Preparation accompanies any news trading strategy, and this is something we cannot underestimate. Just like a sprinter can spend months preparing for a mere 10-sec 100m sprint, very similarly, a trader needs to prepare well in advance for a news event that has a short-lived impact.

Some of these recommendations may appear small, but can play quite a significant role:

- Ensure an uninterrupted internet connection with the highest speed possible. Traders must use a desktop/laptop rather than a mobile device because the latter is limited in its scope. Related to the speed, one needs to ensure the highest RAM possible on their computer, which means very few or no sites and programs running as this can have some effect. The better the connection, the stronger the servers would be on the trading platform. Due to the extreme volatility of these events, a superb connection is better able to reflect the action in a split second as it unfolds.

- Ensure an uninterrupted internet connection with the highest speed possible. Traders must use a desktop/laptop rather than a mobile device because the latter is limited in its scope. Related to the speed, one needs to ensure the highest RAM possible on their computer, which means very few or no sites and programs running as this can have some effect. The better the connection, the stronger the servers would be on the trading platform. Due to the extreme volatility of these events, a superb connection is better able to reflect the action in a split second as it unfolds.

- Ensure an uninterrupted internet connection with the highest speed possible. Traders must use a desktop/laptop rather than a mobile device because the latter is limited in its scope. Related to the speed, one needs to ensure the highest RAM possible on their computer, which means very few or no sites and programs running as this can have some effect. The better the connection, the stronger the servers would be on the trading platform. Due to the extreme volatility of these events, a superb connection is better able to reflect the action in a split second as it unfolds.

- Ensure an uninterrupted internet connection with the highest speed possible. Traders must use a desktop/laptop rather than a mobile device because the latter is limited in its scope. Related to the speed, one needs to ensure the highest RAM possible on their computer, which means very few or no sites and programs running as this can have some effect. The better the connection, the stronger the servers would be on the trading platform. Due to the extreme volatility of these events, a superb connection is better able to reflect the action in a split second as it unfolds.

From a more technical perspective, it may be wise to be selective as to which news to trade. While so-called high-impact news releases are the most anticipated, it’s best to perform some research on the economic data, paying precise attention to the numbers.

High-impact news releases are never always a guarantee for any substantial movement, which is every news trader’s dream. For example, for any news release, if the forecasted figure is different from the previous, this reflects a potential market sentiment that may occur. In an ideal world, this naturally results in a sharp drop or rally if the actual figure released is indeed different from the previous or the forecasted figure. However, this does not always happen.

If there is no difference whatsoever or little difference between the previous and actual figures, this can create an unwanted level of volatility and confusion that is difficult to trade. Though the effectiveness of the strategy that’s employed is essential, it may be useless if there is no smart homework to give one an idea of what to expect.

The best news to trade

There are several high-impact news that garners significant interest. Arguably though, the best news to trade is the interest rate. The reasons are clear since this is one of the principal indicators speculators typically look at to forecast the short-term and, more so, the long-term movements of a currency or pair. Hence, they tend to produce the most consistent, significant, and sudden differences in price, sometimes even when there is no difference between the previous, forecasted, and actual figures.

For example, looking at the numbers of the RBZ interest rate decision for February 2020 and what eventually transpired on the charts confirms this very thought. The previous, forecasted, and actual interest rates all remained the same, yet several NZD pairs felt the impact to some degree. Other news releases that are worth trading include NFP (Non-Farm Payrolls) and GDP (Gross Domestic Product).

