Commodity prices have an impact on other market sectors. Higher oil prices tend to affect industries like airlines and manufacturing. Other commodities like iron ore and copper also have an impact on stocks and indices. In this article, we will focus on some of the popular commodity currencies you can trade.

What is a commodity currency?

A commodity currency refers to commodities that are impacted by the fluctuations of the natural resource industry. Ideally, most of these currencies do well when prices of commodities rise and vice versa. That’s because, as net exporters, their currencies experience higher demand as the price of their natural resources rises.

The Australian dollar (AUD)

Australia is one of the most endowed countries on the planet. It is blessed with resources like iron ore, copper, gold, coal, and aluminum, among others. Indeed, according to the Observatory of Economic Complexity (OEC), its biggest exports are iron ore, coal, petroleum, and gold. It exports most of these items to China.

Therefore, while the Australian government is trying to diversify its economy, the vast majority of the income is from natural resources. Therefore, the Australian dollar is often viewed as a proxy for the commodities market. It is not uncommon to see the AUD decline when the prices of iron ore fall.

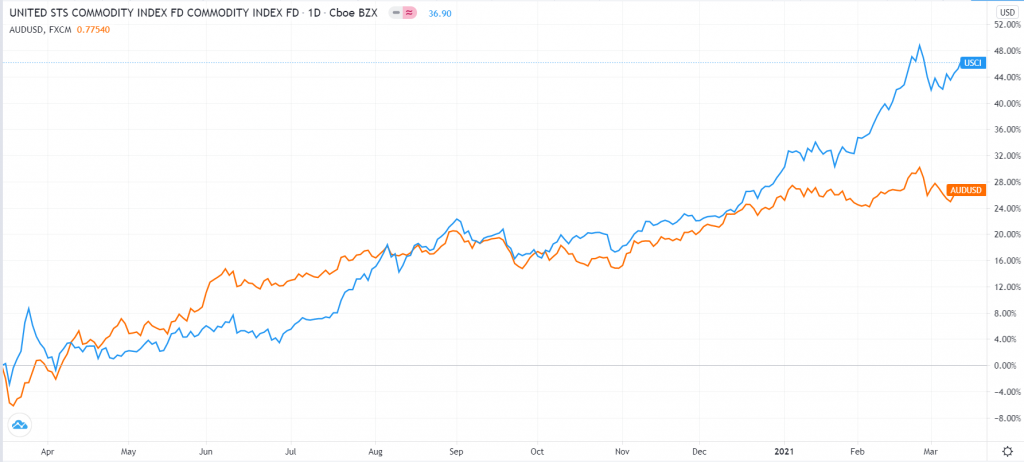

For example, in 2020, the AUD had a relatively strong year mostly because of the weaker US dollar. The currency also performed well because of the resurgence of commodity prices. The chart below shows the close relationship between the Australian dollar and the Commodity Index.

Australian dollar vs. commodity index

The New Zealand dollar (NZD)

New Zealand is a unique developed country. While countries like the United States and the United Kingdom have highly diversified economies, the country is predominantly agriculturally based. Indeed, its biggest exports are concentrated milk, meat, wood, and butter. Indeed, the small country is the biggest exporter of concentrated milk, with key destinations being China, United States, and Japan.

Therefore, New Zealand does well when the prices of dairy products rise. Furthermore, the industry is well-known for its thin margins. A good example of the relationship between the New Zealand dollar and these commodities is shown below.

New Zealand dollar vs. milk prices

The Norwegian krone (NOK)

Norway is a highly-developed European country. It has a highly diversified economy, with several sectors having a significant role. For example, Norway is well-known for its oil and gas industry and the fact that it has some of the most electric cars. In 2019, Norway exported crude oil and natural gas worth more than $52 billion. This makes it the biggest oil and gas country in Western Europe.

However, unknown to many, Norway is also a leading player in the fishing industry. Indeed, it exported non-fish fillet worth more than $6 billion in 2019, making it the biggest player in the industry. It is also well-known in the aluminum industry.

