The concept of fundamental analysis (FA) is believed to have first emerged as far back as 1934 with the release of the book ‘Security Analysis,’ authored by the legendary professors David Dodd and Benjamin Graham.

This body of work is considered the bible in stock fundamental analysis and value investing, philosophies championed by several high-profile investors, most notably Warren Buffett.

Ideas from this book have transcended into virtually all financial markets, including digital currencies.

However, FA for cryptocurrencies is not clear-cut because coins are not backed by central banks, nor are they corporations as with stocks.

Yet, with some studies, experts believe we can view cryptocurrencies similar to how you evaluate a business by observing numerous qualitative, quantitative, and perceptual factors to find intrinsic value.

Hence, specific metrics can prove impactful, which this article will explore further. By the end, we hope that your journey into the fundamental analysis of cryptos will be a lot smoother.

The importance of fundamental analysis

FA can feel like the elephant in the room to many traders because it’s often complex and time-consuming.

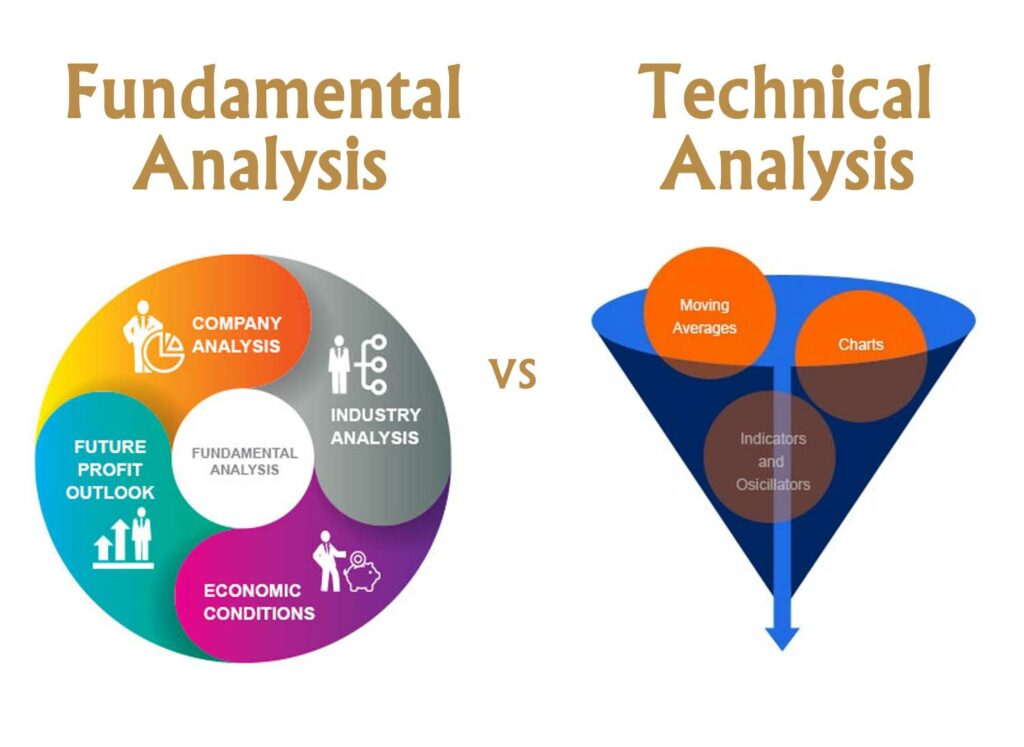

In virtually all legacy financial instruments, investors tend to lean towards technical analysis (TA), where we exploit archetypal patterns using a wide range of charting techniques and mathematical indicators.

However, TA is quite limited because it cannot account for what happens behind the scenes, like economic conditions and industry analysis, factors that one can rarely ignore.

In a nutshell, the image below describes the main distinctions between the two.

The importance of fundamental analysis in many securities continues to be a subject of debate. However, we know that being an analyst is not an easy job because you need to consider many different facets at once.

