Fundamental analysis is a holistic strategy whereby traders and automated trading systems look at the forex market by analyzing economic, social, and geopolitical news. This form of analysis entails assessing the economic well-being of a country that many at times, influence the strength of the native currency.

Conversely, traders and forex robots assess various data points to determine the strength of a particular currency, when it comes to fundamental analysis. With fundamental analysis, the prices, as well as chart patterns that appear, are assumed to underscore traders’ reaction to news releases.

Various economic reports influence currencies strength in the forex market. The economic reports are many at times, interpreted as fundamental indicators in the forex market.

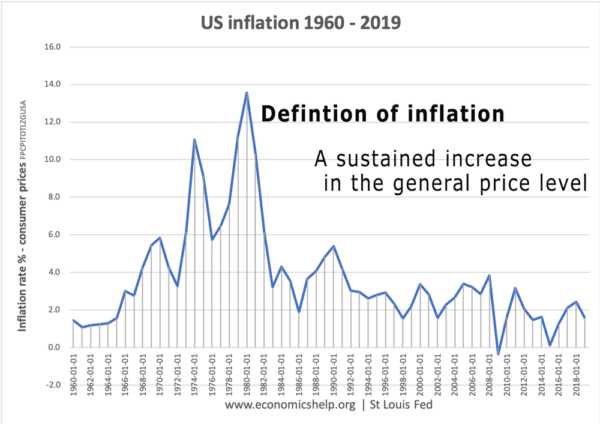

1. Inflation

Inflation is one of the most important fundamental indicators that traders, as well as forex expert advisors, pay close watch to when it comes to analyzing currency pairs in the forex market. Being the rate at which the prices of goods and services increase in the market, inflation demonstrates how healthy a given economy is.

Healthy inflation levels differ from one country to another. For instance, developed economies strive to maintain inflation level at 2% while inflation levels in developing countries can clock highs of 7% without rattling traders in the forex market.

Inflation rate fluctuation from a base point can significantly influence how a given currency performs in the forex market. In the forex market, whenever inflation rises above a given set level or estimates, the underlying currency tends to depreciate in value given the increase in the amount of money in circulation.

Similarly, whenever inflation drops below a given set level, an underlying currency can appreciate as traders tend to see it as a valuable asset.

2. Interest Rate

Interest rate as dispensed by central banks many at times influence price action activity in the forex market. Interest rates are often used to regulate inflation levels. In times of robust economic growth, central banks often increase interest rates to control the pace of money lending in the economy. Higher interest rates tend to cool down an economy by decreasing inflation. Conversely, traders in the forex market react by buying a given currency as higher interest rates are associated with a stable and fast-growing economy.

In contrast, whenever central banks cut interest rates, traders, as well as automated FX trading systems, react by selling a given underlying currency. Central banks cut interest rates as a way of lowering the cost of lending money in the economy so that businesses and individuals can borrow money. The cuts often come when an economy is not growing especially in times of financial crisis.

3. Gross Domestic Product

Gross Domestic Product is a top fundamental indicator that affirms the health of a given economy. Traders play close watch to this figure as it influences a great deal the strength of countries’ currencies.

GDP represents the total market value of goods and services produced in a country in a year. An increase should always follow an increase in the value of goods and services produced in demand if the GDP is to have a positive impact on the underlying currency. Likewise, a currency can only strengthen in the forex market when GDP increases in line with other economic indicators such as the consumer price Index.

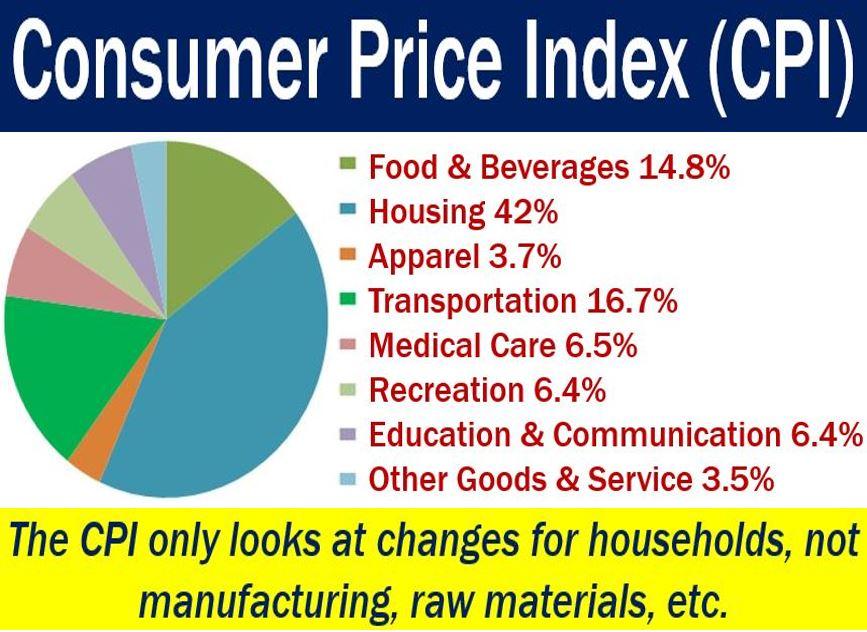

4. Consumer Price Index

Consumer Price Index is a broader fundamental indicator that sheds more light on the health of a given economy from a consumer spending perspective. The index measures the weighted average price of a household basket of goods and services across over 200 categories.

In addition, the CPI reading ascertains the changes in consumer buying power. A higher CPI is many at times associated with increased buying power in an economy. Conversely, forex traders and FX EA tend to buy such currencies in the forex market.

5. Employment Reports

Employment reports are other crucial economic data that forex traders and other automated trading systems pay close watch to when it comes to trading in the forex market. A higher unemployment rate or reduced hourly wages such as in the U.S many at times affects spending patterns leading to currency weakness.

Likewise, higher employment rates are associated with fast-growing economies that result in the creation of more job opportunities. Similarly, a higher employment rate triggers a buying spree in the forex market on the affected currency.

Learn How to trade NFP.

6. Retail sales

Retail sales are another vital economic data that fundamental traders pay close watch to when it comes to forex trading. Retail sales reports indicate the total receipts of all retail stores in a given country. The report is a timely indicator of broad consumer spending patterns in an economy

Retail sales figures can be compared to a sales report delivered by public companies. A higher figure on a retail sales report affirms health of a given economy, conversely leading to the strengthening of the underlying currency.

Conclusion

Fundamental analysis is essentially a way by which traders and forex robots analyze social economic and political news as part of forex trading strategies. Likewise, fundamental traders monitor economic releases of the likes of GDP, Interest rate, and inflation level to try and value currencies

Leave a Reply