Against the Grain in Forex

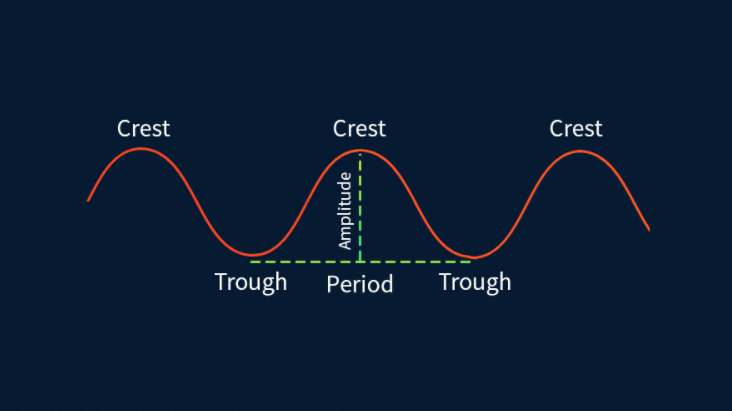

Price action is the most critical aspect of the forex market. The charts that you study everyday plot the behavior of price action. Interestingly, the movement of price action through time is never a straight line because of the market’s complex nature. Different market players react differently to the numerous stimuli in the market. For this reason, price action moves in a series of ups and downs, almost representing a waveform. Each waveform has a top and a bottom.

Picking tops and bottoms is a massive opportunity for traders to generate huge returns. But one must be prepared to go against the grain – to be contrarian – to pull this off. A contrarian trader is ready to make trades that no one else would touch. Can you imagine shorting a market that seems comfortably bullish?

But going against the grain in forex is the hallmark of a successful trader. As earlier mentioned, price action moves in a series of waves that depict bearish and bullish cycles. Nonetheless, predicting where the next trend reversal is going to happen is not an easy task. Picking tops and bottoms means trading the opposite of a trend before the actual reversal happens. This way, you will be well into major profits by the time the rest of the market realizes what is happening.

If you look at it closely, picking tops and bottoms almost resemble what every newbie learns when he/she joins the ranks of forex trading; that you buy low and sell high. But an even closer look tells you that picking tops and bottoms is much more advanced in terms of what to look for before making a trade. In tops and bottoms picking, traders focus on the extremity of sentiments. It includes evaluating the “emotion” of each candle. Emotion simply is the behavior of a candle from the open to close of the session.

The Pitfalls of Being a Contrarian

As you might have noticed, tops and bottoms picking is not an easy trick to pull off. It is almost similar to leaping faith without knowing exactly where you will land. This, ladies and gentlemen, is what it means being contrarian. Again, we have spoken about the upsides of contrarian trading throughout much of our engagement, and perhaps you could be wondering if this style of trading has any downsides. Well, yes, it has disadvantages, and we talk about them below.

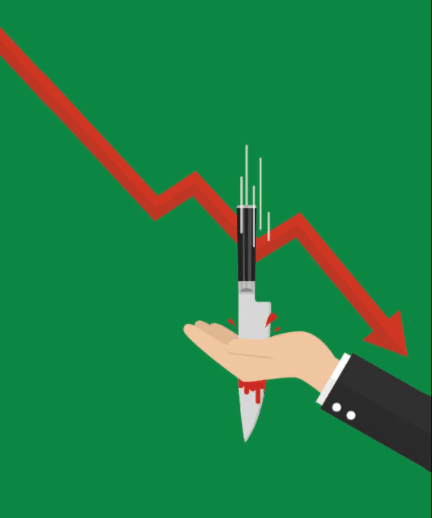

The biggest pitfall of being a contrarian derives from the biggest advantage of the trading strategy. As earlier discussed, contrarian trading entails trading the opposite of the current market sentiment. It means buying a currency pair at its weakest and selling at its strongest. If you recall, this is what tops and bottoms picking is all about. But what happens when the market persists in the current direction for too long?

Interestingly, traders already have a name for this. It is called “catching a falling knife.” This phrase simply refers to the situation where the market descends into a sharp downward spiral, and trying to pick a bottom is like trying to catch an actual knife that is falling. In practice, sometimes, this attempt pays off, but the risk at hand is immense.

Another pitfall of contrarian trading is its overreliance on market sentiment. To be sure, market sentiment is an excellent tool in forex trading. Specifically, this is because the market is a collection of individual traders trying to outsmart each other for the ultimate prize called profits. Therefore, their emotions and mindset matters. But the bitter truth is that market sentiment is anything but a panacea. It will not always work every time you depend on it.

What if You Just Can’t Help Being a Contrarian?

Sometimes it is just in your blood, and catching falling knives has an individual feel to you, like a high. If you cannot let contrarian trading go, you need to follow a personal approach to ensure that falling knives do not chop your hand off, not literally, of course. Here, let us start you off with a few approaches we like.

- Understand how other market players trade

What goes on in the forex trading game is a tug of war among players vying for profits, meaning the weak players ultimately get money yanked away from their hands. For this reason, almost every trader likes to look at charts and try to outsmart what everyone else is doing. Perhaps that is why even non-contrarians misappropriate the title. To be a true contrarian, you must understand the way other market players trade. There is no way you can convince yourself that you are contradicting something you do not understand! You can gather data from sources that you trust to be factual to analyze to determine what positions other retail traders are taking in the market.

- Follow a disciplined approach.

Discipline in contrarian trading implies two things. First, knowing and working with the right tools are oscillators, price action analysis, and more. Secondly, a disciplined approach implies monitoring crowd psychology and behavior around the clock. It is different from analyzing the positions that they take in the market. A disciplined contrarian has a well worked out trading plan, an analysis strategy, and a robust decision-making process.

It takes these and more tricks to succeed as a contrarian. Of course, you also need to equip yourself with tons of information, especially the current data that might hugely influence the direction of the market.

Conclusion

The majority of retail forex traders lose their funds. Being a contrarian, therefore, seems like the natural choice for successful traders. Picking tops and bottoms happen to be one of the most commonly used strategies by contrarians. It mostly succeeds because it entails catching trends before they happen. However, succeeding as a contrarian demands that you understand what other players are doing. Besides, you must cultivate discipline in your activities to remain above the water.

Leave a Reply