A crypto tax software is a platform that helps you figure out your taxable gains and losses on your digital currency holdings. Specifically, you can calculate profit and loss, capital gains and losses, and expenses with this software.

When it comes to tracking and analyzing your cryptocurrency holdings, this type of software often contains a crypto portfolio tracker and analysis tool. This software also makes the process of calculating and filing your crypto taxes a lot simpler. We look at the leading crypto tax software below.

Crypto Trader

Because of its concentration on generating cryptocurrency income, Crypto Trader has become a go-to solution for many traders and cryptocurrency professionals. In order to help your clients import their cryptocurrency transactions, this tax advisor walks them through the process step by step.

Features

- Supports preparation of 8949 Tax Form and Income Statements

- It provides a wealth of information regarding the crypto market.

- Has an easy-to-use tax calculator.

- From a variety of different cryptocurrencies, you can quickly import your transaction data.

- Has a full range of audit support services.

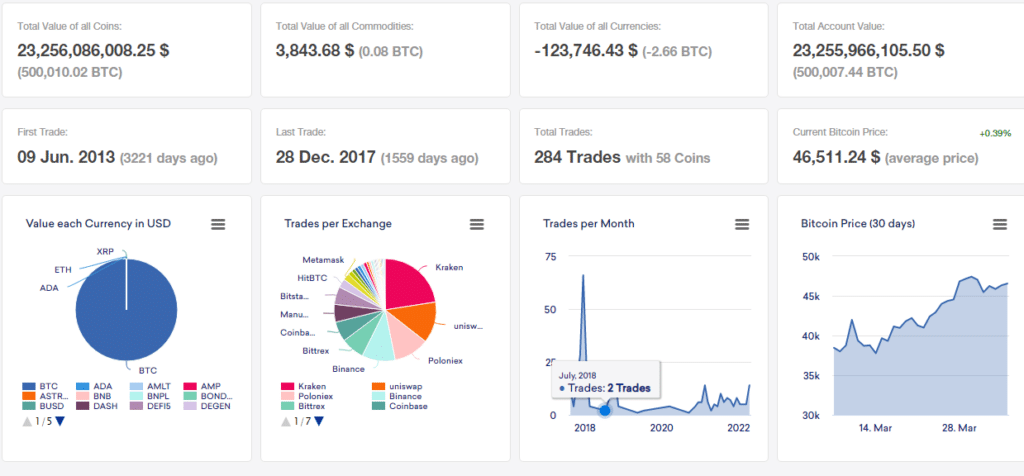

Coin Tracking

Using CoinTracking analysis, you can keep track of your cryptocurrency’s profit and loss, as well as the current market value, in real-time. In addition, you’ll receive regular updates on your profits, realized and unrealized, as well as the generation of related tax documents.

Features

- Customizable reporting on cryptocurrencies

- Supports direct integration with blockchains

- Supports crypto data sharing with cryptocurrency tax advisors

- Integrated with the tax laws of more than 100 countries

- It has 2FA authentication, which ensures greater security

- Instantly shares your financial information with your financial advisor

TokenTax

TokenTax is compatible with every major exchange in the world. They are able to import your trading data from any platform because they have direct integrations with them. You can send a file containing your trading data to an exchange that does not support imports, and their software will automatically import it. In order to file cryptocurrency taxes, TokenTax will generate all of the necessary paperwork. Whether you need TurboTax, FBAR, FATCA, 8949, or any other form, they have it.

