Growing blockchain popularity and use cases are increasingly giving rise to unique investment opportunities. While the focus for the longest time has been on high-flying cryptos trading for hundreds and even thousands of dollars, penny cryptos trading for less than one cent is turning out to be the real deal on the risk-reward front.

While cryptocurrencies are still in the early stages of development compared to other capital markets, the underlying technology, investment community, or team behind the project makes some of the projects stand out. Investing in coins trading for less than $1 but whose value is set to increase over time is turning out to be the biggest play as the likes of Bitcoin and Ethereum look overpriced. However, it is important not to fall into the temptation to invest in crypto because it is cheap.

Some cryptocurrencies have gone under with people’s money, given the unregulated nature of the sector. Therefore, while planning to invest in penny cryptocurrencies, there are three main things to consider.

Coin use cases

First, it is important to carry out an in-depth analysis of the underlying token focusing on its strength and weakness.

The focus, in this case, should be on each coin use case, market value, price projections, and the team backing it. The development team behind the penny coin should be experienced and knowledgeable about matters of crypto if one is to accrue significant value from the coin in the long run.

Market capitalization

Secondly, it is important to watch the underlying market cap and supply range closely. It is advisable to only invest in penny cryptocurrencies with a market cap of more than $20 million. While any coin can collapse, a market cap of more than $20 million adds a layer of credibility as it affirms a significant number of people betting on cryptocurrencies.

In addition, the coin should have a supply range of between 10 million and 1 billion coins. Limited supply is of the essence as it helps balance the forces of supply and demand. When supply is limited amid heightened demand, the coin’s value is always poised to increase significantly.

Thirdly and probably one of the most important things to consider before investing in the lowly priced cryptocurrency is the exchange in which they are listed. High-profile cryptocurrency exchanges will always add support and list coins with tremendous potential backed by a solid use case and development team.

Conversely, if a coin is listed on Coinbase, Binance, Bitmex Okex, and Huobi, there is always a high probability that a huge community backs it. In addition to listing, the coin should boast of a daily trading volume of more than $1 million and not less. It is also important to look at the coins’ trading history focusing on all-time highs and lows. Market performance over the years and future projections are some of the other factors to consider before investing.

Below are some of the best penny cryptocurrencies to invest in, going for less than one cent.

VeChain (VET)

VeChain is another important project affirming Blockchain’s ripple effect in various industries. The blockchain platform is already enhancing supply chain management and business processes as it seeks to streamline processes and information flow for complex supply chains.

The platform is backed by distinct tokens, including VET and VTHO. VET acts as a medium of exchange through which value is transferred on the network. VTHO, on the other hand, acts as energy or gas that powers smart contract transactions.

Given the impact VeChain is having in supply chain management, it might come as a surprise that VET is still trading for pennies. However, the cryptocurrency might be a worthy investment given the solid use case behind the underlying platform and its powers.

Dent (DENT)

In an era where privacy and data security is of utmost importance amid increased cybersecurity attacks, Dent might as well be a worthy investment. The blockchain project has created a marketplace for mobile data and eSIM cards for users.

The blockchain-powered project accords people the opportunity to own their mobile data and secure it from the reach of unscrupulous users or fictitious companies looking to use it for their own good. The project already resonates well with people going by a more than 25 million customer base.

DENT token, which acts as a medium of exchange on the network, already boasts a market cap of more than $345 million while still trading for less than one cent. As more people turn to blockchain solutions to secure their data and privacy, the DENT token is well poised to increase in value on the increased usage of the Dent platform.

HOLO (HOT)

Sustainability is a big topic amid the growing push to conserve the environment and combat climate change. HOLO is one project living up to the hallmarks of blockchain technology while also being environmentally friendly.

Offering an alternative digital ledger technology platform, Holo is turning out to be an ideal platform for hosting smart contracts and decentralized applications. The relatively new project offers a peer-to-peer platform for hosting decentralized applications.

While it operates the same way as other high-profile smart contract platforms such as Ethereum, it stands out as being eco-friendly. The holochain does not rely on any consensus mechanism to validate transactions. Instead, it depends on distributed hash tables’ low energy intensity while processing transactions.

What this means is that the amount of electricity used in the end-to-end process on the network is quite low. The network is powered by the Hot token, which has exploded to command a market cap of more than $700 million barely a year into the listing. It is one of the best performing tokens trading for less than one cent but with tremendous potential at a time when sustainability is a hot subject in the blockchain space.

