The blockchain space is fast developing as new solutions and apps are introduced on a number of networks, many of which are experiencing scaling issues. The growth of a network in digital space in terms of transaction processing speeds and processing capacity to handle the inclusion of additional applications and increased user operations is known as blockchain scalability. Scaling allows blockchain networks to compete with centralized networks for transaction volumes, application development, and user engagement by providing larger processing capacity and capabilities. The introduction of Layer 1 solutions is one of the leading strategies for addressing the scalability challenge.

What is a layer 1 blockchain and how do they work?

A layer-1 blockchain is a collection of solutions that improve the fundamental protocol in order to make the system more scalable as a whole. The consensus protocol changes, as well as sharding, are the two most prevalent layer-1 options.

When it comes to consensus procedures, projects like Ethereum are shifting away from the old, inefficient protocols like proof-of-work (PoW) in favor of significantly speedier and less energy-intensive protocols like proof-of-stake (PoS).

Sharding is also one of the most widely used layer-1 scalability techniques. Instead of forcing a network to work on each transaction in order, sharding divides transaction sets into little data sets known as “shards,” which can then be handled in parallel by the network. When it comes to layer-1 solutions, one of the benefits is that nothing needs to be added to the existing infrastructure.

Solana (SOL)

Solana is a layer-1 blockchain with smart contract capabilities that is one of the most advanced. Scalable, low-cost, and decentralized are some of its key features. SOL is its native cryptocurrency.

Solana has a transaction throughput of 50,000 transactions per second. It accomplishes this by combining an Optimistic Concurrency Control approach with Proof of History (PoH) in a distributed system. On a normal gigabit network, this approach can achieve 710,000.

It has exceptionally low transaction costs, which it intends to maintain. The chain currently charges an average fee of 0.00005 cents every transaction. There will be no need to worry about fees as the user base grows.

It also features decentralization and ideal throughput, as well as protocol compatibility. Solana’s single global state eliminates the need for users and projects to deal with various shards or layer-2 systems.

Ethereum (ETH)

Ethereum is a protocol, a collection of rules or procedures. The protocol is used to run multiple separate blockchains. Actual-value transactions take place on the blockchain’s mainnet, which is the principal public Ethereum production network. Ether (ETH) is the native cryptocurrency.

“The Ethereum Virtual Machine (EVM) is the virtual environment in which all ‘Ethereum’ accounts and smart contracts exist.” The protocol’s main aim is to ensure the EVM is continuous, uninterrupted, and unchangeable operation. ERC-20 for fungible tokens and ERC-721 for non-fungible tokens are the most widely used Ethereum standards. Then there’s ERC-777 which contains both fungible and non-fungible assets.

Because each transaction consumes computational resources, each transaction demands a fee called “gas.” The time it takes to mine a new block, which is a collection of transactions, is referred to as block time. The typical time is between 12 and 14 seconds.

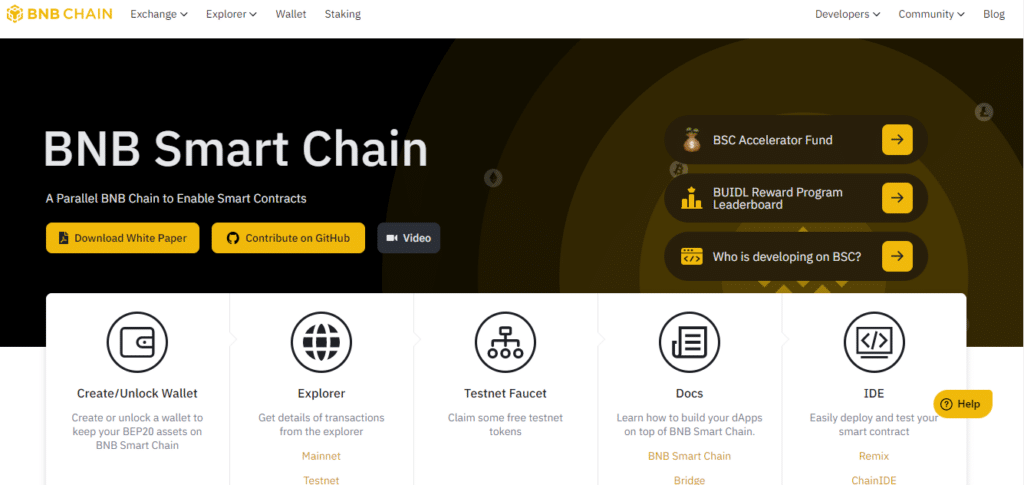

Binance smart chain (BNB)

Binance Chain, the company’s initial blockchain, is designed for quick decentralized trade, however it lacks smart contracts and programmability. Binance Smart Chain (BSC) was built to address this issue. It is compatible with the Ethereum Virtual Machine and runs in parallel to the original Binance Chain. It also supports smart contract functionality.

BNB is the native token of both blockchains. Validators can earn transaction fees by staking BNB. There is no block reward in the form of newly coined BNB, unlike Bitcoin. This is due to the fact that BNB is not an inflationary currency. Instead, the quantity of BNB diminishes over time as the Binance team “burns” coins on a regular basis.

The block time on Binance Smart Chain is roughly 3 seconds. Binance Chain’s BEP-2 and BEP-8 tokens can be exchanged for BSC’s BEP-20 tokens. This is made easy by using Binance Chain Wallet.

Polkadot (DOT)

Polkadot has been rated one of the best layer one protocols in the crypto space by the team at Weiss Ratings. It is powered by the DOT, the network’s native coin. Polkadot is a heterogeneous multi-chain network, which means it combines multiple blockchains created for different reasons into a unified ecosystem. These diversified layer-1 blockchains are known as parachains, and are connected together using the Polkadot Relay Chain.

The Relay Chain was developed using Substrate, Parity’s platform for creating custom blockchains. It is in charge of the network’s common security, consensus, and interoperability between chains.

Parachains are connected to the Relay Chain in a parallel way. Each parachain can have its own design, functionality, and governance. By connecting to Polkadot, parachains gain access to the entire network’s security, eliminating the need to build their own validator community and allowing them to exchange data other than tokens.

Avalanche (AVAX)

Avalanche is a fast-growing Layer 1 Proof-of-Stake blockchain platform with smart contracts. AVAX is the native cryptocurrency. It provides one of the greatest user experiences of any Layer 1 blockchain, thanks to its fast performance and full compatibility with the Ethereum Virtual Machine (EVM). It offers low-latency block periods of around one second.

Avalanche is a scalable blockchain that can handle 4,500 transactions per second while maintaining appropriate decentralization. The network now has the most validators of any Proof-of-Stake protocol in terms of network security.

Avalanche provides the tools needed to develop customized blockchains known as subnets or subnetworks, with a focus on scalability and ease of usage. On the Avalanche network, a subnet is a standalone blockchain with its own group of validators.

Summary

There are various layer-1 protocols in today’s blockchain ecosystem. When a protocol conducts and completes transactions on its own blockchain, it is considered layer 1. They have a native token that is used to pay transaction fees. They must also be decentralized, safe, and scalable.

Leave a Reply