News is an essential part of forex trading. This is because the way currency pairs move on any given day is determined by the overall news of the day. For example, the US dollar will often rise when there is several major negative news since most traders view it as a hedge against risk. In this article, we’ll look at how to trade the news in forex profitably.

Types of news in forex trading

There are broadly two types of news in the forex market:

- One-time news. Also known as unexpected news, the news happens when no one is expecting it. For example, the 911 attack in New York was a one-time news event since no one was expecting it.

- Periodic news events. This news is often scheduled. For example, when the president of the US has a speech or when the Federal Reserve is releasing its interest rate decision. That’s because traders know about these events in advance.

The economic calendar

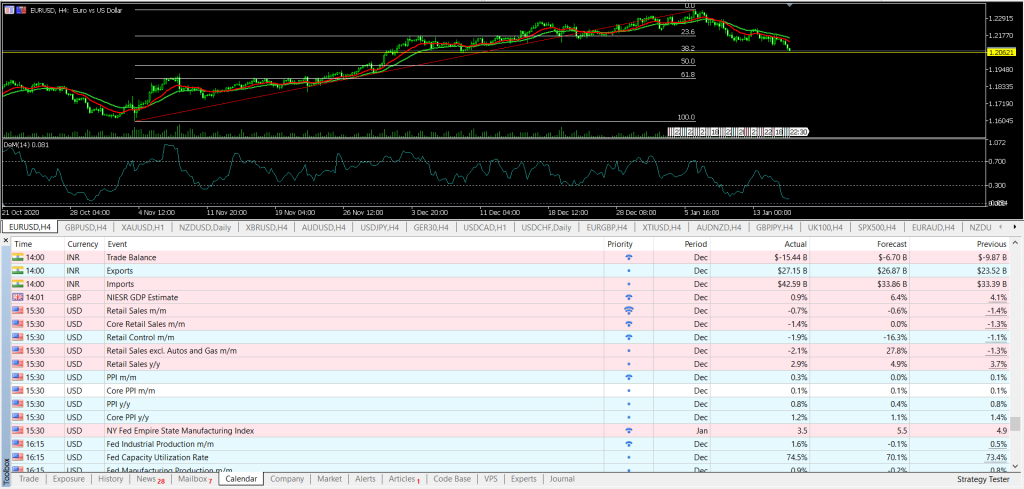

When trading periodic news events, an economic calendar is a must tool to use. The tool gives you a diary of all major events that will come out on a particular day and how much it will affect the currencies. The calendar is provided by most forex brokers and other free websites like DailyFX and Investing.com. It is also provided for free in MetaTrader 5. You can access it, as shown in the chart below.

Using the MT5 economic calendar

Some of the key events in the economic calendar are:

- Interest rate decision. It is taken when a Central Bank concludes its monetary policy meeting and delivers its rate decision. This is usually one of the most important events on the calendar.

- Inflation. This data usually comes out in the form of the consumer price index (CPI) and the producer price index (PPI). A higher number usually increases the likelihood that the central bank will hike interest rates and vice versa.

- Employment numbers. This is when a country releases its employment figures for a given month. The most-closely watched is the nonfarm payrolls from the United States. Other numbers that come at the same time are the unemployment rate, participation rate, wages, and working hours.

- Manufacturing and services PMIs. These numbers show the performance of the two sectors. A reading above 50 shows that the sectors are improving while a figure below 50 is a sign of contraction.

- Retail sales. The data measures the volume of products and services sold by retailers. These are important because retailers are usually the biggest employers in a given country.

- Trade data. The numbers show the volume of imports and exports in a given country. The difference between the two is known as the trade surplus or deficit.

- Consumer and business confidence. This number shows the confidence level among consumers and businesses. A higher reading is usually a sign of rising confidence levels.

For other assets like stocks, there is other important periodic news that is usually important. They include:

- Earnings calendar. This is the calendar that shows when companies will release their quarterly results.

- IPO calendar. The calendar shows a list of companies that are preparing to go public in the near term.

- Lock-up expiration calendar. It shows a list of recently-public companies whose lock-up period is about to expire.

- Options expiration calendar. It shows when options are about to expire.

How to trade the news in forex

Trading the news is a relatively simple – but often confusing process. To do it successfully, you need to follow various steps.

You need to ensure that you have access to the latest news. For periodic news, this process is usually relatively easy because of the economic calendar.

For timely news, you need to have the best tools that will help you get this information. Fortunately, there are many free sources of this information. Some of the best that we recommend are Investing.com, Bloomberg.com, WSJ.com, and FT.com.

Most importantly, we suggest that you have access to Bloomberg and CNBC television channels because of the value they bring. As the most important financial television channels, they have thousands of journalists around the world. They are also among the first to report the latest financial information.

Buy the rumors, sell the news!

Getting the news is the first step but interpreting it is a bit harder. In fact, this is where most day traders go wrong. They assume that the currency pair will trade in the direction of the event. For example, if the US nonfarm payroll numbers are better than estimates, they assume that the dollar will automatically go up.

In reality, a currency usually reacts to news in a broader way. In the above example, the dollar could gain because the weak results will lead to more stimulus in the US. This will, in turn, force the Federal Reserve to raise interest rates faster than expected. Subsequently, this will lead to a stronger dollar.

Also, it could rise because of the concept of buying the rumor and selling the news. This refers to a situation where the price of an asset moves in the direction of the expectation and then reverses when the expectations are met. In the above example, the dollar could be falling before the event because investors expect the news to be bad. When the bad news comes in, the currency reverses.

Summary

Trading the news is an important concept regardless of the type of trader that you are. Scalpers, swing traders, and position traders all use the news in one way or the other. Scalpers use the news to find currency pairs set to experience high volatility. Long-term traders, on the other hand, use the news to find the macro issues that will affect a currency pair.

Therefore, as a trader, it is important that you have access to the latest news using the platforms we mentioned above. Most importantly, you need to know how to interpret this information.

Leave a Reply