The forex trading industry has its jargon or special terms that all participants must know. Having a good understanding of certain terms can help you become a better trader. In this article, we will look at some of the most important forex terminologies or jargon that you need to master.

Currency pair

A currency pair refers to a set of currencies that you buy and sell in forex. It is the foundation of the forex industry. Examples of currency pairs are EUR/USD, USD/TRY, and EUR/ZAR.

A currency pair is made up of two parts. The first currency is known as the base currency. It simply refers to the currency that is being quoted against. For example, if the USD/TRY is trading at 16, it means that 1 US dollar is equivalent to 16 Turkish liras. Similarly, if the EUR/USD is trading at 1.1200, it means that 1 USD is equivalent to 1.1200 euros. The other currency is known as the quote or counter currency.

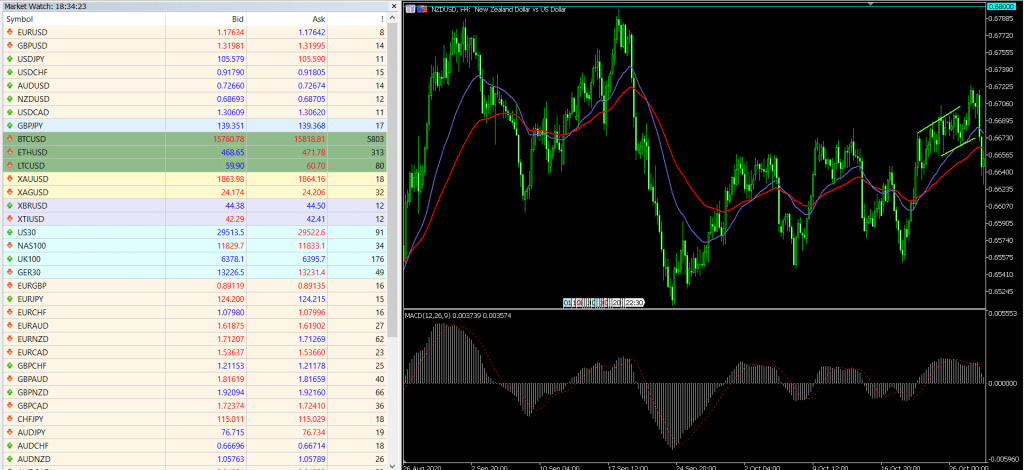

Therefore, in the chart below, we see that the NZD/USD pair has risen by 26% in the past few months. This means that the New Zealand dollar (base currency) has risen against the US dollar, which is the counter currency.

Currency pair example

There are three primary types of forex pairs in trading. Forex majors are those of developing countries that have the dollar like the EUR/USD, GBP/USD, and USD/JPY. Forex minors are currencies of developing countries that don’t include the US dollar like AUD/NZD, EUR/GBP, and EUR/AUD. Finally, exotics combine developed countries and emerging markets like EUR/ZAR and GBP/TRY.

Leverage and margin

Leverage and margin are essential terms that you need to understand in the forex market. Indeed, most new traders lose money mostly because they don’t have a good understanding of these two.

Leverage refers to additional capital that helps you maximize your profits. For example, assume that the share price of company A is trading at $10, and you have $1,000 to invest. In this case, you can buy 100 shares. If the stock moves to $13, your total profit will be $300. On the other hand, if you took a loan of $1,000 and bought the shares, your profit will be ~600. This is how leverage works in forex.

Ideally, a forex broker will provide you with leverage that can help you increase your profits. This leverage is usually quoted in ratio. If you have $1,000 and you select leverage of 1:50, it means that your buying power is $50,000.

Margin, on the other hand, is the collateral that the broker holds for ‘lending’ you their money. Margin is usually expressed in percentages. For example, when using the leverage of 1:100, the broker will ask for a margin that equals 1% of your funds.

Please note. While a higher margin exposes you to higher profits, it is also risky. Indeed, the European Union has placed maximum leverage that brokers can offer to 1:30.

Bid, ask, and spread

A currency pair and other financial assets have two prices, as shown in the chart below. On the left side, we have the bid price and ask price on the right. The two prices are stipulated by the two main participants in the forex market – buyers and sellers.

