Cryptocurrencies’ growing popularity has given rise to some of the best investment opportunities in the capital markets. Retail and institutional investors are increasingly exploring various tools for gaining exposure to some of the fastest-growing digital assets whose use case and utility continue to grow. In addition to buying crypto outright in exchanges, some leverage derivatives to try and profit from the extreme volatility always in play, triggering extreme price swings.

While the focus for the longest time has been on Bitcoin and Ethereum, as the most established and known cryptocurrencies, their high valuation is forcing investors to look elsewhere. It’s becoming clear that some coins going for less than $1 provide some of the best investment opportunities on the risk-reward front.

Below are some of the best cryptos under $1 to invest in.

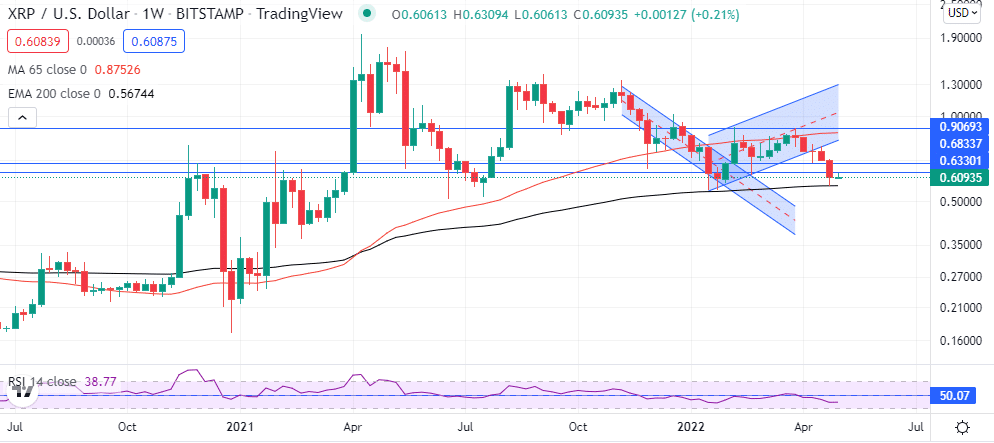

Ripple XRP international payment edge

Developed by Ripple Labs, an enterprise blockchain company, XRP is increasingly becoming the poster child of international payments. The open-source cryptocurrency leverages a distributed ledger to facilitate global transactions at some of the lowest costs.

RippleNet is the decentralized local network that banks and other financial institutions are using to facilitate reliable, fast, and low-cost transactions using the XRP coin. The growing use case around international payments is one factor that affirms XRP credentials as one of the best investments below $1.

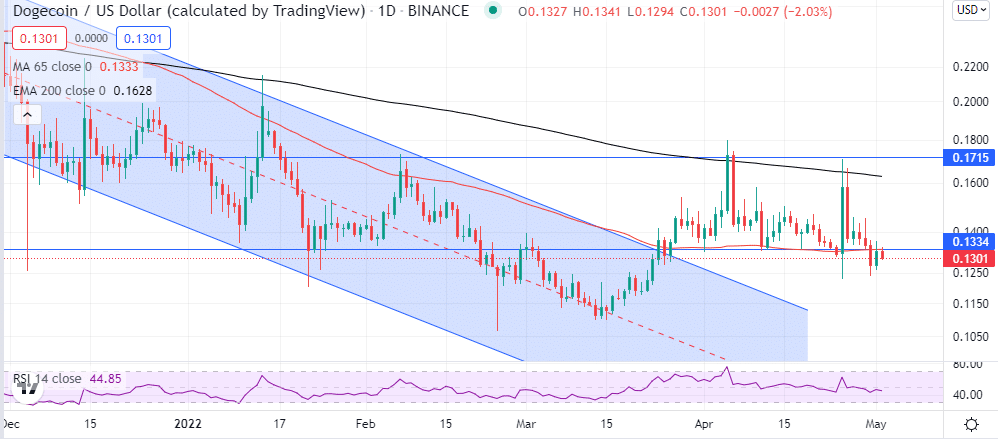

Dogecoin: the ultimate meme coin

When it comes to cryptocurrency investments focus is usually on the use case as investors try to gauge their long-term prospects and adoption in the mainstream sector. However, some coins trade purely on hype from high-profile personalities. Dogecoin is one such coin for investors looking to take advantage of extreme volatility.

