Today, traders are looking for smart trading strategies to earn large profits on a regular basis. Every Forex trader must place a high emphasis on market trends, and the price channel technique provides an easy and effective way to analyze the price behavior in Forex.

While trading in Forex, trend lines do not often tell you everything you need to know. Channel trading, on the other hand, gives you a much clearer perspective and allows you to make better trading decisions.

What is channel trading?

It is a trading technique involving oscillators that point out areas that indicate the rise or fall in the price of an asset. Armed with this knowledge, you can easily judge whether you should start with a sell or buy position. It allows you to find out just how volatile the present market is.

How do channels work?

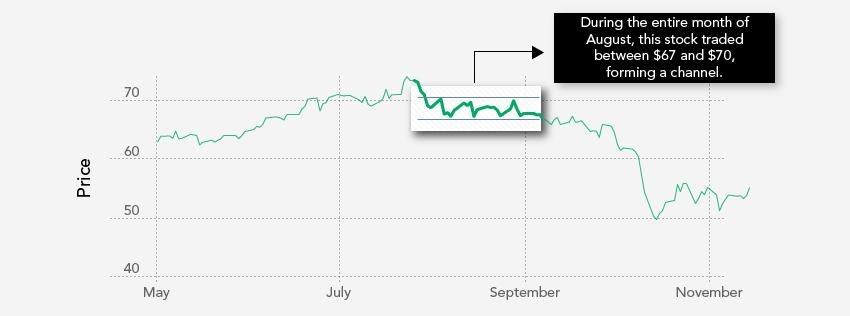

A channel takes birth when the security’s price is shifting between two trend lines lying parallel to each other. In a price chart, a channel could be moving upwards, sideways, or downwards.

An upside breakout, as shown in the figure below, signals that there will be a sustained increase in price. In the event of a downside breakout, traders often sell their stocks as the prices dip.

This technique is most suitable for assets that are moderately volatile, and this could be vital if you wish to figure out how much profit you can make through trading. If the stock is not that volatile, the size of the channel will be less, indicating a small amount of profit. With increasing volatility, the channel size also increases, thus enhancing the chances of making larger gains.

Types of channels

The different channel types are as follows:

- Descending channel. This indicates a bearish trend since an overall downward drift can be seen in the stock price. In a descending channel, both the peaks and troughs are at relatively low positions.

As the market moves downward, several traders will enter short trades in order to cash in on the downtrend. But on the completion of the channel, when the latent price starts to spike again, the same traders might contemplate engaging in long trades to reap the benefits of the same.

- Ascending channel. This indicates a bullish market trend due to the fact asset price encounters an enhancement of higher lows and higher highs. Traders normally enter short trades once the asset price reaches a level beyond which it cannot rise in order to make profits.

In contrast, they enter long trades as the price comes to a point it cannot fall beneath. This allows them to benefit from the price increase. Such a channel is said to be complete upon price closure beneath the lowest point or above the highest point.

- Ranging channel. This is a channel with zero variance in the angle between the closest troughs and peaks. As shown in the below figure, the price fluctuates between horizontal zones of resistance and support.

Traders use these kinds of channels to validate sideward trends by pointing out a few contact points between the two zones. When the asset price reaches a support point, traders will enter long trades, and when it reaches resistance, they will engage in short trades.

How to trade channels

Now, let us look at the different ways you can trade channels.

Trading the breakout

Breakouts create strong signals that are widely used by merchants, as they promise greater gains. Once the price of the asset exceeds the channel’s lower or upper band, you have to assume a stance on that price action. If the price crosses the upper band, you can enter a long trade and conversely enter a short one, given the price descends beneath the channel’s lower boundary.

This kind of trade can potentially earn you swift profits. But even for a seasoned trader, mastering the art of recognizing genuine breakouts is not easy at all.

Trading the range

Channels are used not only for identifying trends but also for recognizing trades that are bound by range. If the channel in question is horizontal, naturally, there is no strong bias in terms of direction. In this scenario, traders usually sell at the channel top and purchase at the channel bottom.

Let us consider the figure below. Position 1 indicates a buy signal, with the target being the top boundary. Position 2 shows yet another signal for buying, and at position 3, the trader exits the long trade, making gains and entering a short trade. Position 4 denotes the lower boundary after a period of steady decline where traders start engaging in long trades.

Trading the trend

If you are looking to make continuation trades, channels present the perfect opportunity. In this regard, you should be on the lookout for a channel that’s neither too even nor too vertical. When you find a channel like this, you know that the trend is sustainable in nature.

Trading the reversal

The size of a channel determines how volatile the stock is going to be, so if a market that is trending propels itself beyond, it may mean the trend is exhausted. So it is more than reasonable to expect a finishing move once the stock price goes beyond the channel’s trend line.

Summing up

By using channel trading, you can easily identify resistance and support areas and position yourself favorably according to the trend direction. You can also get early signals about current prices in the market while trading in channels. But in this regard, you should remember that a channel does not appear for all financial instruments, and volatility plays a huge factor in this case.

Leave a Reply