Nonetheless, FA is significant because current market performance doesn’t always reflect the actual price of a particular cryptocurrency. In other words, even if a coin may not be performing technically, it wouldn’t necessarily make it a bad bet in the long run.

Also, there are well over 15 000 coins in existence, with hundreds that have already failed. FA can allow you to separate the wheat from the chaff and help you get to the bottom of what makes a coin really stand out from the competition.

The key fundamental analysis factors to observe

The overarching problem when performing FA with crypto is you can’t necessarily assess it in the same manner as you would with other instruments like forex, equities, and commodities; nothing is a perfect science.

However, the following metrics we’ll uncover have their place in conducting the best fundamental analysis. It’s up to the trader to decide what’s more relevant or not.

It’s worth noting that this list is not exhaustive because, like any financial market, many other factors can be significant in influencing the price movements of a coin.

Project metrics

These aspects deal with the qualitative side of things to establish a unique value proposition. This is understandably crucial because there are hundreds of cryptocurrencies that more or less do the same thing.

Below are the aspects to look at.

- The whitepaper: This is a technical document any investor must read as the first reference point to critically understand the main problems the project is trying to solve, along with clearly defined use cases, the roadmap, supply distribution, the technologies, etc.

- Existing competitors: As previously mentioned, it’s paramount to identify the competitors within the industries that the project is targeting. Of course, the more competitors, the harder it would be for that coin to perform well and make itself truly valuable.

- The team: Here, you would look to see the experience of all the team members, whether they have the required skills, and if their reputation is clean. Sometimes, a cryptocurrency may get special attention from the market if there’s a popular developer behind it.

Moreover, a thriving and active developer community (e.g., on platforms like Github and Reddit) suggests a coin can receive beneficial contributions.

Financial metrics

Overall, this deals with tokenomics, market cap, liquidity, etc., which are helpful to know in FA.

- Tokenomics: This is perhaps one of the most crucial fundamental elements to observe because it relates to supply and demand. Coins with a finite supply are generally viewed more favorably than those that don’t because they are less inflationary.

The questions to ask in this regard include how many tokens currently exist, is there a maximum supply, how many have been set aside privately, are there any that might be burned in the future, etc.

- Market cap: Typically, experts class coins based on different market cap categories: low-risk (over $10 billion), medium-risk (between $1-$10 billion), and high-risk (less than $1 billion). The lower the market cap, the riskier a project becomes, although this can result in potentially higher growth.

- Liquidity: The more liquid a digital asset is (as in its ability to be bought and sold without any slippage and altering of value), the more stable people can trade it.

Higher liquidity can increase trading volume, meaning that an uptick in the number of buyers can be more sustainable over a certain period.

On-chain metrics

These elements are arguably the most difficult to track as they often require one to look at the block explorers. Also, these will vary widely depending on whether the coin uses proof-of-work (PoW), proof-of-stake (PoS), or some other consensus mechanism.

Regardless, here are the observable components:

- Transaction count: This denotes how many transactions have occurred over the past hour, day, or week and how much they are worth. Of course, these can correlate with an increase or decrease in price.

If the coin uses PoS, you could alternatively look at how much has currently been staked and whether it has gone up or down.

- Transaction fees paid: This is generally applicable for PoW coins like Bitcoin and Ethereum. Higher transaction fees can suggest greater demand for block space, indicating a higher number of transactions.

- Active addresses: Here, analysts consider the total of active blockchain addresses to gauge the amount of activity.

Curtain thoughts

Ultimately, observing digital currencies is a lot trickier than with other financial securities. Moreover, there is a lot of subjectivity involved, and no fool-proof method currently exists.

However, the fundamental analysis seeks to understand where a coin truly derives its value from, the source of whether it’s undervalued or overvalued. Comprehending these elements can understandably result in better decision-making.

However, FA has its flaws and cannot be used in isolation, which is why most trading experts recommend combining it with technical analysis.

Leave a Reply