Volatility is a concern that must be considered at all times. Despite the fact that more liquid markets, such as the foreign exchange market, have reduced volatility, some currency pairs are more volatile than others for a number of reasons. The currency pair‘s volatility will have an impact on practically every element of forex trading. One should do in-depth market research before trading the top 5 most volatile currency pairs in 2022.

Definition of currency volatility

In forex trading, volatility refers to the frequency and magnitude of changes in a currency’s value. Depending on how much its value deviates from the average, volatility is a measure of standard deviation. A currency can be regarded as having high or low volatility. More volatility means more trading risk, but it also means more trading opportunities because price movements are larger.

Some traders prefer trading volatile currency pairs because of the higher potential gains. When trading extremely volatile currency pairings, traders should consider limiting their position sizes because the increased potential gain comes with a higher risk.

5 most volatile pairs in 2022

AUDJPY

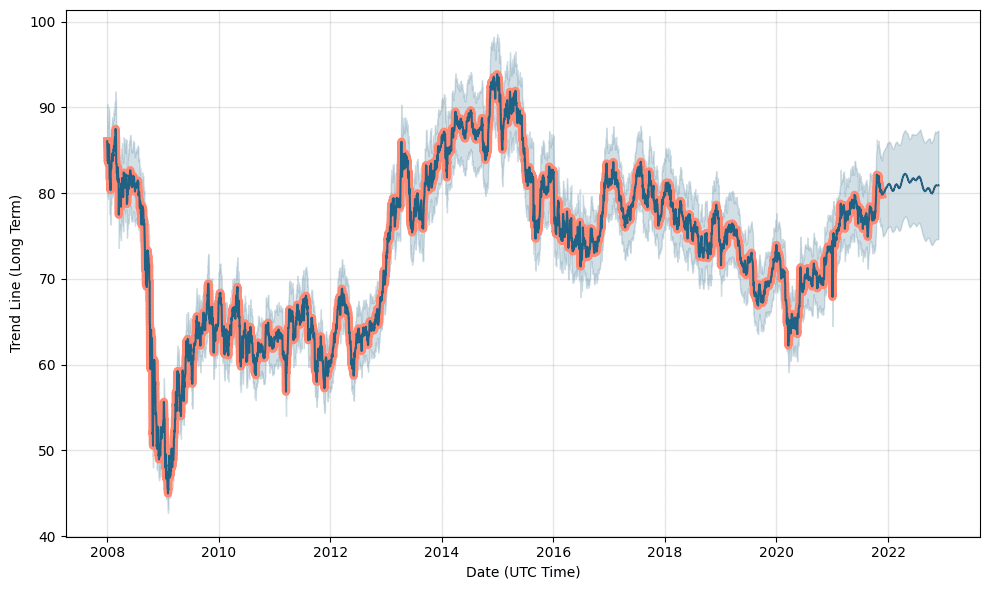

The inverse relationship between the Australian dollar and the Japanese yen makes this pair highly volatile. The Australian dollar is a commodity currency, which means its value is highly influenced by the price and volume of Australia’s exports, especially minerals, metals, and agricultural products. Iron ore serves as a solid supportive basis for AUD. According to Goldman Sachs and the Australian government’s commodity forecaster, the price of iron ore would stay relatively stable for the rest of 2022.

The Japanese yen, on the other hand, is commonly regarded as a safe-haven currency, which means that investors frequently turn to it in times of economic difficulty, something that they do not do with the Australian dollar.

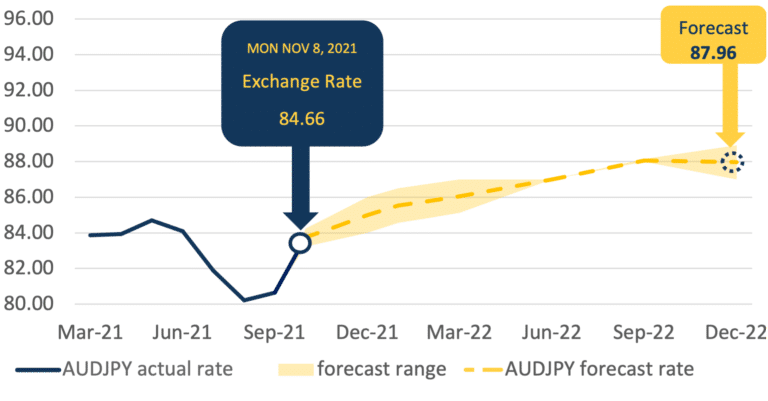

Because the pair is so vulnerable to fluctuations in market sentiment, the currency pair sees a lot of volatility. Banks have predicted that the AUDJPY will rise in 2022.

For example, Westpac forecasts that the AUDJPY rate will reach 88 cents by December 2022, while NAB forecasts that the AUDJPY rate will be around 87 cents by the end of 2022.

NZDJPY

The NZDJPY is regarded as a volatile currency because JPY is stable while NZD is not a stable currency. New Zealand is a commodity currency because it is rich in natural resources and a major exporter of agricultural products, including whole milk powder, fruit, and meat. New Zealand’s tourism industry is a major economic driver, therefore when the industry is doing well, the currency tends to strengthen.

The Japanese yen, on the other hand, is commonly regarded as a safe-haven currency, which means that investors frequently turn to it during times of economic distress.

The NZDJPY is expected to rise slightly in 2022 and will continue to be volatile. Any changes in the price of any of these markets will affect the value of the New Zealand dollar against the Japanese yen.

GBPAUD

These two currencies have historically been linked, especially because Australia is a member of the Commonwealth of Nations. However, as a commodity currency, the AUD’s price is greatly influenced by the value of Australia’s exports, as previously stated.

As a result of the United States’ trade war with China, Australian imports to Chinese markets have decreased. Because China is one of Australia’s most important trading partners, this is bad news for Australian manufacturers and exporters who rely on strong economic ties with China to boost revenues.

As a result, since the commencement of the trade war, currency pairs containing AUD have seen greater volatility. To make matters worse for the GBPAUD pair, after the Brexit referendum outcome in 2016, the pound has seen greater volatility.

CADJPY

This pair is quite volatile and is heavily influenced by market movements. Oil prices have a big impact on the Canadian dollar and the Japanese yen as safe-haven currency. That is where the concept of volatility comes into play.

Furthermore, because Japan is a major importer of oil, the cost of purchasing Canadian dollars in yen tends to rise as the price of oil rises. This is because as oil prices rise, more yen must be exchanged into CAD to purchase a single barrel of oil, leading the CADJPY rate to climb as well.

For example, if oil supplies from other nations were to be limited, the price of Canadian oil exports would almost certainly rise, causing the Canadian dollar to rise versus the yen.

USDZAR

The price of gold has a significant impact on the volatility of this pair. This is because gold is one of South Africa’s principal exports, and gold is valued in US dollars on the international market, which means that gold’s price is closely linked to the strength or weakness of the US dollar.

As a result, if gold prices rise, the dollar’s value against the South African rand will certainly rise as well. This is beneficial to South African exporters since it implies they will be able to earn more US dollars for their gold on international markets.

However, buying US dollars with a South African rand will become costlier as a result of this. As a result, traders interested in the USDZAR pair should do thorough research into the price of gold and the variables that influence it before taking a position. In 2022, gold should have new highs thus the pair will remain volatile.

Conclusion

You should take the volatility into account before placing an order in FX. Volatility exposes you to higher risks. When trading highly volatile assets, reducing trades or minimizing positions may help to reduce risk in the Forex market. Because the factors aren’t likely to change, most currencies that are experiencing volatility now may continue to do so in 2022.

Leave a Reply