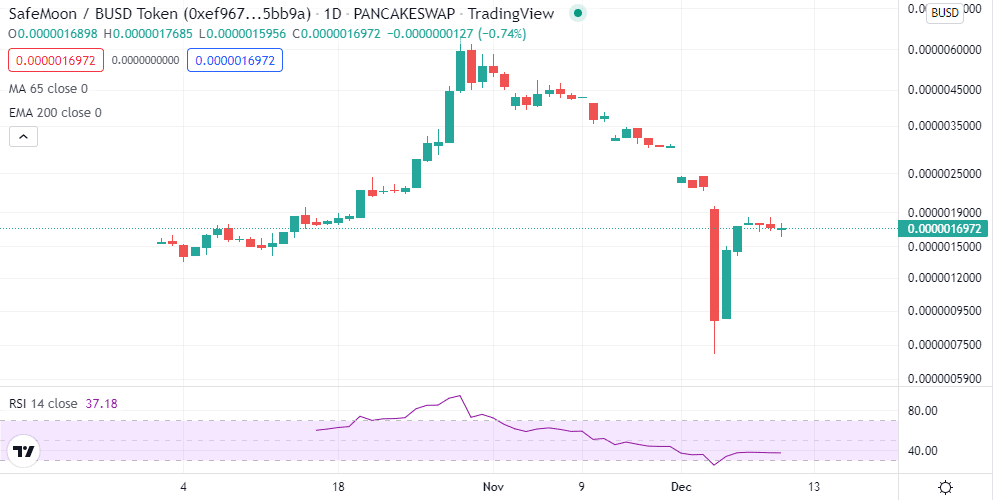

SafeMoon

SafeMoon is more of a speculative or meme token trading for less than one cent. It came into being in March of 2021 to offer a community-driven approach to decentralized finance. With a market cap of more than $700 million, it is arguably one of the biggest in the sector.

One of the most volatile penny cryptocurrencies, SafeMoon tends to accrue most of its value from market speculation. It operates as a meme coin alongside Dogecoin and Shiba Inu. Therefore, it would be an ideal investment play for any investor who is looking to take advantage of extreme volatility levels.

The coin’s price action and wild swings have been attributed to a market frenzy fuelled by celebrities. However, financial experts have in the recent past termed it as the furthest thing from safe.

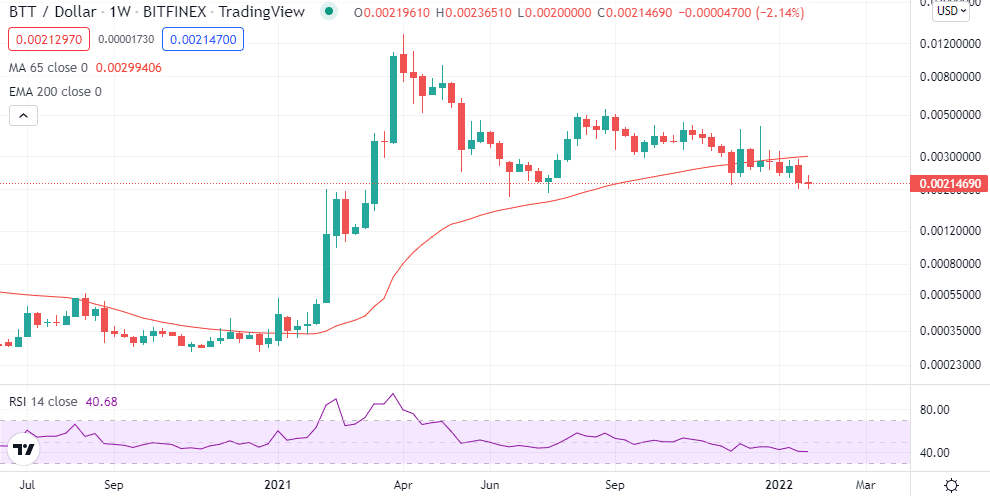

BitTorrent currency (BTT)

BitTorrent is one of the oldest file-sharing platforms that gained prominence in the early 2000s. The platform provided a network whereby computers could connect and exchange files and data without uploading them first to a single server.

The acquisition of BitTorrent by Tron blockchain has once again propelled BitTorrent to the realms of ledger technology, all but enhancing its capabilities. The introduction of BitTorrent token BTT has helped enhance the platform protocol and incentivized the network’s participants.

