The nearly 100-year-old American investment advisor and author John Train put it best when they said, “For the investor who knows what he is doing, volatility creates opportunity.” It’s natural for many people to frown upon volatility.

Heck, even the Oxford dictionary defines volatility as ‘liability to change rapidly, especially for the worse.’ Despite being a relatively volatile instrument, not every forex market is equal; some pairs are less volatile than others.

Nonetheless, it’s practically impossible to make decent money trading without volatility. Therefore, this concept is not something to be fearful of once you understand how to take advantage of it, as it can lead to bigger profits in a short span of time.

After exploring volatility in more detail, we’ll look at the top five most volatile forex pairs to follow.

The concept of volatility in the forex

In any financial market, volatility is a measurement of how much an instrument’s price has fluctuated within a given period. This is measured using a specific statistical value which, in currencies, are pips.

Unsurprisingly, forex pairs do not move at the same rate of change. Volatility partly explains the non-linear trajectory of price where one market can easily travel 50 pips in an hour while another may only do so in a day.

Generally, a less volatile currency market like the euro (and most major pairs) will have the most traders, making it more voluminous or liquid. This means this pair is relatively stable, resulting in smaller price variances.

If more people are trading a particular market, prices will not change as erratically. It would take a substantially large individual order to affect the value quickly in extreme conditions.

These qualities are in stark contrast to more volatile pairs in forex, most notably the minor and, even significantly, exotic pairs. Such markets will have lower volume, and the ease of getting in and out of positions won’t be the same as in other pairs.

A massive order can easily ‘manipulate’ price because there would be fewer orders, to begin with, meaning the value can change dramatically. Moreover, specific economic data releases can see a pair suddenly move several tens of pips in one direction.

Traders use several indicators, most notably the Average True Range, to measure volatility across different time frames.

However, it’s worth knowing that major pairs have low volatility, minor pairs have medium to high volatility, and exotic pairs are the most volatile (along with commodity-based markets like gold and silver).

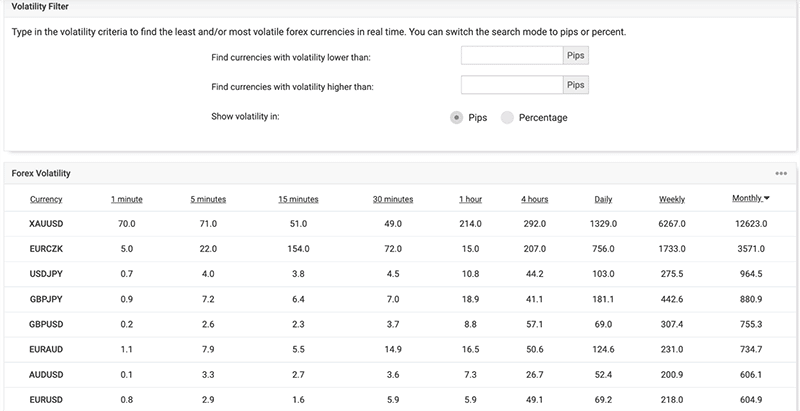

Below is a table from Myfxbook that currently ranks the most volatile forex pairs based on monthly pips.

GBPUSD

For understandable reasons, America and the United Kingdom are the juggernauts of world economics. Hence, pound-USD (or ‘Cable’) is one of the most traded currency pairs. However, interestingly, the British pound is more valuable than the USD dollar on a notional basis.

Yet, historically, the ‘tug of war’ between the two currencies hasn’t been a one-sided affair. We’ve experienced multi-monthly up and downswings within this pair over the years, making it quite interesting to analyze from various perspectives.

While cable isn’t the most volatile pair, we have ranked it #1 as it’s the cheapest to trade. With virtually all brokers, you shouldn’t be paying above a 2-pip spread at most times of the day.

GBPJPY

GBPJPY is usually positively correlated with GBPUSD. However, you can study this pair for unique opportunities in many instances (if you prefer exposure away from the US economy).

The British pound has historically been stronger than the Japanese yen, although it doesn’t mean that GBPJPY is always bullish. Traders like this market for one primary reason. As previously mentioned, minor pairs are generally more volatile than the major markets (particularly Yen-based pairs).

Therefore, the movements of these markets can be more pronounced in one direction than most other pairs, especially if the Japanese economy isn’t doing so well. This is why GBPJPY has earned several peculiar nicknames such as ‘The Widow-Maker,’ ‘The Beast,’ and ‘The Dragon.’

XAUUSD

This market is driven by the substantial interest in gold as a commodity and a so-called store of value away from fiat currencies.

Therefore, investments in gold will never subside because investors continuously pile up on the precious metal as a hedge against inflation. Generally, XAUUSD moves in tandem with all USD pairs most of the time.

However, in some cases, this market can travel in a different direction based on individual factors not tied to the relationships shared by the other major pairs. The only drawback is that gold requires a much larger account to achieve relatively the same position sizes as with other standard forex markets.

EURNZD

Similar to GBPJPY, EURNZD (or alternatively, EURAUD) is an excellent addition to any skilled trader’s watchlist as USD markets don’t heavily influence this market. This pair consists of NZD (kiwi) as the quote currency.

The New Zealand kiwi is usually regarded as a ‘commodity currency’ because of the massive gold reserves held by its respective country (along with its closest trading partner Australia). Therefore, it could be a substitute for trading XAUUSD, where you can experience relatively high volatility but with more affordable position sizes.

USDCAD

USDCAD or the ‘Loonie’ is one of three so-called commodity pairs (along with NZDUSD and AUDUSD). This is because Canada is a prominent exporter of oil. Therefore, this market is an alternative to trading the actual commodity, which, like gold, usually requires a slightly bigger account.

When it comes to major pairs, USDCAD tends to be the second-most volatile pair after GBPUSD. Its volatility range is still, of course, lower than minor pairs. However, you would get more stable movements and cheaper spreads than the former.

Curtain thoughts

Even if one doesn’t follow every forex market, they should have at least one of these volatile forex pairs in their portfolio for trading opportunities. While exotic pairs are technically the most volatile of the lot, you’ll generally want to avoid these for a few reasons.

Firstly, such markets have the highest spreads (although you can lower these using a zero spread account). However, the most significant deterrent is their erratic behavior, particularly on smaller time-frames from the 4HR and below.

Thus, we have provided a good mixture of major and minor forex pairs as they are more stable, predictable, and cheaper in spreads. Despite this, some of these will be somewhat correlated most of the time, meaning you should ensure proper risk management.

Leave a Reply