Examples of news-based trading strategies

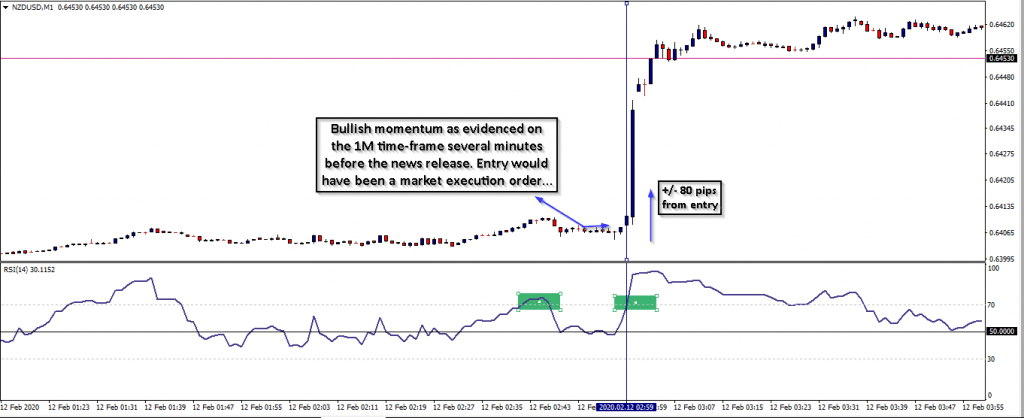

The following strategy is a little more aggressive as it requires swift reactions. Utilizing the 1M time-frame is necessary when trading news and is often the go-to time-frame generally. The whole point of news trading is to be very quick but, at the same time, very strategic because the movements happen at a rapid pace.

On the 1M NZD/USD chart, two highlighted sections display bullish momentum on the RSI indicator due to a peak above the 70 line/overbought zone. Not only should this incline a trader to a bullish bias, unless there is even the slightest difference between the previous and eventual interest rate, a trader can also assume the bias to stay the same.

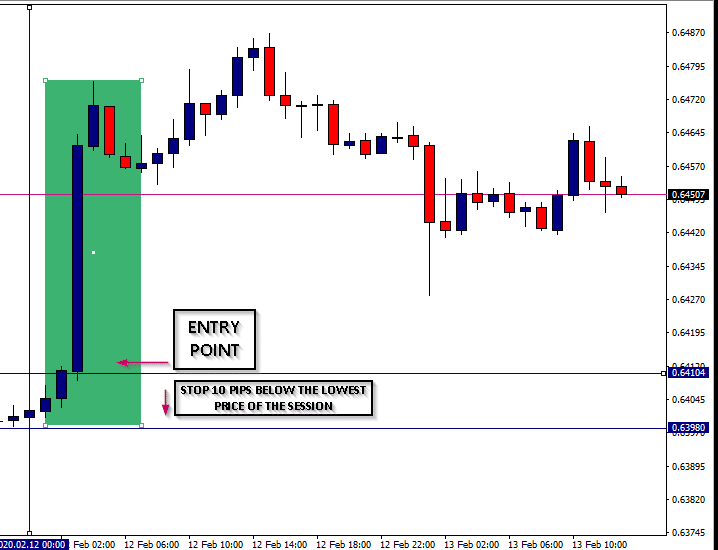

In this particular instance, the forecasted figure was the same as the current interest rate at the time. This knowledge may have been another sign that NZD-related markets would trade as normal. The minute the news was released, the RSI peaked again on the 70 line, which would have been the trigger to go long. All three respective figures remain unchanged, and the market rallied +/- 80 pips from the entry point. Stops were going to be ten pips below the support level at 0.63980:

Inversely, if the market went in the opposite direction, the trader was going to observe any RSI peak below the 30 line and sell right on that peak using market execution. Such an action would be regardless of any difference in the numbers, being precisely why the market’s reaction holds more significance than any difference in the numbers. The stop loss would go ten pips above the resistance level of the trading session. It’s also necessary to observe the spreads to ensure proper position sizing since they can widen dramatically during these events.

Other strategies, or variations thereof, may employ the use of pending orders that look to take advantage of both market directions. Another method, albeit a little more conservative as it uses the 5M time-frame, looks to exploit the confirmed break of candles several minutes after the news. Here is an example below during an NFP release:

Summary

Though the technical aspects of trading news are critical, what happens right before and during a news event is just as essential, if not more. Ideally, trading news is fruitful if the resulting movement is substantial enough. In other words, some news events are not worth trading. It may also help the trader to have two different systems they utilize to adapt to the different outcomes of how price may structure itself after a news release. Ultimately, speculating in this regard requires homework on the figures, trading more favorable high-impact news, preparation, fast reactions to data, proper analysis, and, most importantly, risk management as with any other trade.

Leave a Reply