DISCLAIMER: This article presents no direct guidance on specific actions regarding your investment and personal funds management. We may recommend certain assets at a certain time, but you are responsible for your investment.

THORChain blockchain project and RUNEUSD

THORChain explained

THORChain is a decentralized liquidity protocol built on top of the Cosmos blockchain. The project seeks to enhance cross-chain connectivity, thus making it easy for people to swap tokens between different networks at the lowest costs possible and at high speeds.

Conceptualized in 2018, it facilitates cross-chain liquidity, reducing the need for centralized exchanges and third parties to enable the swapping of coins between different networks. Acting as the vault manager enables the exchange of layer-1 assets such as Bitcoin and Ethereum.

THORChain operates as a layer-1 network and as a permissionless Decentralized Exchange. It leverages the Threshold Signature Schemes to secure the network and secure token swapping. Unlike other cross-chain protocols, it does not wrap assets. Instead, it leverages its native asset RUNE to facilitate autonomous transparent asset swaps.

In the THORChain network, there are swappers whose main role is to swap assets as liquidity providers, thus providing the much-needed liquidity pools to facilitate the swapping. Node operators, on the other hand, verify transactions and are also paid to secure the network, while traders monitor and rebalance pools to squeeze profits.

RUNE whitepaper and tokenomics

RUNE is the native token that powers the THORChain network, acting as a medium of exchange. It serves as base pair through which swaps on the network are carried out. As a settlement asset, there must be a 1:1 ratio of RUNE: ASSET in each pool for a swap to take place. For instance pool of $10,000ETH will need $10,000 RUNE to facilitate swaps.

Node operators who are tasked with securing the THORChain network must bond or stake twice as many RUNE tokens as the amount added to the pool. The RUNE bonds serve as collateral, therefore, ensuring the node operators operate in the chain’s best interest.

RUNE also doubles up as a governance token. Consequently, token holders can vote on any changes or upgrades to the network. Any pool with the highest RUNE amount will always enjoy higher priority when voting.

The total number of RUNE tokens that will ever be in circulation is capped at 500 million. Currently, there are about 330.69 million RUNE tokens in circulation from a total supply of 334.94 million with a market cap of $1.13 billion. The total value of RUNE broken locked in decentralized finance applications stands at $233.61 million.

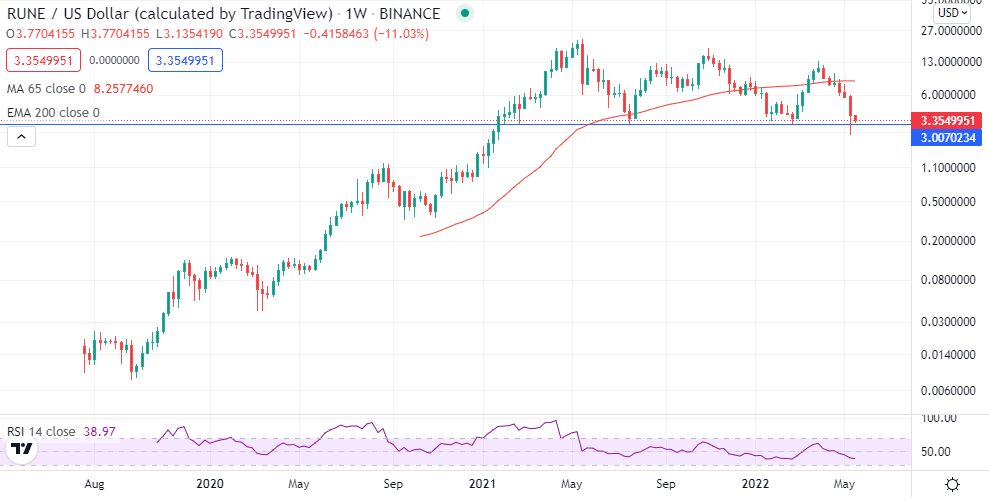

RUNE coin price analysis

RUNE coin has been under immense pressure going by the 50% plus decline year to date. The deep pullback coincides with a sell-off wave engulfing the broader cryptocurrency market as investors shun riskier assets favoring safe havens such as treasuries and bonds.