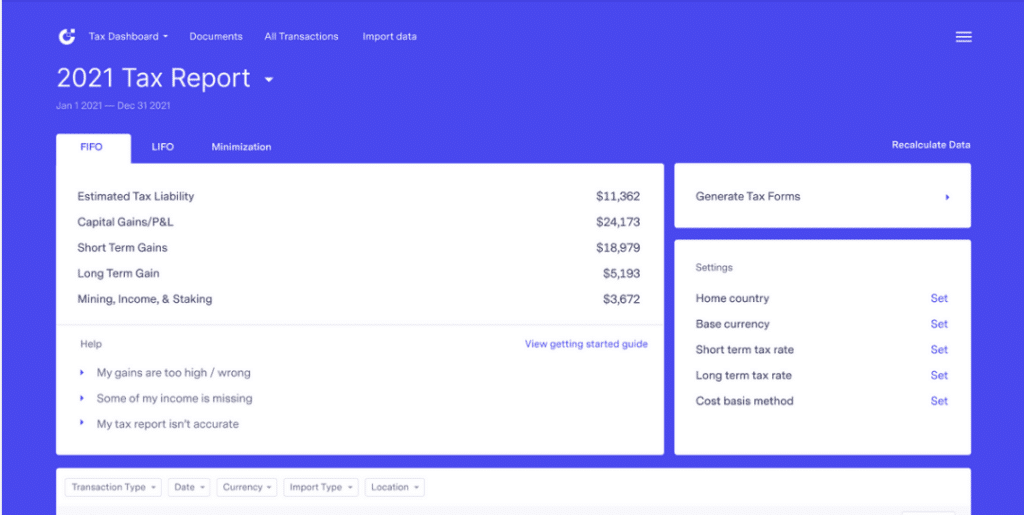

CryptoTrader.tax

Using CryptoTrader.tax, cryptocurrency traders may determine their capital gains/losses exposure in minutes. With their straightforward interface, it’s simple to import your trades and ensure that you aren’t overspending your tax obligations. In addition, users have the option of simply uploading their finished tax returns into TurboTax, making the filing process simpler. Over 20 exchanges are presently supported by the CryptoTrader.Tax platform, making it the most comprehensive.

Features

- It has an intuitive tax calculator

- Supports the importation of transaction data from several crypto platforms in a quick and efficient manner

- Supports the 8949 tax form and preparation of income statements

- All-inclusive audit support

- Take advantage of a tax-loss harvesting strategy

ZenLedger

ZenLedger is an easy-to-use tool for working out your crypto-related taxes. It is compatible with popular exchanges and supports all major crypto and fiat currencies. Their technology automatically populates your tax paperwork by importing your transaction history from supported exchanges. It gets better because there are no issues with ZenLedger’s generated documents when it comes to submitting your tax returns to the Internal Revenue Service (IRS).

Features

- Has tax-loss harvesting instruments

- You can easily create a schedule based on your cryptocurrency transaction history

- TurboTax can be readily integrated

- You may use your transaction history to figure out how much money you’ve made or lost in crypto