BTT is the native token that powers the network. The token is bought and spent by people looking to increase their download speed. It also acts as a medium of exchange through which people are paid for sharing their files.

With most people shunning centralized platforms for file sharing, BitTorrent looks set to continue attracting the masses, which should drive BitTorrent demand conversely its value. The token already boasts a market cap of over $2 billion and a daily trading volume of over $4 million.

Shiba Inu

For investors looking to take advantage of extreme levels of volatility, then Shiba Inu might as well be a worthy investment. Dubbed as a Dogecoin killer, it is one of the most popular coins among meme coins. The coin has continued to grow in popularity because of tweets from high-profile personalities such as Elon Musk.

Last year it was the most popular coin attracting 43 million views more than Bitcoin, with its price increasing tenfold. It is often dubbed as a Dogecoin killer, given the increased capabilities it comes with. Being powered by the Ethereum blockchain, it attracts interest for its smart contract capabilities. Its blockchain allows people to lend and stake their tokens. The platform plans to develop a Decentralized Finance ecosystem that will let people stake their tokens.

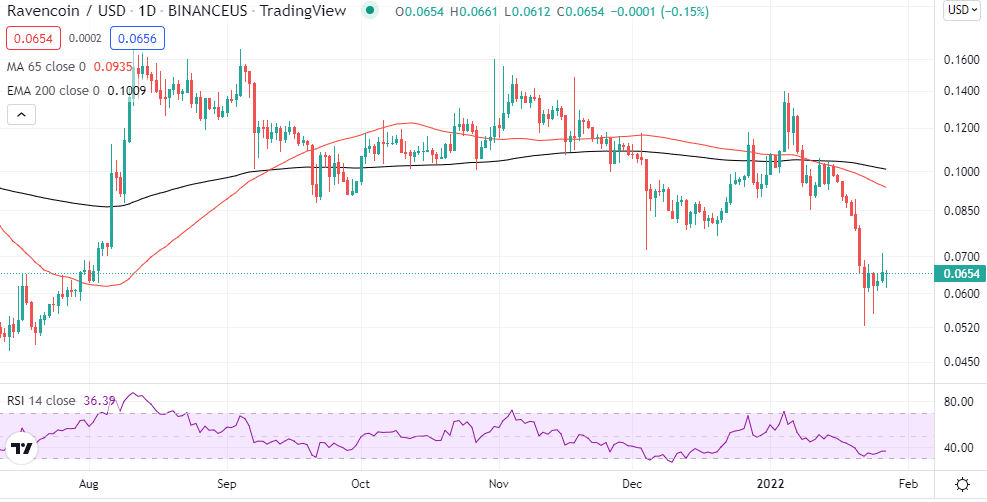

Ravencoin (RVN)

Raven coin is another exciting cryptocurrency trading for less than a penny but with tremendous potential. The coin powers a Ravencoin software that seeks to incentivize a network of computers to operate a platform that people can use to develop a new set of crypto assets.

Conversely, the blockchain-powered project seeks to create and transfer tokens that represent real-world assets such as collectibles, gold, and securities. The platform came into being as an open-source fork of the Bitcoin codebase but with additional features to meet its coins.

Increased use of the platform to digitize real-world items and develop new crypto assets has been the driving force behind RVN coin. The coin currently boasts of a market cap of about $660 million but with tremendous prospects as the digitization spree gathers steam.

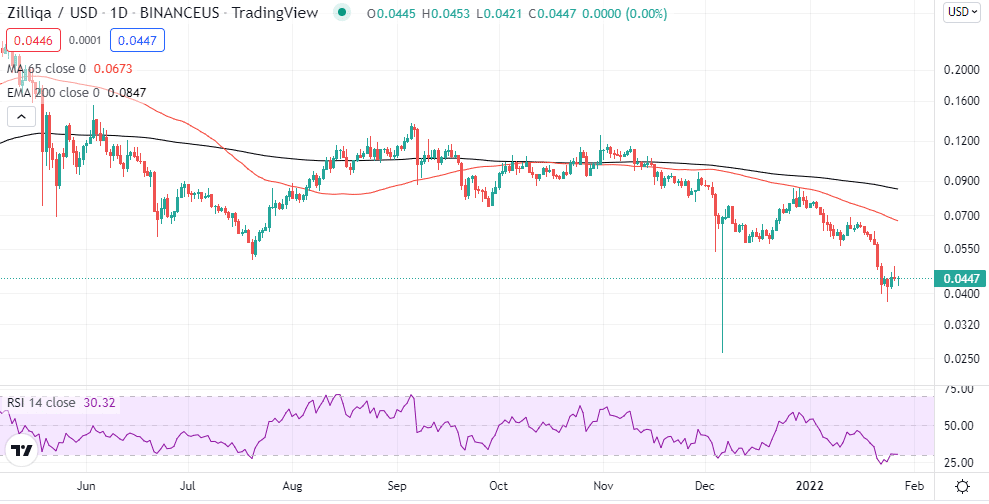

Zilliqa (ZIL)