A firm favorite of Tesla CEO Elon Musk, the coin is known to generate exciting investment opportunities with every rhetoric from the Tesla executive. Last year, the coin rallied by more than 400%. Its prospects have improved significantly in 2022 amid talk it could be used to pay for subscriptions on Twitter following its acquisition by Musk. While the coin has been hit hard amid the crypto sell-off, it is increasingly becoming an attractive play on the dip.

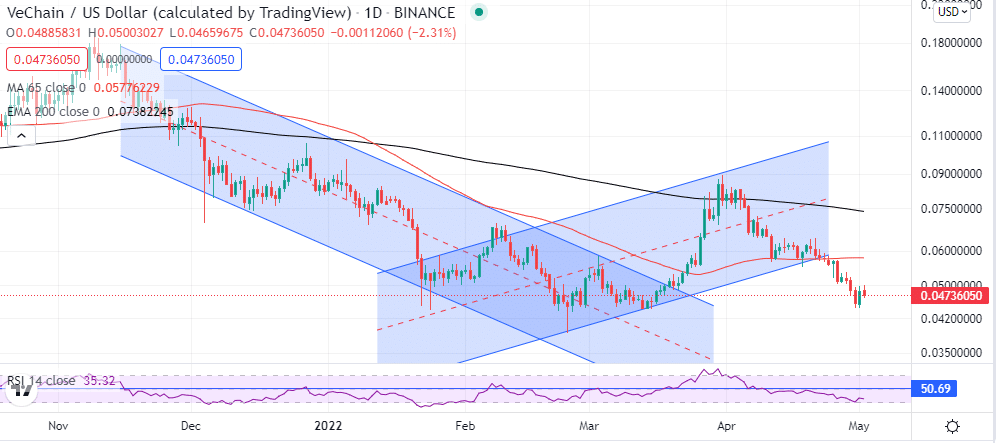

VeChain VET: supply chain edge

VET is the native token that powers the VeChain network, a network that seeks to transform supply chain operations. The blockchain platform aims to improve supply chain management and other business processes. It leverages the ledger technology to smoothen the flow of information through complex supply chains.

VeChain envisions a future whereby all business processes will be carried out from one point, therefore, eliminating multiple stakeholders. Its competitive edge stems from enabling a network in which information can be transmitted smoothly and timely. Its prospects in transforming business processes and people’s life all but affirms VET token prospects as an investment play.

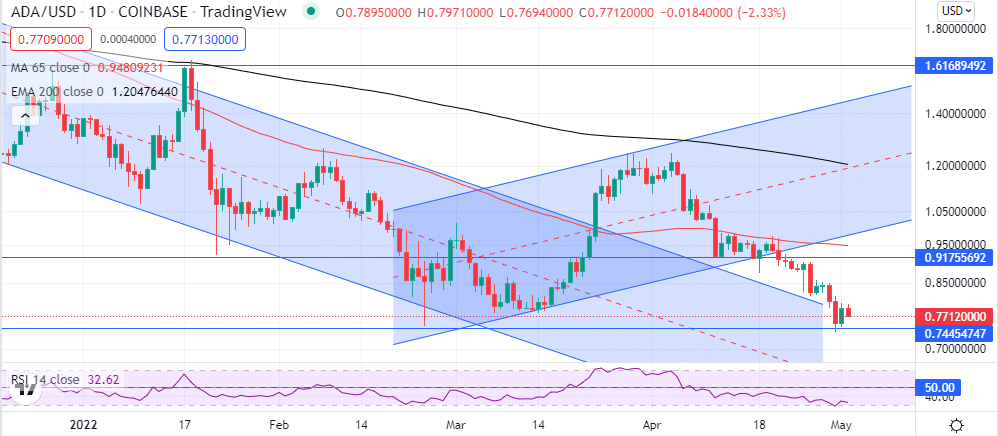

Cardano: the Ethereum killer

While investing in cryptocurrencies, it is important to diversify holdings based on what the tokens do. Cardano is one attractive play that stands out given its growing popularity in the development of decentralized applications. It’s become developers’ preferred platform given the Blockchain’s ability to process up to 250 transactions per second compared to 15 for Ethereum.