The bid price refers to the maximum price at which buyers are comfortable buying at while the ask is the maximum price that sellers are willing to sell. In the chart below, we see that for the EUR/USD pair, the bid price is 1.1763 while the ask is 1.1764. As such, the bid is usually smaller than the ask price. Also, the price that is charted or quoted by the trading platform is usually the equilibrium between the bid and ask price.

Bid, ask, and spread

The spread is the difference between the bid and ask prices. In the EUR/USD example above, the spread is 8. For volatile assets like Bitcoin, Ethereum, and Litecoin, the spread is usually higher. In forex trading, this number is usually important because brokers never charge a commission. Instead, they make their money on this spread. As such, when finding a broker, you should always consider one with thin spreads.

Stop loss and take profit

Stop loss and take profit are tools you will encounter in your trading journey. A stop loss is a tool provided by most trading platforms to limit your risk exposure. When placed in a trade, the stop loss will automatically stop the trade at a predetermined level. For example, assume that you have a $10,000 trading account and you are only willing to lose 3% or $300.

In this case, you should place a stop loss at a level that ensures that the maximum loss is $300. As such, if you have bought a currency pair and its price drops, the system will automatically stop the trade when you lose $300.

Another similar tool is known as the trailing stop loss. It differs from the first stop loss in since it moves with the trade. For example, if you buy the EUR/USD at 1.1200 and the price moves to 1.1250 and then starts falling, the trailing stop will move with it and protect your account.

Take profit is a tool that stops your trade automatically when it reaches a certain level. In the example above, if your take profit was 1.1250, your trade would be stopped automatically.

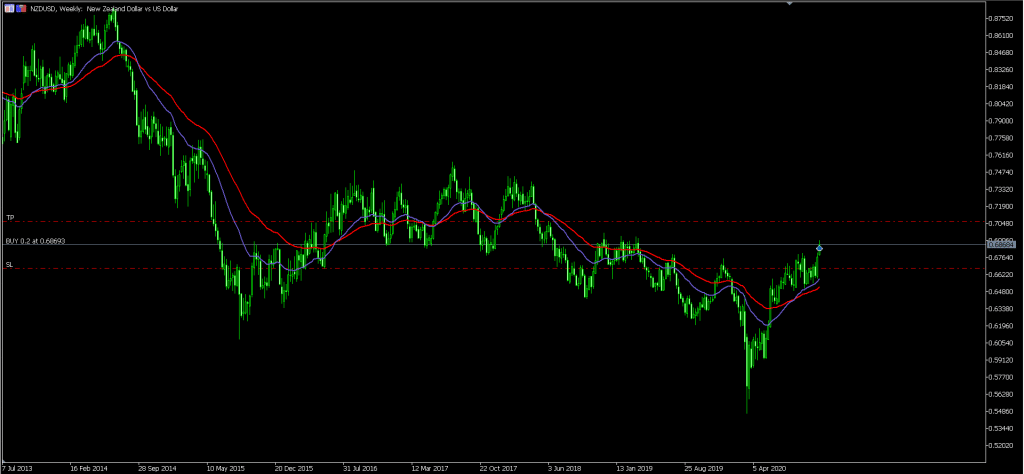

The advantage of these tools is that they help you manage your risk. Also, you can set-up your trade in the morning and leave without any fear. The chart below shows an NZD/USD trade with a stop loss and a take profit.

Stop loss and take profit

Support and resistance

You will encounter support and resistance levels in forex trading. Support is the price where a currency pair or any other asset struggles to move below. You can think of it as a floor. Resistance, on the other hand, is the price where a financial asset struggles to move above. You can think of it as a ceiling. The two levels will often form your buying zones or areas where you enter your stop loss and take profit. They are shown in the chart below.

Support and resistance

Final thoughts

There are other top terms you will meet in your forex trading journey. These include pips, moving averages, going short and going long, lot size, limit order, and market order, among others. Having a good understanding of their meaning will help you become a better forex trader.

Leave a Reply