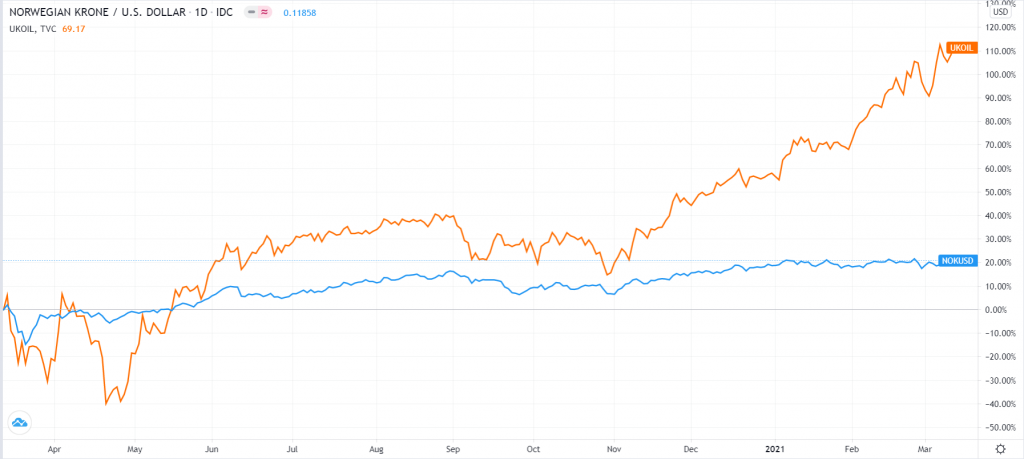

Therefore, the Norwegian krone is one of the key commodity currencies in Europe. Because of the role of crude oil, the currency usually reacts to the daily movements of the commodity. It usually does well when the price of oil rises and vice versa. The chart below shows that the krone has done well as the price of crude oil has rebounded.

Norwegian krone vs. crude oil

The Chilean peso (CLP)

Chile is an emerging market economy that is well-known in the commodity industry. The country is endowed with vast natural resources, which has attracted some of the biggest global mining giants to the country.

Chile has the biggest copper deposits in the world. In 2019, it exported copper ore and refined copper worth more than $32 billion. Codelco, a company mostly owned by the government, is the biggest copper miner in the world. Further, most people in the country are employed directly and indirectly in the mining sector.

Therefore, higher commodity prices are usually positive for the Chilean economy and the peso. Furthermore, these prices will attract more people in the industry and help reduce the unemployment rate. It will also lead to more foreign income.

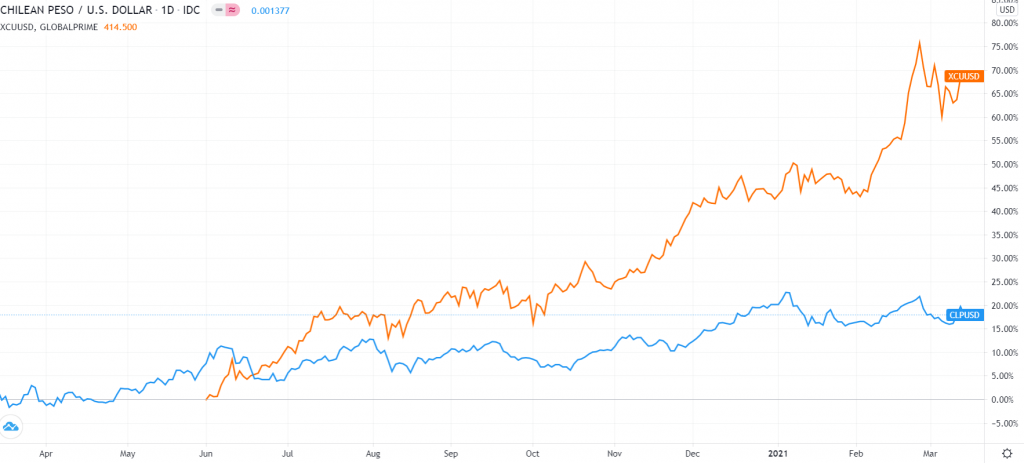

Therefore, the Chilean peso has a close relationship with the copper prices, as shown below. However, for most traders, the challenge is that the Chilean peso is not offered by most forex brokers. Also, even for brokers that provide the currency, it is usually thinly-traded, making it relatively expensive to trade.

Chilean peso vs. copper prices

The Canadian dollar (CAD)

Canada is a highly developed country that many people don’t think of as being commodity-oriented. However, in reality, a substantial part of the Canadian economy is made up of commodities. For example, the country’s biggest export is crude oil.

It exported oil worth more than $67 billion and refined petroleum worth more than $12 billion in 2019. This makes the Canadian dollar highly sensitive to the price of crude oil. Canada is also a key exporter of gold as well. It exported gold worth more than $14 billion in 2019.

Therefore, there tends to be a closer correlation between the Canadian dollar and the price of crude oil. However, it is worth noting that the Canadian government has done a lot to diversify its economy. Today, the country exports a lot of machinery and vehicles to the United States. And its services industry has taken a substantial role in the economy. The chart below shows the relationship between the Canadian dollar and crude oil prices.

Canadian dollar vs. crude oil prices

Summary

There are other common commodity prices we have not looked at. For example, Brazil is widely known for its commodities like sugar, soybeans, crude oil, and iron ore. This qualifies the Brazilian real as a major commodity currency. Mexico is also a major player in the oil and gas industry. It exports oil worth billions of dollars every day. Therefore, it can also be said to be an oil currency. Other thinly-traded commodity currencies are the Nigerian naira, Saudi Arabian real, and the Qatar rial.

Leave a Reply