Its ability to process transactions without high energy costs has strengthened its sentiments when people are shunning Bitcoin over the amount of energy used to mine one coin. In addition, Cardano leverages Ouroboros, a consensus protocol that allows it to scale to global requirements without compromising security. Trading at less than $1 a coin, Cardano might as well be a top pick for investors looking to gain exposure to decentralized finance.

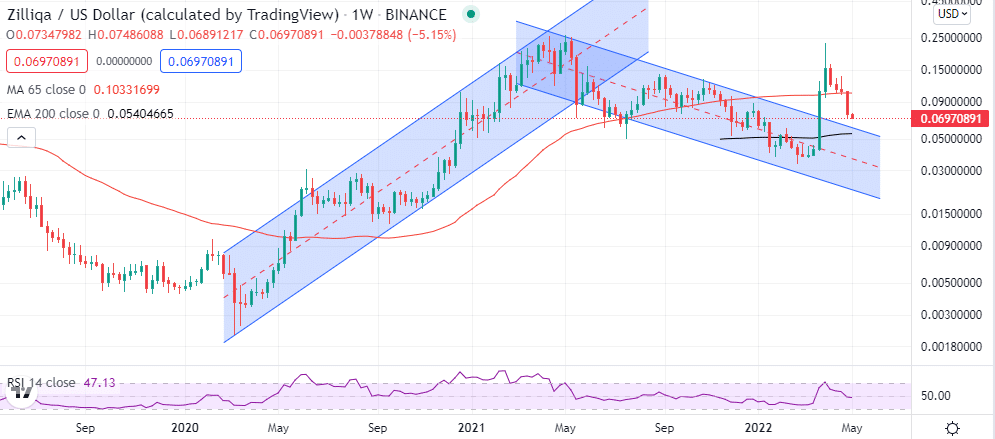

Zilliqa ZIL for decentralized applications

Zilliqa is one open-source project that stands out as a potential Ethereum Killer. It aims to grow an ecosystem of decentralized applications by making it easy to create user-friendly dApps. It stands out from other projects by using sharding technology that splits its infrastructure into several interconnected blockchains.

The splitting action allows the blockchain to handle more transactions. In addition, it leverages the Scilla programming language, which allows developers to write and launch customizable decentralized applications while adhering to the highest security levels.

The growing use case of the Zilliqa blockchain in developing dApps is one factor that affirms ZIL native token long-term prospects. While the token is trading for less than $1, it’s been one of the best performing tokens at a time when most have posted double-digit losses.

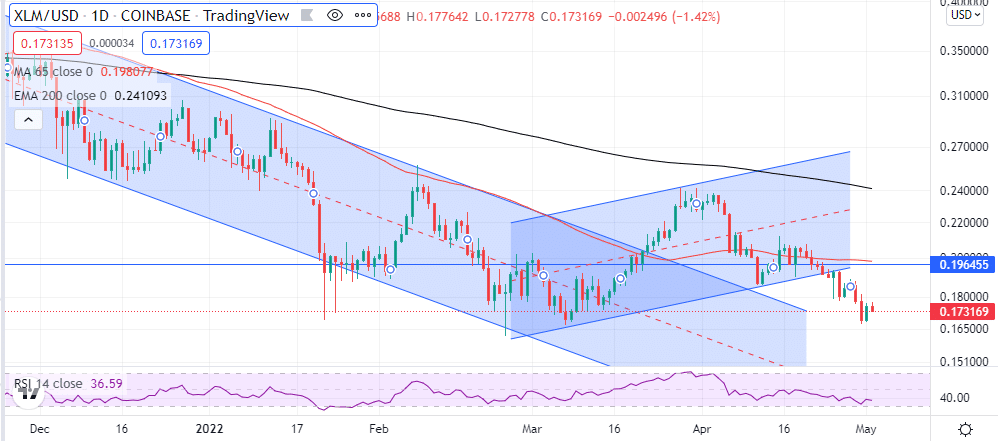

Stellar Lumens for cross border payments

Stellar Lumens is another exciting play with tremendous potential for international payments. The network came into being to connect financial institutions to enable large transactions at some of the lowest costs.

