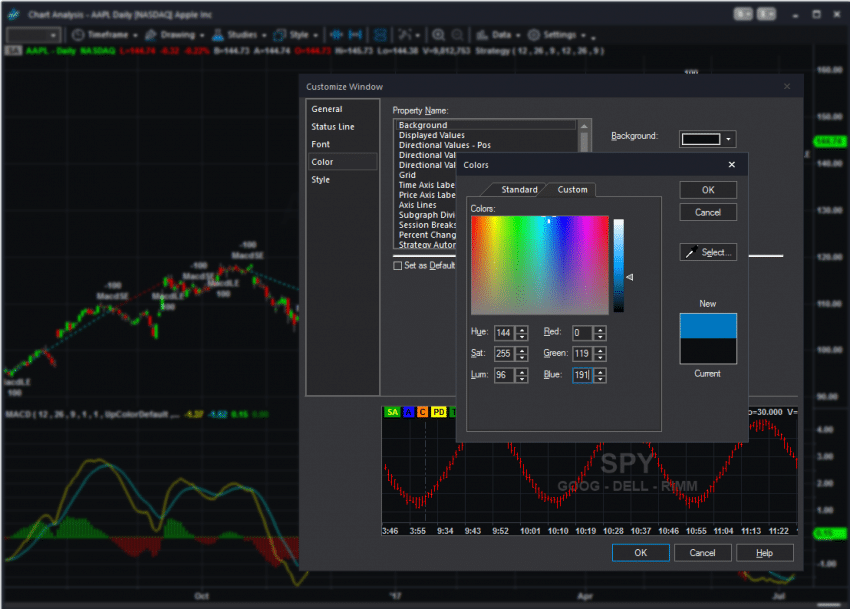

Trading in all categories of financial instruments is carried out through the built-in web platform. After passing two-factor authentication, you can get a variety of analysis tools on the charts. Overall, the web platform is no different from the classic Metatrader.

Leave a Reply