Conversely, RUNEUSD has pulled to the $3.37 level closing in on the pivotal $3 support level. A sell-off followed by a daily close below the support level could result in the coin tanking to the $2.4 area, the next substantial key level. On the flipside, RUNEUSD needs to find support above the $3 handle to avert the prospects of further losses.

That said, caution is of utmost importance while looking to invest in the THORChain coin. Given that all the major indicators are bearish, the prospect of it losing some value is still high. However, the coin-finding support above the $3 handle would make it an attractive buy on the dip.

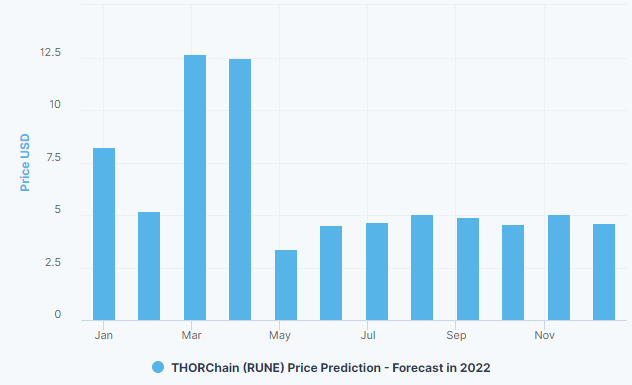

RUNE price prediction for a year

While RUNE remains under pressure after the recent slide to the $3.3 handle, it remains well-positioned to bounce back going by immediate estimates. Analysts at Digitalcoinprice.com expect the coin to bounce back and average $$4.44 for the year and could rally to highs of $4.73 before year-end, representing a 43% plus gain from current levels.

Analysts at Walletinvestor.com also expect the coin to bounce back to highs of $4.47 before year-end.

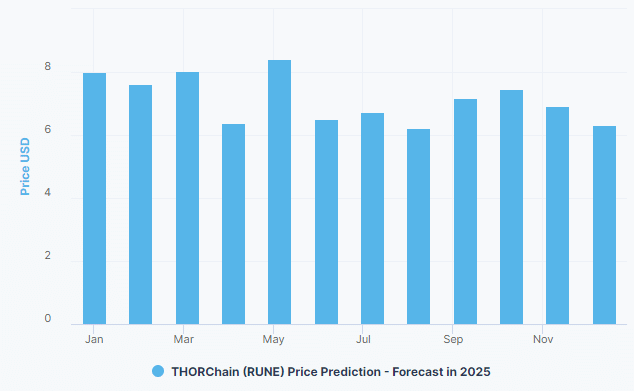

RUNE price prediction for 2025

While the short-term outlook remains bearish, the same cannot be said about RUNE’s long-term prospects. Analysts at Digitalcoinprice.com expect the coin to more than double over the next three years. The bounce-back will mostly depend on the crypto crash dust settling.

Consequently, RUNE is expected to average $6.41 by 2025 and could rally to highs of $7.16, representing a 116% plus gain from current levels.

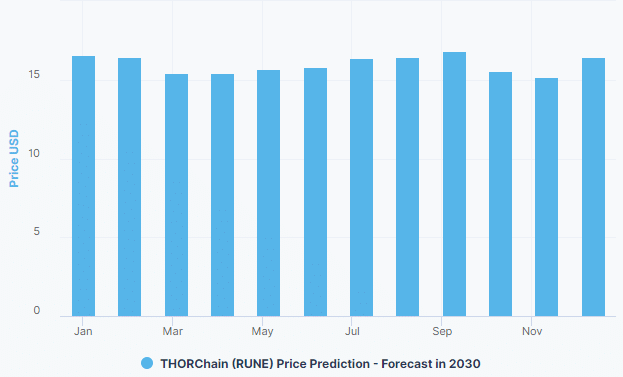

RUNE price prediction for 2030

The long-term outlook is even more bullish amid the expected cryptocurrency and blockchain adoption in the mainstream sector. THORChain becoming the preferred network for facilitating cross-chain asset swaps will be a key factor to RUNE exploding to record highs amid the expected spike in demand.

Consequently, analysts at Digitalcoinprice.com expect the coin to hit highs of $16.05 a coin by 2030, representing a 400% plus gain from current levels. Given how volatile cryptocurrency can be, the coin could be worth more.

Leave a Reply