Stellar Lumens is already giving traditional payment networks such as SWIFT a run for their money, given the high speeds in cross-border processing payments. Amid the adoption of blockchain in the mainstream financial sectors, it stands to be one of the biggest winners. While the XLM token has lost significant value over the past few months, it stands to bounce back on the broader cryptocurrency market, turning bullish.

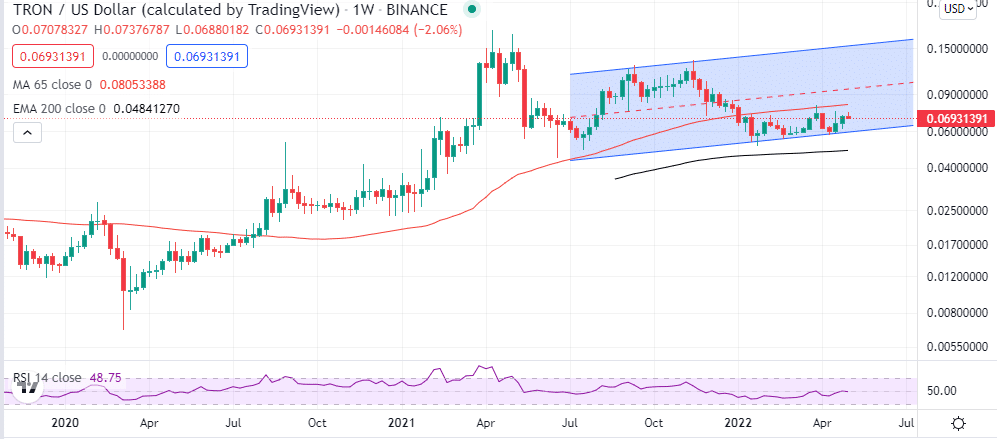

Tron for content distribution

Tron is another exciting cryptocurrency trading for less than $1 but with a solid use case that affirms its long-term growth metrics. The open-source project seeks to enhance the connections between consumers and content providers by enabling peer-to-peer transactions. It is the native token powering the file sharing service Bit Torrent, one of the largest when it comes to content distribution.

The blockchain-based operating system is proving to be the real deal in content distribution as it can handle up to 2,000 transactions per second. As it stands, it currently plays in the same league as the likes of PayPal. Tron’s solid use case affirms its growth prospects despite trading for pennies.

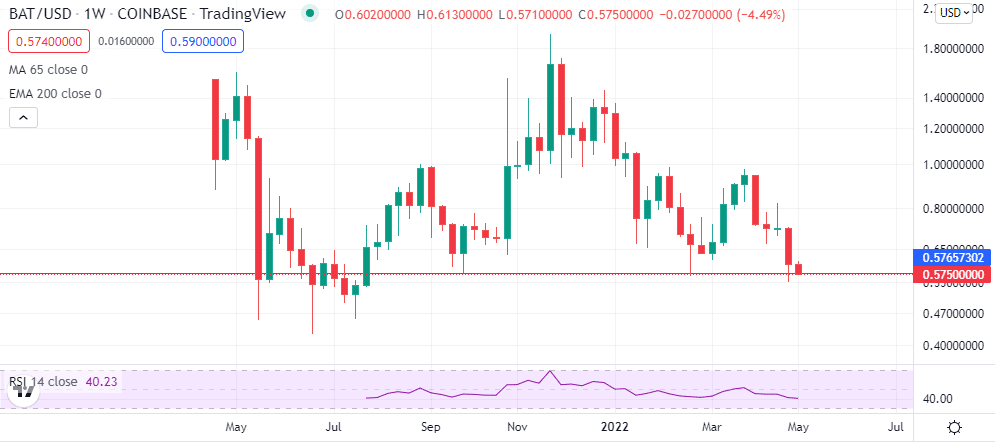

Basic Attention Token (BAT): advertising industry opportunity

Basic Attention Token is another exciting token with an important use case in the multibillion advertising industry. The blockchain project seeks to solve problems around user abuse and fraud by advertisers. It also seeks to address slow load times.

Brave Software, the company behind the token, plans to revolutionize the advertising industry by enhancing how the internet treats users, serves advertisements and collects user information. By transforming how people view adverts, it hopes to impact the multibillion-dollar industry significantly. It plans to do so by eliminating intermediaries in the digital advertising sector.

Leave a Reply