- With all of its strategies, a tax pro is at your disposal

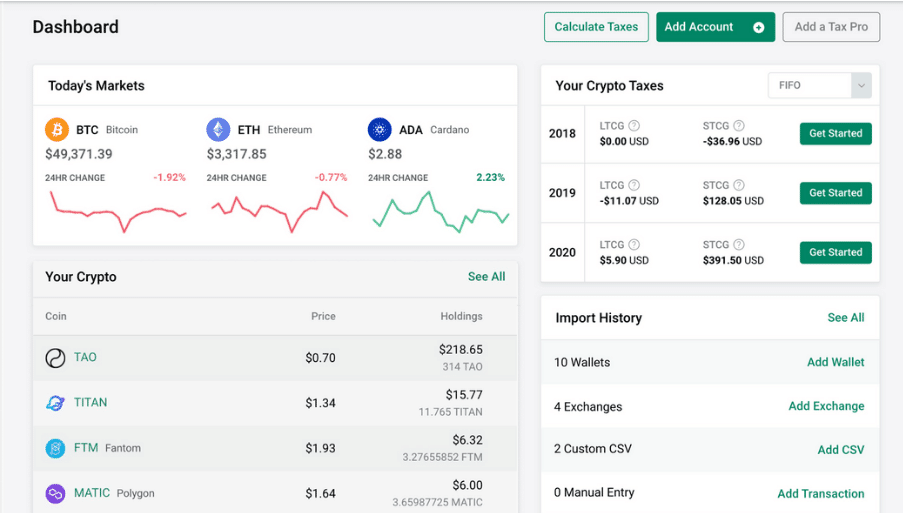

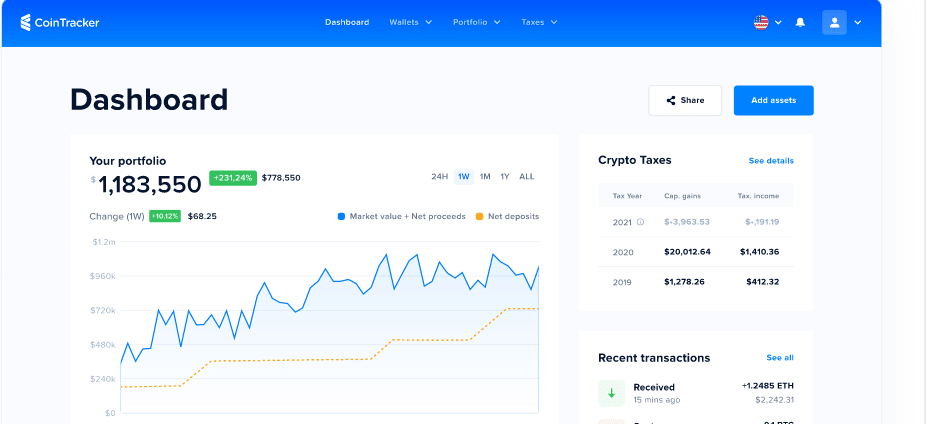

CoinTracker

Using CoinTracker, you can ensure that you are in full compliance with crypto tax regulations. Using TurboTax or your own accountant, you may have your tax returns ready in minutes after downloading them. It is in sync with the tax regimes of many jurisdictions, including support for the United States, United Kingdom, Canada, and Australia.

Features

- You can save thousands of dollars a year by taking advantage of tax-loss harvesting in your portfolio.

- It is possible to determine your capital gains.

- You can accurately monitor the performance of your cryptocurrency assets and taxes.

- It uses simple steps to help users ensure full compliance with crypto tax regulations.

Koinly

Besides token support, Koinly has DeFi support at every level, even the $49 newbie tier. When you move to a new jurisdiction, Koinly creates localized copies of your tax returns, so it’s not just changing the currency values. Also, taxes for algorithmic traders who make 500,000+ transactions a year are also supported by the corporation.

Features

- Has tax harvesting support

- Use more than 350 different cryptocurrency exchanges and wallets

- Create tax reports on demand

- Widespread assistance for almost all jurisdictions around the world

- Incorporation of TurboTax and TaxAct

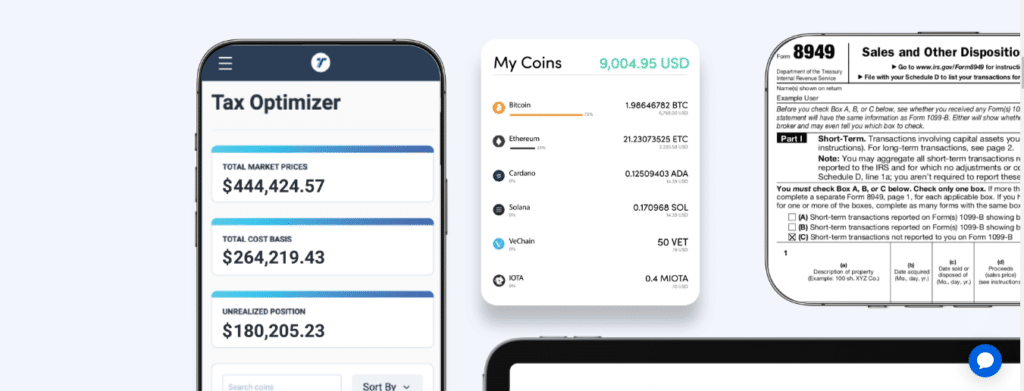

TaxBit

To date, TaxBit is the only tax software built from the ground up by CPAs, tax lawyers, and software developers. During an audit, a CPA or IRS inspector may readily verify the accuracy of your crypto taxes because TaxBit maintains a complete audit record of all their calculations. TaxBit is compatible with all of the major cryptocurrency exchanges.

In addition to annual tax reports, TaxBit Plus and Pro software keep track of ongoing tax obligations. In the previous year, investors who have been actively trading and have under-withheld have found this tool to be an excellent addition. Some of the most prominent VCs in fintech and crypto have invested in TaxBit, just like BlockFi.

Features

- It was created by a team of accountants and tax attorneys

- Supports 150+ exchanges and more than 2,000 currencies

- Provides a dashboard that displays your tax situation, asset balances, and unrealized earnings and losses

- Portfolio performance analysis and tax-loss harvesting are available

- Automated tax forms are available on 500+ platforms for free

- It costs $50-$500 a year for access to the paid plan

In summary

Most crypto investors require a combination of specialized crypto tax software with standard tax return capabilities. The discussion above has covered the best crypto tax software in the market in 2022. However, given the various features that come with each software, you should be keen to select one that not only helps you file your taxes but also compliments your crypto investment style.

Leave a Reply