Sharding is a revolutionary technique gaining prominence as more blockchain projects look for ways to scale to enable the processing of more transactions per second. Zilliqa has already beaten the competition in becoming the first platform to harness sharding power.

Zilliqa is essentially a blockchain software seeking to support a network of computers to run a blockchain platform capable of increasing user scalability through sharding. Increased scalability on the platform has set it in a collision course in rivaling other platforms at the heart of decentralized applications development.

The platform stands out partly because it uses the sharding process to split its infrastructure into several blockchains, thus supporting more transactions. The network is powered by the ZIL token, whose value is expected to continue increasing as more people use the platform to develop dApps.

Chili (CHZ)

Cryptocurrencies are also finding great use in the sports industry and gaming. Chili is one cryptocurrency seeking to accord fans unique experiences worldwide while supporting their teams. The platform leverages blockchain technology to accord fans and their favorite teams a connection for direct engagement.

On the platform, fans can purchase Fan Tokens of their favorite teams using CHZ token. The platform also allows teams to customize the real-world experience to holders of their Fan Tokens. In addition, Fan token holders can participate in key decisions such as new uniform designs, stadium names, and celebration songs.

CHZ is the native token that powers the fan’s network. The platform’s growing popularity has seen an increase in demand for the tokens to more than a $1 billion market cap. As more fans and teams sign up to the Chiliz platform, demand for the token can only increase its value consequently.

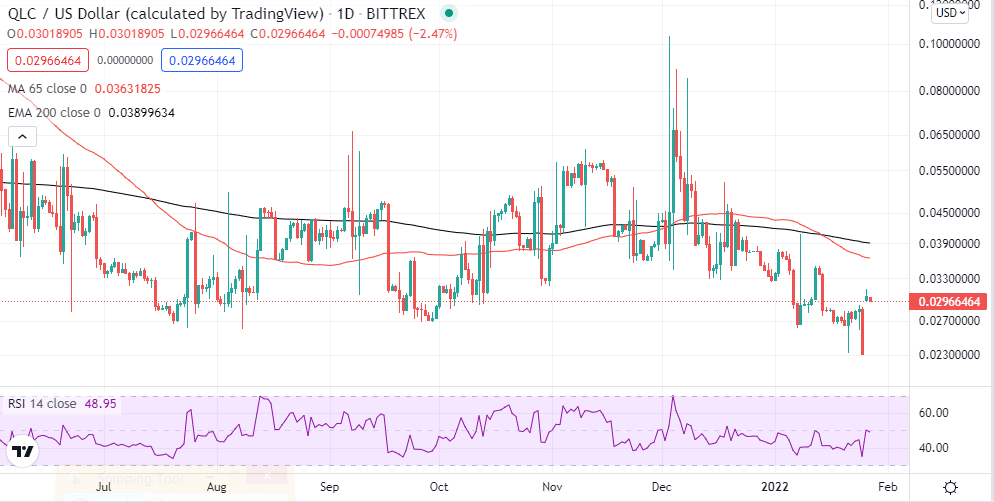

QLC Chain (Qlink)

In the race to build up a decentralized communications network, QLC Chain stands out. It bills itself as a next-generation blockchain decentralized network as a service that allows businesses and individuals to leverage network resources to become service providers or network operators.

For instance, instead of a person receiving a phone service from a centralized wireless provider, QLC Chain has set out to make it easy for people to buy connectivity from peers with ease. Conversely, one can access other people’s Wi-Fi or receive cell signals from a base station in another person’s home. Built on the NEO blockchain, the project has launched a mobile app for sharing Wi-Fi and VPN access.

QLC is the token powering the network through which transaction fees are made within the marketplace. The token has become increasingly famous amid strong demand for decentralized networks to bypass the limitations of the traditional telecom industry.

Leave a Reply